Region:North America

Author(s):Rebecca

Product Code:KRAB4106

Pages:80

Published On:October 2025

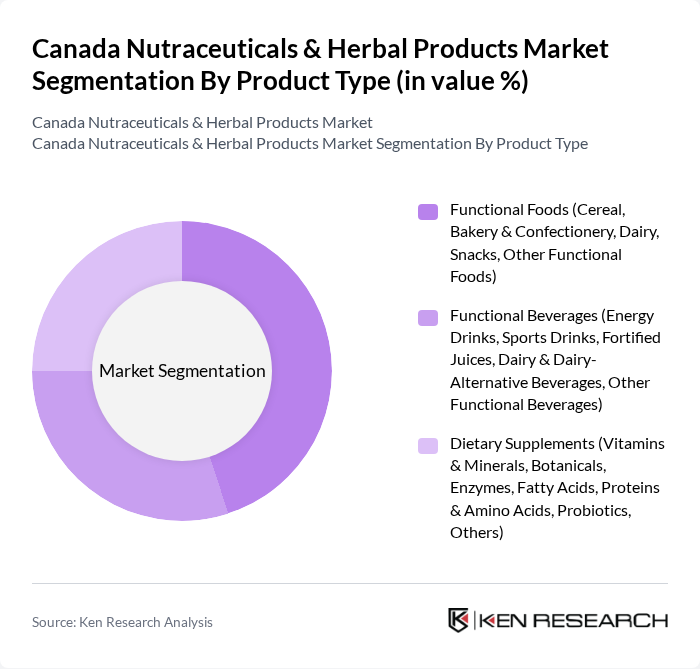

By Product Type:The product type segmentation includes Functional Foods, Functional Beverages, and Dietary Supplements. Among these, Functional Foods are leading the market due to their increasing popularity as a convenient way to enhance health and nutrition. Consumers are increasingly opting for foods that offer health benefits beyond basic nutrition, such as probiotics in dairy products and fortified cereals. This trend is driven by a growing awareness of the link between diet and health, leading to a significant rise in demand for functional foods .

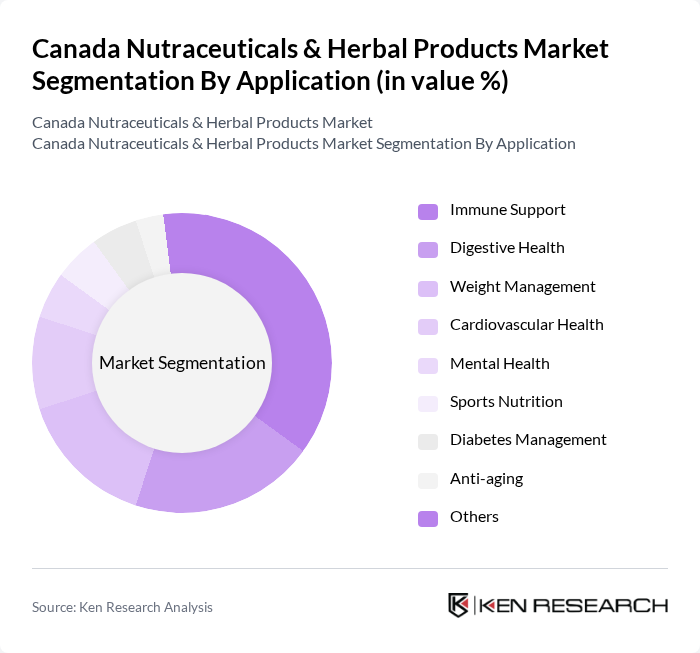

By Application:The application segmentation includes Immune Support, Digestive Health, Weight Management, Cardiovascular Health, Mental Health, Sports Nutrition, Diabetes Management, Anti-aging, and Others. Immune Support is currently the leading application area, driven by heightened health awareness and the impact of global health events. Consumers are increasingly seeking products that bolster their immune systems, leading to a surge in demand for supplements and functional foods that promote immune health .

The Canada Nutraceuticals & Herbal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jamieson Wellness Inc., Herbalife Nutrition Ltd., Nature's Way Products, LLC, GNC Holdings, LLC, New Chapter, Inc., NOW Foods, CanPrev, AOR (Advanced Orthomolecular Research), Organika Health Products Inc., Flora Manufacturing and Distributing Ltd., Prairie Naturals, Sisu Inc., Genuine Health, Botanica Health, Pure Encapsulations, Nestlé S.A., Danone S.A., PepsiCo Inc., TopGum, Apotex Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian nutraceuticals market appears promising, driven by increasing health awareness and a growing preference for natural products. Innovations in product development, particularly in personalized nutrition, are expected to enhance consumer engagement. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of products, catering to the diverse needs of consumers. As the market adapts to these trends, it is likely to witness sustained growth, particularly in segments targeting preventive healthcare and age-related health concerns.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Functional Foods (Cereal, Bakery & Confectionery, Dairy, Snacks, Other Functional Foods) Functional Beverages (Energy Drinks, Sports Drinks, Fortified Juices, Dairy & Dairy-Alternative Beverages, Other Functional Beverages) Dietary Supplements (Vitamins & Minerals, Botanicals, Enzymes, Fatty Acids, Proteins & Amino Acids, Probiotics, Others) |

| By Application | Immune Support Digestive Health Weight Management Cardiovascular Health Mental Health Sports Nutrition Diabetes Management Anti-aging Others |

| By Distribution Channel | Supermarkets/Hypermarkets Drug Stores/Pharmacies Convenience Stores Specialty Stores/Health Food Stores Online Retail Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Infants, Children, Adults, Pregnant Women, Seniors) Gender Income Level Lifestyle Choices Others |

| By Packaging Type | Bottles Sachets Blister Packs Jars Gummies/Chewables Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers First-Time Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Retailers | 100 | Store Managers, Product Buyers |

| Herbal Product Manufacturers | 60 | Production Managers, Quality Control Officers |

| Health Practitioners | 80 | Nutritionists, Herbalists |

| Consumers of Nutraceuticals | 120 | Health-conscious Individuals, Fitness Enthusiasts |

| Regulatory Experts | 40 | Compliance Officers, Regulatory Affairs Specialists |

The Canada Nutraceuticals & Herbal Products Market is valued at approximately USD 8.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of health and wellness, demand for natural products, and a shift towards preventive healthcare.