Region:Africa

Author(s):Dev

Product Code:KRAB0506

Pages:88

Published On:August 2025

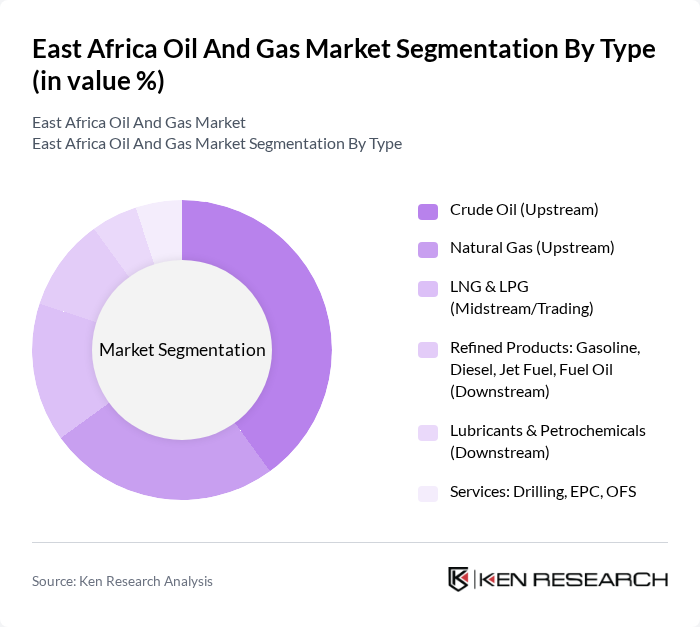

By Type:The East Africa Oil and Gas Market is segmented into various types, including upstream, midstream, and downstream activities. The upstream segment, which includes crude oil and natural gas extraction, is particularly significant due to the region's untapped reserves and stalled-to-early-stage developments in Uganda, Kenya, and offshore Tanzania. The midstream segment, encompassing LNG and LPG trading, plays a crucial role in the transportation and storage of hydrocarbons, with increasing investments in pipelines and import terminals such as EACOP and coastal terminals. The downstream segment, which includes refined products and petrochemicals, is essential for meeting local and regional energy demands, as most countries remain net importers of refined fuels with growing LPG penetration for households and commerce .

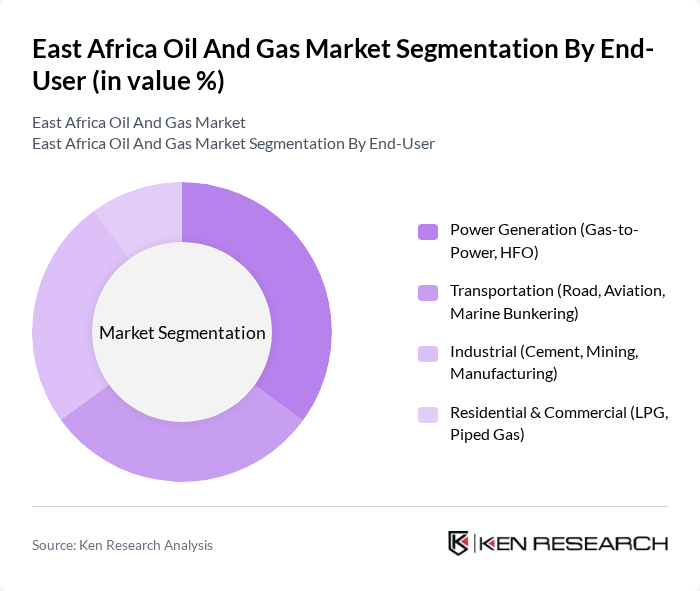

By End-User:The end-user segmentation of the East Africa Oil and Gas Market includes various sectors such as power generation, transportation, industrial, and residential. The power generation sector is a major consumer of natural gas where available and increasingly relies on fuel oil and imported LNG/LPG options; the transportation sector relies heavily on refined products given limited refining capacity; the industrial sector (cement, mining, manufacturing) is expanding demand for diesel, HFO, and gas; and residential & commercial LPG adoption is rising with policy pushes to shift households from biomass to cleaner fuels .

The East Africa Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, Tullow Oil plc, Africa Oil Corp., Eni S.p.A., Shell plc, ExxonMobil Corporation, Chevron Corporation, CNOOC Limited, EACOP Ltd. (East African Crude Oil Pipeline Company), Uganda National Oil Company (UNOC), Tanzania Petroleum Development Corporation (TPDC), Kenya Pipeline Company (KPC), National Oil Corporation of Kenya (NOCK), Mozambique’s Empresa Nacional de Hidrocarbonetos, E.P. (ENH), South Sudan’s Nilepet (Nile Petroleum Corporation), Sasol Limited, Equinor ASA, QatarEnergy, Azule Energy (Eni/BP JV – Mozambique interests), Rubis Énergie East Africa contribute to innovation, geographic expansion, and service delivery in this space .

The East African oil and gas market is poised for transformative growth, driven by increasing energy demand and substantial foreign investments. As countries prioritize energy security and infrastructure development, the integration of renewable energy sources will become crucial. Additionally, technological advancements will enhance operational efficiencies, while local content policies will encourage regional participation. By in future, the market is expected to witness a shift towards sustainable practices, positioning East Africa as a key player in the global energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil (Upstream) Natural Gas (Upstream) LNG & LPG (Midstream/Trading) Refined Products: Gasoline, Diesel, Jet Fuel, Fuel Oil (Downstream) Lubricants & Petrochemicals (Downstream) Services: Drilling, EPC, OFS |

| By End-User | Power Generation (Gas-to-Power, HFO) Transportation (Road, Aviation, Marine Bunkering) Industrial (Cement, Mining, Manufacturing) Residential & Commercial (LPG, Piped Gas) |

| By Region | Kenya Uganda Tanzania Mozambique South Sudan Ethiopia Rwanda, Burundi, Somalia, Djibouti & Others |

| By Value Chain Activity | Exploration & Appraisal Field Development & Production (Onshore/Offshore) Midstream: Pipelines, Storage, LNG (Liquefaction/Regas) Downstream: Refining, Marketing & Retail |

| By Investment Source | National Oil Companies (NOC) & State Entities International Oil Companies (IOC) Foreign Direct Investment (FDI) & Development Finance Public-Private Partnerships (PPP) Local Private Capital & Capital Markets |

| By Policy/Project Type | Local Content & Procurement Fiscal/Tax Regime (PSAs, Royalties, Incentives) Environmental & Social Compliance (ESIA, HSE) Cross-Border Projects (EACOP, Kenya–Tanzania Gas Pipeline, ARP) |

| By Distribution & Logistics Mode | Pipeline (Crude, Product, Gas) Marine Shipping & LNG Carriers Trucking (White Oils, LPG) Rail (Products & Equipment) Retail Outlets & Last-Mile (Service Stations, Cylinder Distribution) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Exploration and Production Companies | 100 | CEOs, Operations Managers, Geologists |

| Regulatory Bodies and Government Agencies | 80 | Policy Makers, Regulatory Officers |

| Local Community Stakeholders | 60 | Community Leaders, Local Business Owners |

| Service Providers and Contractors | 70 | Project Managers, Business Development Executives |

| Environmental NGOs and Advocacy Groups | 50 | Environmental Scientists, Advocacy Coordinators |

The East Africa Oil and Gas Market is valued at approximately USD 90 million, reflecting its strategic importance despite limited production outside South Sudan and Mozambique. The market is characterized by rising imports of refined products and LPG in Kenya, Tanzania, and Uganda.