Region:Asia

Author(s):Shubham

Product Code:KRAD0680

Pages:94

Published On:August 2025

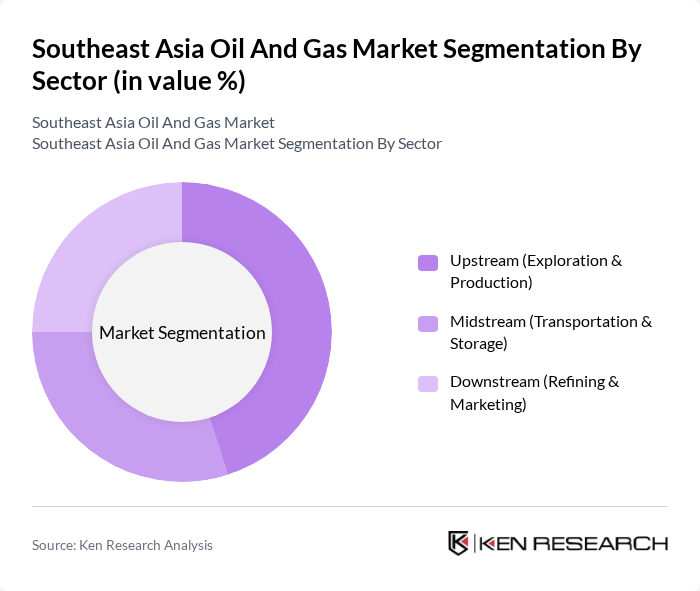

By Sector:The market is segmented into three main sectors: Upstream (Exploration & Production), Midstream (Transportation & Storage), and Downstream (Refining & Marketing). Each sector plays a crucial role in the overall oil and gas supply chain, with upstream focusing on resource extraction, midstream on transportation and storage, and downstream on refining and distribution. The region is experiencing heightened upstream activity from new offshore investments, expanding midstream gas and LNG networks (pipelines, regasification, liquefaction), and continued downstream refining and petrochemical operations to meet transport fuels and chemicals demand .

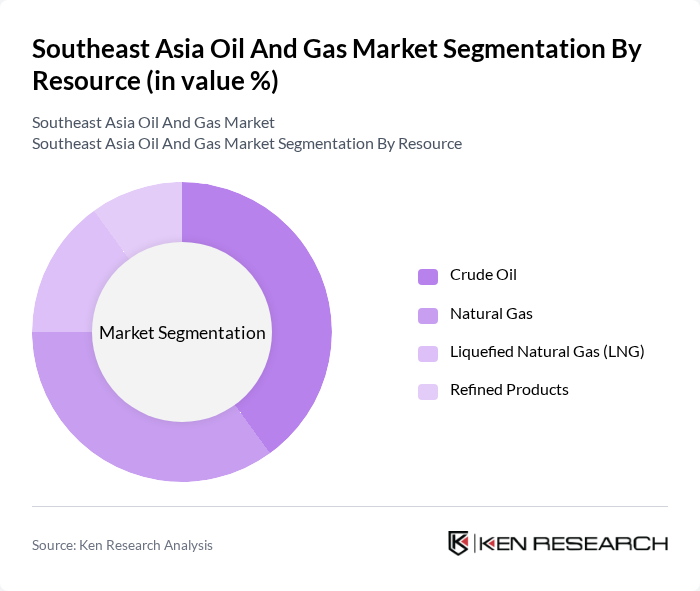

By Resource:The market is categorized into four primary resources: Crude Oil, Natural Gas, Liquefied Natural Gas (LNG), and Refined Products. Each resource type has distinct characteristics and applications, influencing market dynamics and investment trends. Natural gas and LNG are increasingly central due to regional gas-to-power growth and LNG import/export projects in development, while crude oil and refined products remain critical for transportation and industrial use .

The Southeast Asia Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as PETRONAS (Petroliam Nasional Berhad), PTT Public Company Limited, Pertamina (PT Pertamina Persero), Chevron Corporation, ExxonMobil, TotalEnergies SE, Shell plc, ConocoPhillips, Repsol S.A., Eni S.p.A., Woodside Energy Group Ltd, Santos Ltd, Hess Corporation, CNOOC Limited, Sinopec (China Petroleum & Chemical Corporation), PT Medco Energi Internasional Tbk, Harbour Energy plc, SKK Migas (Special Task Force for Upstream Oil and Gas, Indonesia), Vietnam Oil and Gas Group (Petrovietnam), Brunei Energy (Brunei Methanol/Brunei Shell Petroleum – key JV operators), PTTEP (PTT Exploration and Production Public Company Limited), Sembcorp Industries Ltd (incl. Sembcorp Marine legacy yard capabilities), Keppel Offshore & Marine Ltd, Singapore Petroleum Company (SPC), ENEOS (Malaysia/SEA trading and downstream presence) contribute to innovation, geographic expansion, and service delivery in this space.

The Southeast Asia oil and gas market is poised for significant transformation as it navigates the dual pressures of rising energy demand and environmental sustainability. In the future, the integration of renewable energy sources alongside traditional oil and gas operations will become increasingly prevalent. Additionally, advancements in digital technologies will enhance operational efficiencies, enabling companies to optimize resource management. The region's commitment to energy security and sustainability will shape investment strategies, fostering a more resilient and adaptive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Marketing) |

| By Resource | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Refined Products |

| By Operation | Onshore Offshore (Shallow Water) Offshore (Deepwater/Ultra-deepwater) |

| By Application | Exploration Production Transportation & Distribution (Pipelines, Shipping) Refining & Petrochemicals |

| By End-User | Power Generation Transportation Industrial Residential & Commercial (City Gas) |

| By Country | Indonesia Malaysia Thailand Vietnam Philippines Singapore Brunei Myanmar Cambodia & Laos |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Exploration | 100 | Geologists, Exploration Managers |

| Midstream Transportation and Storage | 80 | Logistics Coordinators, Operations Managers |

| Downstream Refining and Distribution | 120 | Refinery Managers, Supply Chain Directors |

| Natural Gas Market Dynamics | 90 | Market Analysts, Regulatory Affairs Specialists |

| Renewable Energy Integration | 70 | Energy Transition Managers, Sustainability Officers |

The Southeast Asia Oil and Gas Market is valued at approximately USD 300 billion, reflecting sustained demand growth, significant upstream investment commitments, and ongoing development of gas and LNG infrastructure across the region.