Region:North America

Author(s):Geetanshi

Product Code:KRAA1185

Pages:99

Published On:August 2025

By Source:The protein market can be segmented into four primary sources: Animal-Based Proteins, Plant-Based Proteins, Microbial Proteins, and Insect Proteins. Among these, Animal-Based Proteins, which include whey, casein, collagen, egg, gelatin, milk, and other animal proteins, continue to dominate the market due to their high biological value and consumer preference for traditional protein sources. Plant-Based Proteins are gaining traction, particularly among health-conscious and environmentally aware consumers, but Animal-Based Proteins remain the leading choice .

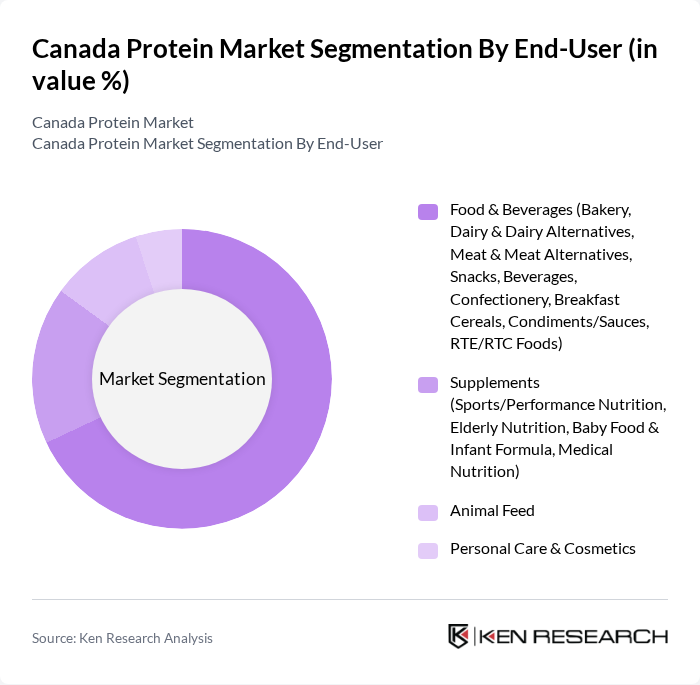

By End-User:The protein market is segmented by end-users into Food & Beverages, Supplements, Animal Feed, and Personal Care & Cosmetics. The Food & Beverages segment, which includes bakery, dairy & dairy alternatives, meat & meat alternatives, snacks, beverages, confectionery, breakfast cereals, condiments/sauces, and RTE/RTC foods, is the largest segment. This dominance is attributed to the increasing incorporation of protein in everyday food products, driven by consumer demand for healthier options and functional foods .

The Canada Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maple Leaf Foods Inc., Cargill Limited, Tyson Foods, Inc., Protein Industries Canada, Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Nestlé S.A., Burcon NutraScience Corporation, Beyond Meat, Inc., Sunwarrior, Orgain, Inc., Garden of Life, LLC, Vega (a subsidiary of Danone S.A.), Axiom Foods, Inc., The Tofurky Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Canada protein market is poised for continued growth, driven by evolving consumer preferences towards health and sustainability. Innovations in product formulations, particularly in plant-based proteins, are expected to enhance market offerings. Additionally, the rise of e-commerce platforms is likely to facilitate broader access to protein products, catering to the growing demand for convenience. As consumers increasingly seek personalized nutrition solutions, companies that adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Source | Animal-Based Proteins (Whey, Casein, Collagen, Egg, Gelatin, Milk, Other Animal Proteins) Plant-Based Proteins (Soy, Pea, Wheat, Hemp, Oat, Potato, Rice, Other Plant Proteins) Microbial Proteins (Algae Protein, Mycoprotein) Insect Proteins |

| By End-User | Food & Beverages (Bakery, Dairy & Dairy Alternatives, Meat & Meat Alternatives, Snacks, Beverages, Confectionery, Breakfast Cereals, Condiments/Sauces, RTE/RTC Foods) Supplements (Sports/Performance Nutrition, Elderly Nutrition, Baby Food & Infant Formula, Medical Nutrition) Animal Feed Personal Care & Cosmetics |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Application | Nutritional Supplements Functional Foods Sports Nutrition Meal Replacements Infant Formulations Clinical Nutrition Animal Nutrition Personal Care & Cosmetics |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Single-Serve Packaging |

| By Region | Western Canada (British Columbia, Alberta, The Prairies) Central Canada (Ontario, Quebec) Eastern Canada (Atlantic Provinces) Northern Canada |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Sector | 100 | Plant Managers, Quality Assurance Managers |

| Dairy Product Manufacturers | 75 | Production Supervisors, R&D Managers |

| Plant-Based Protein Producers | 60 | Marketing Directors, Product Development Managers |

| Retail Grocery Chains | 85 | Category Managers, Procurement Specialists |

| Health and Nutrition Experts | 50 | Registered Dietitians, Nutrition Researchers |

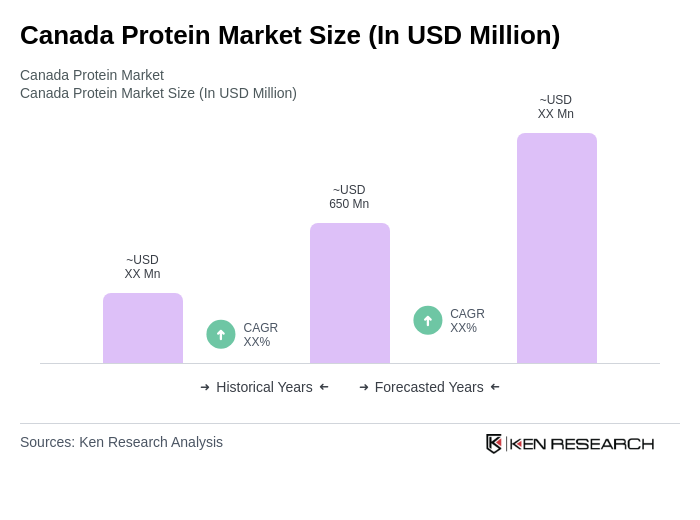

The Canada Protein Market is valued at approximately USD 650 million, reflecting a significant growth trend driven by increasing consumer demand for protein-rich foods and the popularity of fitness and wellness trends.