Region:North America

Author(s):Rebecca

Product Code:KRAB5888

Pages:85

Published On:October 2025

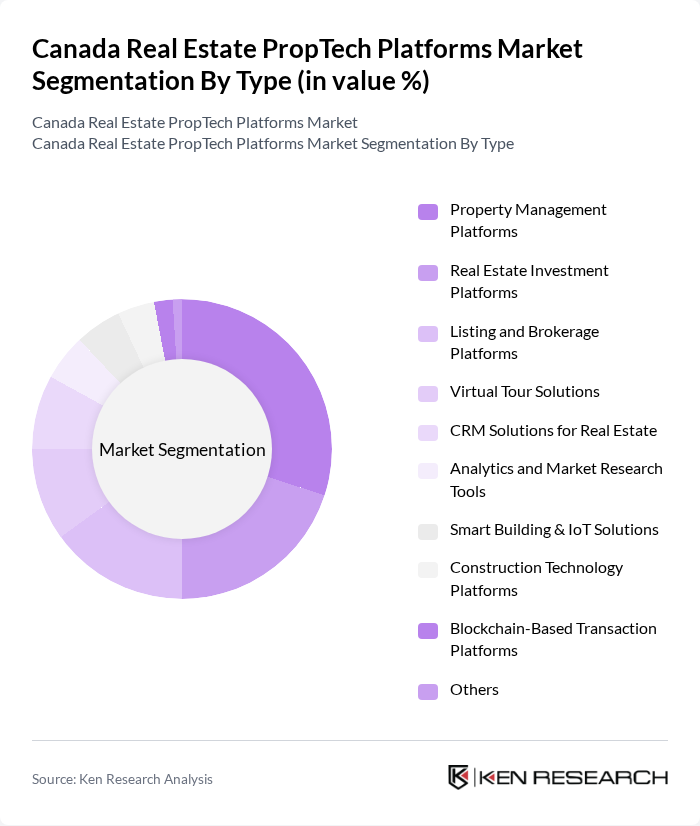

By Type:The market is segmented into various types of platforms that cater to different needs within the real estate sector. The subsegments include Property Management Platforms, Real Estate Investment Platforms, Listing and Brokerage Platforms, Virtual Tour Solutions, CRM Solutions for Real Estate, Analytics and Market Research Tools, Smart Building & IoT Solutions, Construction Technology Platforms, Blockchain-Based Transaction Platforms, and Others. Among these, Property Management Platforms are currently leading the market due to the increasing demand for efficient property management solutions that enhance tenant experiences and streamline operations. The adoption of smart building and IoT solutions is also accelerating, driven by the need for energy efficiency and predictive maintenance .

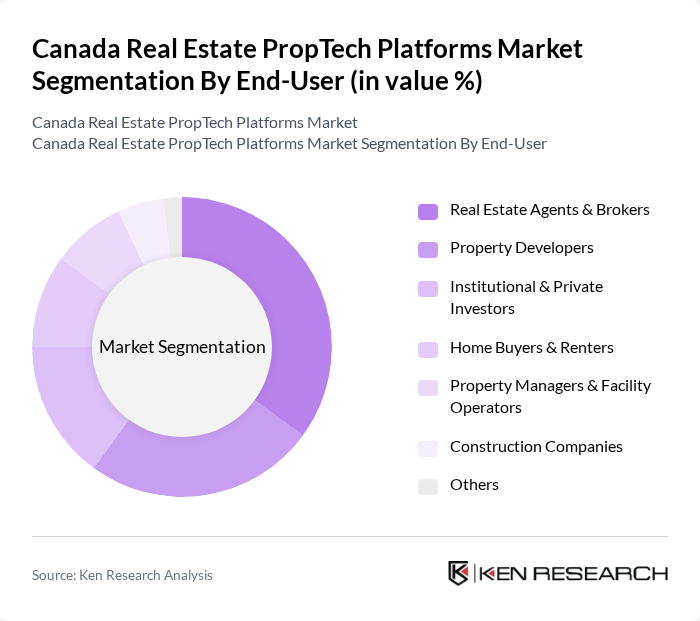

By End-User:The end-user segmentation includes Real Estate Agents & Brokers, Property Developers, Institutional & Private Investors, Home Buyers & Renters, Property Managers & Facility Operators, Construction Companies, and Others. Real Estate Agents & Brokers dominate this segment as they increasingly rely on technology to enhance their service offerings, improve client interactions, and streamline transactions. Institutional and private investors are also expanding their use of PropTech platforms to access real-time analytics and optimize investment decisions .

The Canada Real Estate PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altus Group Limited, Properly Homes Inc., Real Matters Inc., Zillow Group, Inc., Realtor.ca (Canadian Real Estate Association), Opendoor Technologies Inc., Yuhu Inc., Zumper Inc., ManageCasa, Ascendix Technologies, Guesty, Coadjute, Reggora, Enertiv, HomeLight, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Real Estate PropTech market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for innovative solutions will likely increase, fostering collaboration between PropTech firms and traditional real estate companies. Additionally, the integration of AI and machine learning technologies is expected to enhance operational efficiency and customer engagement, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Platforms Real Estate Investment Platforms Listing and Brokerage Platforms Virtual Tour Solutions CRM Solutions for Real Estate Analytics and Market Research Tools Smart Building & IoT Solutions Construction Technology Platforms Blockchain-Based Transaction Platforms Others |

| By End-User | Real Estate Agents & Brokers Property Developers Institutional & Private Investors Home Buyers & Renters Property Managers & Facility Operators Construction Companies Others |

| By Application | Residential Real Estate Commercial Real Estate Industrial Real Estate Mixed-Use Developments Others |

| By Sales Channel | Direct Sales Online Platforms Partnerships with Real Estate Firms Channel Partners & Resellers Others |

| By Investment Source | Venture Capital Private Equity Government Grants Crowdfunding Corporate Investment Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support for Startups Others |

| By Customer Segment | First-Time Home Buyers Real Estate Investors Commercial Property Owners Real Estate Agents & Brokers Property Managers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Agents | 100 | Real Estate Agents, Brokers |

| Commercial Property Managers | 60 | Property Managers, Asset Managers |

| Real Estate Developers | 50 | Development Executives, Project Managers |

| PropTech Solution Providers | 40 | CEOs, Product Managers |

| Real Estate Investors | 50 | Investment Analysts, Portfolio Managers |

The Canada Real Estate PropTech Platforms Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by the increasing adoption of technology in real estate transactions, property management, and investment processes.