Region:Middle East

Author(s):Rebecca

Product Code:KRAB3546

Pages:92

Published On:October 2025

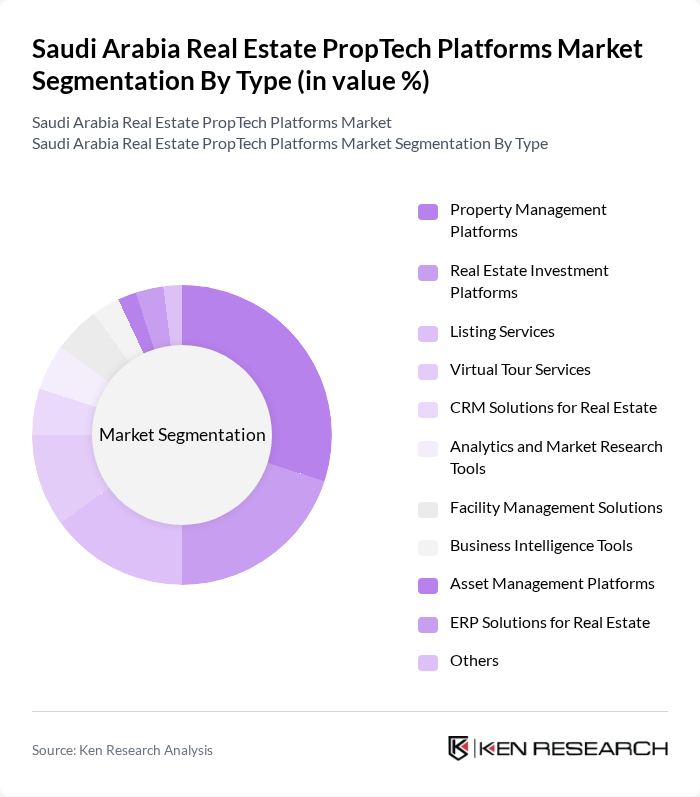

By Type:The market is segmented into various types of platforms that cater to different needs within the real estate sector. The subsegments include Property Management Platforms, Real Estate Investment Platforms, Listing Services, Virtual Tour Services, CRM Solutions for Real Estate, Analytics and Market Research Tools, Facility Management Solutions, Business Intelligence Tools, Asset Management Platforms, ERP Solutions for Real Estate, and Others. Among these, Portfolio Management platforms are experiencing the fastest growth due to their critical role in managing diverse real estate portfolios and optimizing investment returns through advanced analytics and automation.

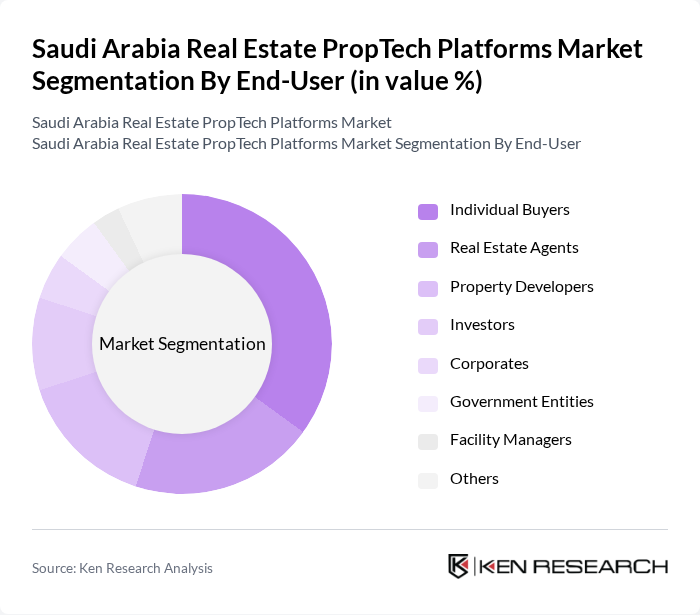

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, Investors, Corporates, Government Entities, Facility Managers, and Others. The Individual Buyers segment is currently the most significant contributor to the market, driven by the increasing number of first-time homebuyers seeking digital solutions for property transactions and management. This growth is supported by Saudi Arabia's demographic profile, with more than 60% of the MENA population under the age of 30, creating a digitally fluent consumer base that readily adopts real estate technology platforms.

The Saudi Arabia Real Estate PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, JLL MENA, RE/MAX Saudi Arabia, Aqarat.com, Sakani, Makanak, Aqar, Nawy, Musanada, Sakan, Ejar, Balady, Dubizzle, Smart Crowd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Real Estate PropTech market appears promising, driven by ongoing urbanization and government support for technological advancements. In future, the integration of AI and big data analytics is expected to revolutionize property management, enhancing decision-making processes. Additionally, the rise of mobile applications will facilitate seamless transactions, catering to the tech-savvy population. As these trends unfold, the market is likely to witness increased investment and innovation, positioning Saudi Arabia as a leader in the PropTech sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Platforms Real Estate Investment Platforms Listing Services Virtual Tour Services CRM Solutions for Real Estate Analytics and Market Research Tools Facility Management Solutions Business Intelligence Tools Asset Management Platforms ERP Solutions for Real Estate Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors Corporates Government Entities Facility Managers Others |

| By Application | Residential Real Estate Commercial Real Estate Industrial Real Estate Mixed-Use Developments Land Development Co-working Spaces Others |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agents Auctions Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Venture Capital Funding Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support for Startups Others |

| By Customer Segment | First-Time Home Buyers Luxury Property Buyers Commercial Tenants Institutional Investors Landlords Tenants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Heads |

| Commercial Property Managers | 80 | Operations Managers, Asset Managers |

| Real Estate Investment Trusts (REITs) | 60 | Investment Analysts, Portfolio Managers |

| PropTech Solution Providers | 50 | Product Managers, Chief Technology Officers |

| Real Estate Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

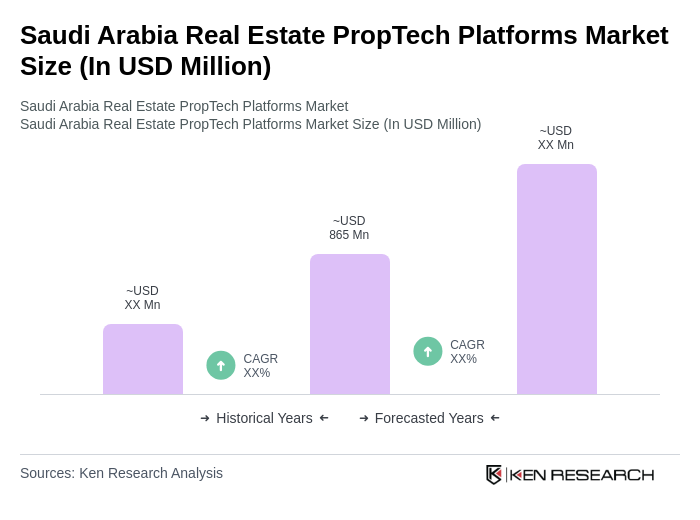

The Saudi Arabia Real Estate PropTech Platforms Market is valued at approximately USD 865 million, reflecting significant growth driven by technological adoption in real estate transactions and government initiatives aimed at digital transformation.