Region:Middle East

Author(s):Shubham

Product Code:KRAB3784

Pages:86

Published On:October 2025

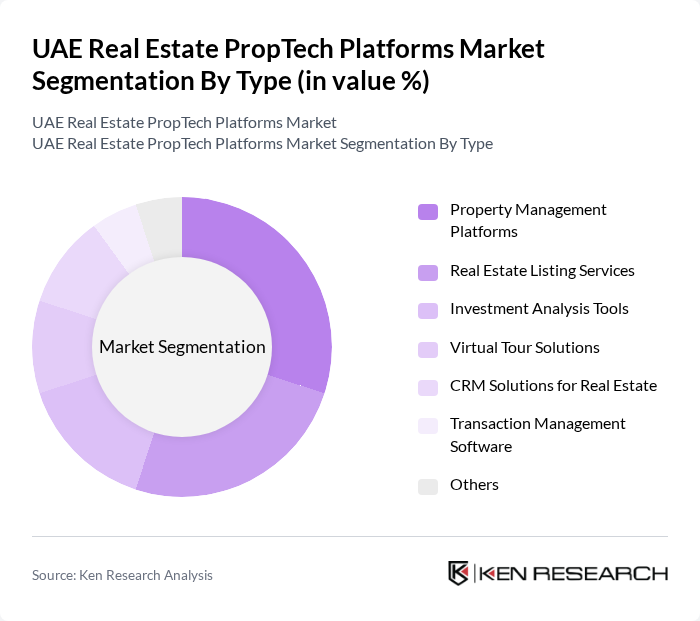

By Type:The market is segmented into various types of platforms that cater to different aspects of real estate management and transactions. The key subsegments include Property Management Platforms, Real Estate Listing Services, Investment Analysis Tools, Virtual Tour Solutions, CRM Solutions for Real Estate, Transaction Management Software, and Others. Among these, Property Management Platforms are gaining significant traction due to the increasing need for efficient property management solutions in a rapidly growing real estate market.

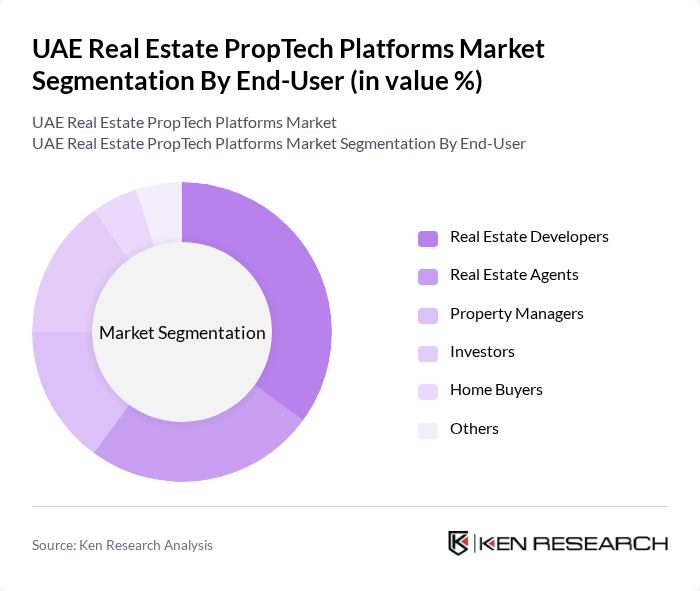

By End-User:The end-user segmentation includes various stakeholders in the real estate market, such as Real Estate Developers, Real Estate Agents, Property Managers, Investors, Home Buyers, and Others. Real Estate Developers are the leading end-users, driven by the need for efficient project management and marketing solutions to enhance their operational efficiency and customer engagement.

The UAE Real Estate PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, Dubizzle, YAPILI, SmartCrowd, Provis, Aqarat, Aqarat.com, RAK Properties, Emaar Properties, Aldar Properties, DAMAC Properties, Nakheel, Azizi Developments, JLL MENA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Real Estate PropTech market appears promising, driven by ongoing technological advancements and urbanization trends. As the government continues to invest in smart city initiatives, PropTech platforms are likely to play a pivotal role in transforming the real estate landscape. The integration of AI, big data, and blockchain technology will enhance operational efficiencies and customer experiences, while the growing demand for sustainable solutions will further shape market dynamics. Overall, the sector is poised for significant evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Platforms Real Estate Listing Services Investment Analysis Tools Virtual Tour Solutions CRM Solutions for Real Estate Transaction Management Software Others |

| By End-User | Real Estate Developers Real Estate Agents Property Managers Investors Home Buyers Others |

| By Business Model | Subscription-Based Models Commission-Based Models Freemium Models Pay-Per-Use Models Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas International Markets Others |

| By Customer Segment | Individual Buyers Corporate Clients Government Entities Non-Profit Organizations Others |

| By Service Type | Consulting Services Technical Support Services Training and Development Services Marketing Services Others |

| By Pricing Model | Tiered Pricing Flat Rate Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Management | 100 | Property Managers, Real Estate Agents |

| Commercial Real Estate Transactions | 80 | Commercial Brokers, Investment Analysts |

| Real Estate Analytics Platforms | 70 | Data Analysts, Business Intelligence Managers |

| Virtual Property Tours | 60 | Marketing Managers, Technology Officers |

| Smart Building Technologies | 90 | Facility Managers, IT Directors |

The UAE Real Estate PropTech Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by technological adoption in real estate transactions and enhanced customer experiences through digital platforms.