Region:Africa

Author(s):Rebecca

Product Code:KRAA5092

Pages:93

Published On:September 2025

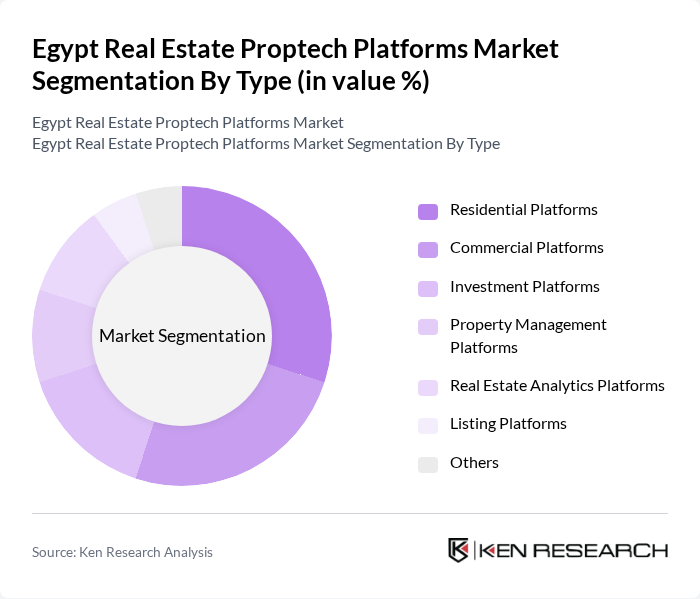

By Type:The market can be segmented into various types, including Residential Platforms, Commercial Platforms, Investment Platforms, Property Management Platforms, Real Estate Analytics Platforms, Listing Platforms, and Others. Each of these segments caters to different consumer needs and preferences, with specific functionalities and services tailored to enhance user experience.

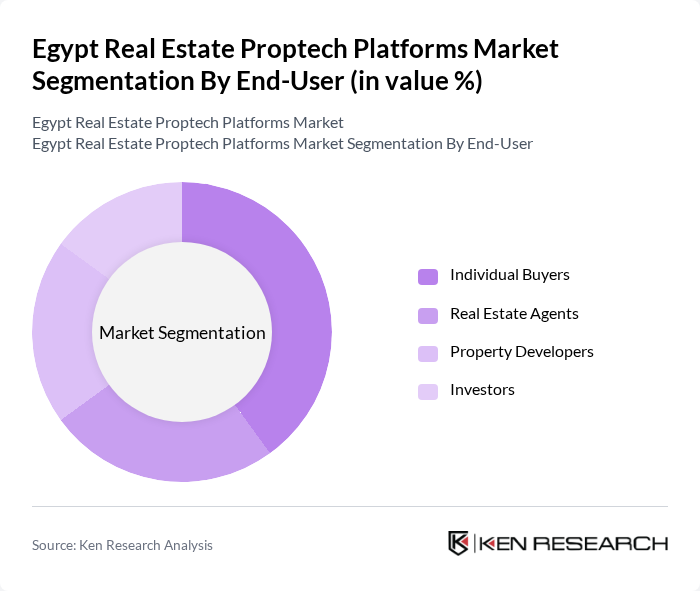

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group has distinct requirements and preferences, influencing the types of platforms they utilize for their real estate needs.

The Egypt Real Estate Proptech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Aqarmap, B2B Egypt, Eqarat, Nawy, ElWaseet, Oqood, Zawya, Sakan, Hometime, Real Estate Egypt, EGYPT Real Estate, Makanak, Benaa, Takhyil contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's real estate proptech market appears promising, driven by ongoing urbanization and technological advancements. As the government continues to invest in infrastructure and digital solutions, the integration of AI and big data analytics will enhance property management and customer experiences. Additionally, the increasing popularity of smart homes and sustainable living solutions will likely create new avenues for proptech platforms, fostering innovation and attracting both local and foreign investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Investment Platforms Property Management Platforms Real Estate Analytics Platforms Listing Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Sales Offline Sales |

| By Application | Residential Sales Commercial Leasing Property Management |

| By Pricing Model | Subscription-Based Commission-Based Freemium |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | First-Time Buyers Luxury Buyers Investors Corporates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 100 | Real Estate Agents, Home Buyers |

| Commercial Property Management Solutions | 80 | Property Managers, Business Owners |

| Real Estate Investment Platforms | 70 | Investors, Financial Advisors |

| Construction Technology Integration | 60 | Construction Managers, Architects |

| Smart Home Technology Adoption | 90 | Homeowners, Technology Enthusiasts |

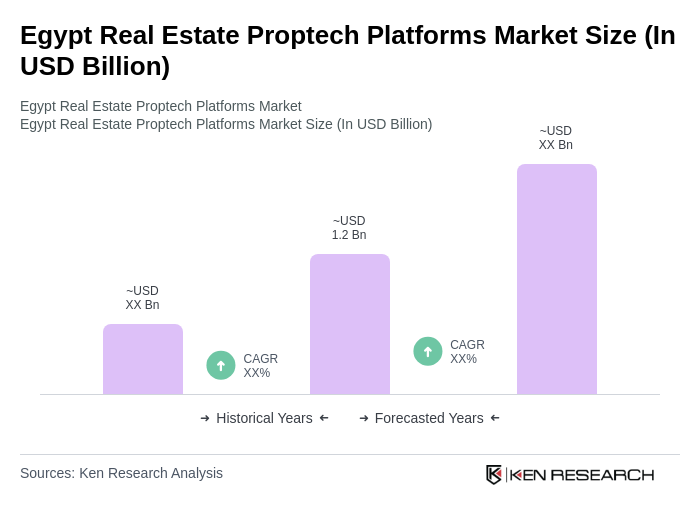

The Egypt Real Estate Proptech Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological adoption, urbanization, and consumer demand for digital solutions in real estate transactions.