Region:Asia

Author(s):Shubham

Product Code:KRAA4979

Pages:89

Published On:September 2025

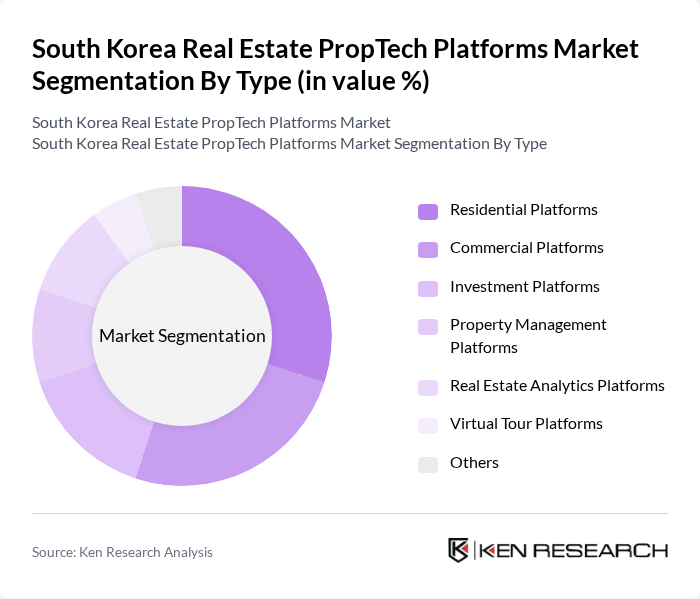

By Type:The market is segmented into various types, including Residential Platforms, Commercial Platforms, Investment Platforms, Property Management Platforms, Real Estate Analytics Platforms, Virtual Tour Platforms, and Others. Each of these segments caters to different needs within the real estate ecosystem, with specific functionalities and target audiences.

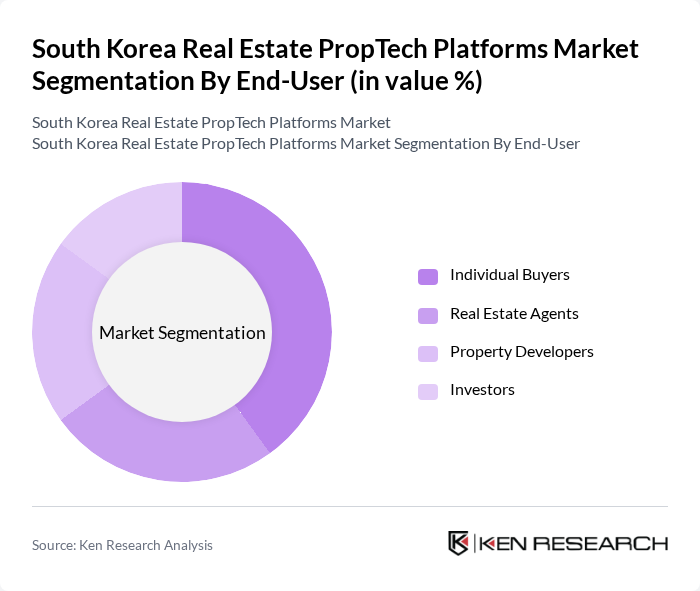

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group utilizes PropTech platforms differently, with specific requirements and preferences that drive the development of tailored solutions.

The South Korea Real Estate PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naver Real Estate, Kakao Real Estate, Zigbang, Dabang, Real Estate 114, Jikbang, Homates, Bithumb Real Estate, Property Finder, K-Realty, Space 1, Rentberry, MyRealTrip, WeWork, Airbnb contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean PropTech market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for innovative real estate solutions will rise, particularly in smart home technologies. Collaborations between PropTech firms and traditional real estate companies are expected to enhance service offerings, while regulatory frameworks may evolve to support digital transformation. Overall, the market is likely to witness increased investment and innovation, positioning it for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Investment Platforms Property Management Platforms Real Estate Analytics Platforms Virtual Tour Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Direct Sales Online Marketplaces Partnerships with Real Estate Firms |

| By Application | Property Listing Market Analysis Transaction Management Customer Relationship Management |

| By Investment Source | Venture Capital Private Equity Government Grants |

| By Policy Support | Subsidies for Startups Tax Incentives Regulatory Support |

| By Market Maturity | Emerging Platforms Established Platforms Niche Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Agents | 150 | Real Estate Agents, Brokers |

| Commercial Property Managers | 100 | Property Managers, Facility Managers |

| PropTech Platform Users | 120 | End-users, Home Buyers, Investors |

| Real Estate Developers | 80 | Development Managers, Project Leads |

| Investors in Real Estate Technology | 70 | Venture Capitalists, Angel Investors |

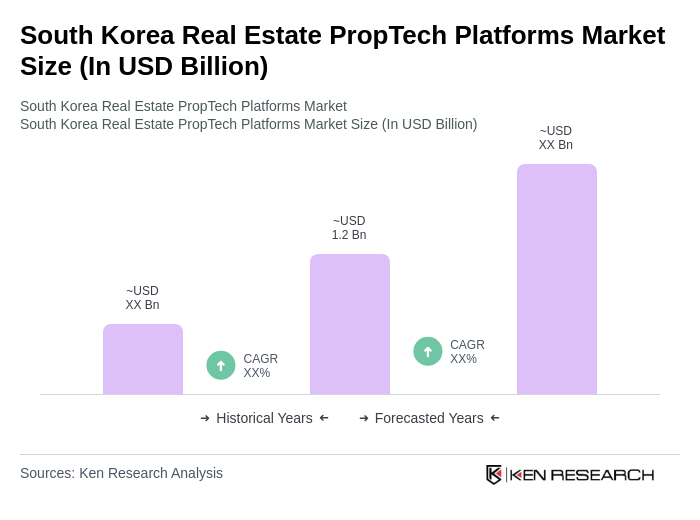

The South Korea Real Estate PropTech Platforms Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by technological adoption and urbanization in the real estate sector.