Region:Asia

Author(s):Geetanshi

Product Code:KRAA0146

Pages:81

Published On:August 2025

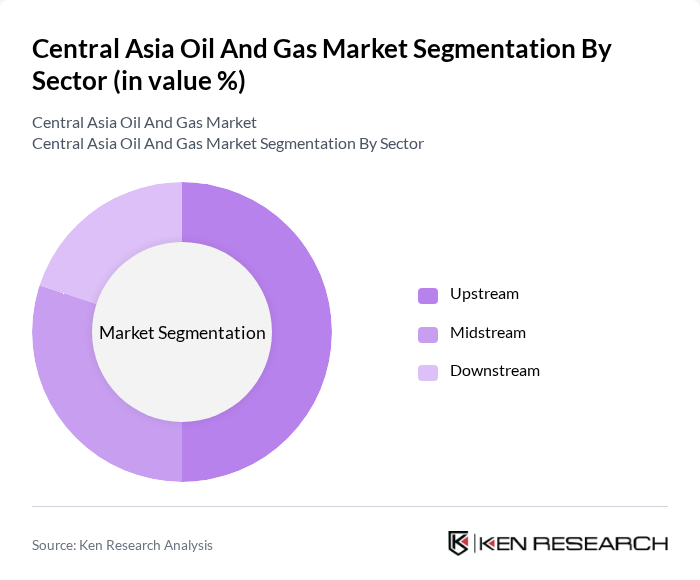

By Sector:The market is segmented into Upstream, Midstream, and Downstream sectors. The Upstream sector is focused on exploration and production of oil and gas resources. The Midstream sector covers transportation and storage, including pipelines and export terminals. The Downstream sector involves refining, petrochemical processing, and the distribution of finished oil and gas products to end users .

By Product Type:The market is further segmented into Crude Oil, Natural Gas, Refined Products, Petrochemicals, and Others. Crude Oil and Natural Gas are the dominant products, driven by strong demand from both domestic consumption and export markets. Refined Products and Petrochemicals represent a smaller but growing share, reflecting ongoing investments in refining and chemical processing capacity .

The Central Asia Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as KazMunayGas (Kazakhstan), CNPC (China National Petroleum Corporation, active in Kazakhstan, Turkmenistan, Uzbekistan), Lukoil (Russia, active in Uzbekistan, Kazakhstan), Gazprom (Russia, active in Turkmenistan, Uzbekistan, Kazakhstan), Uzbekneftegaz (Uzbekistan), Turkmengaz (Turkmenistan), Chevron (active in Kazakhstan), TotalEnergies (active in Kazakhstan), Eni (active in Kazakhstan, Turkmenistan), Petronas (active in Turkmenistan), Rosneft (Russia, active in Central Asia), ExxonMobil (active in Kazakhstan), OMV (active in Kazakhstan), SOCAR (Azerbaijan, regional partnerships), Repsol (active in Kazakhstan), Tethys Petroleum (active in Kazakhstan, Tajikistan), Dragon Oil (subsidiary of ENOC, active in Turkmenistan) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Central Asia oil and gas market appears promising, driven by increasing energy demand and technological advancements. As countries in the region enhance their extraction capabilities and infrastructure, they are likely to attract more foreign investment. Additionally, the integration of renewable energy sources is expected to complement traditional oil and gas operations, fostering a more sustainable energy landscape. Overall, the region is poised for significant growth, provided it navigates its political and regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream Midstream Downstream |

| By Product Type | Crude Oil Natural Gas Refined Products Petrochemicals Others |

| By End-User | Power Generation Transportation Industrial Manufacturing Residential Heating Others |

| By Geography | Kazakhstan Turkmenistan Uzbekistan Tajikistan Kyrgyzstan Rest of Central Asia |

| By Application | Exploration Production Transportation Refining Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Investment Incentives Others |

| By Technology | Conventional Extraction Enhanced Oil Recovery Hydraulic Fracturing LNG Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Production Companies | 100 | CEOs, Operations Managers |

| Gas Distribution Firms | 70 | Supply Chain Directors, Regulatory Affairs Managers |

| Energy Policy Makers | 50 | Government Officials, Energy Advisors |

| Investment Analysts in Energy Sector | 60 | Financial Analysts, Investment Managers |

| Environmental Consultants | 40 | Sustainability Officers, Environmental Managers |

The Central Asia Oil and Gas Market is valued at approximately USD 140 billion, driven by abundant hydrocarbon reserves, increasing energy demand, and significant foreign investments in exploration and production activities.