Region:Europe

Author(s):Shubham

Product Code:KRAA0913

Pages:98

Published On:August 2025

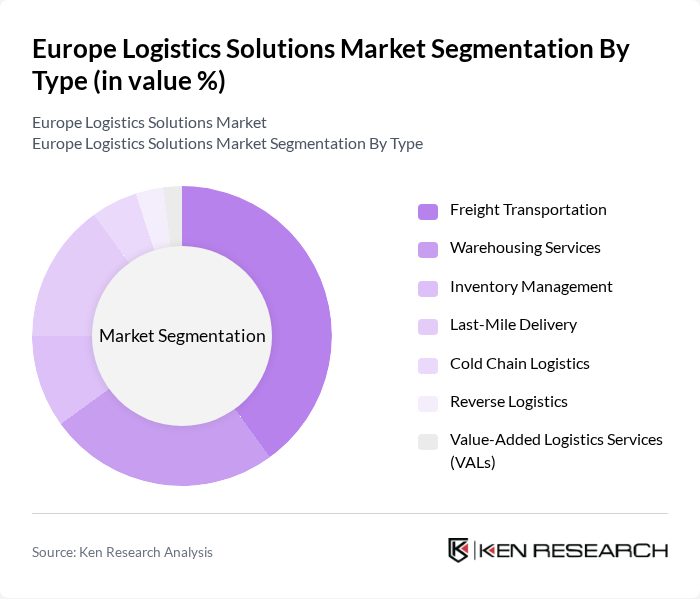

By Type:The logistics solutions market is segmented into various types, including Freight Transportation, Warehousing Services, Inventory Management, Last-Mile Delivery, Cold Chain Logistics, Reverse Logistics, and Value-Added Logistics Services (VALs). Among these, Freight Transportation is the most dominant segment, driven by the increasing demand for efficient and timely delivery of goods across Europe. The rise of e-commerce and cross-border trade has significantly boosted the need for reliable freight services, leading to innovations in transportation methods, digital tracking, and logistics management .

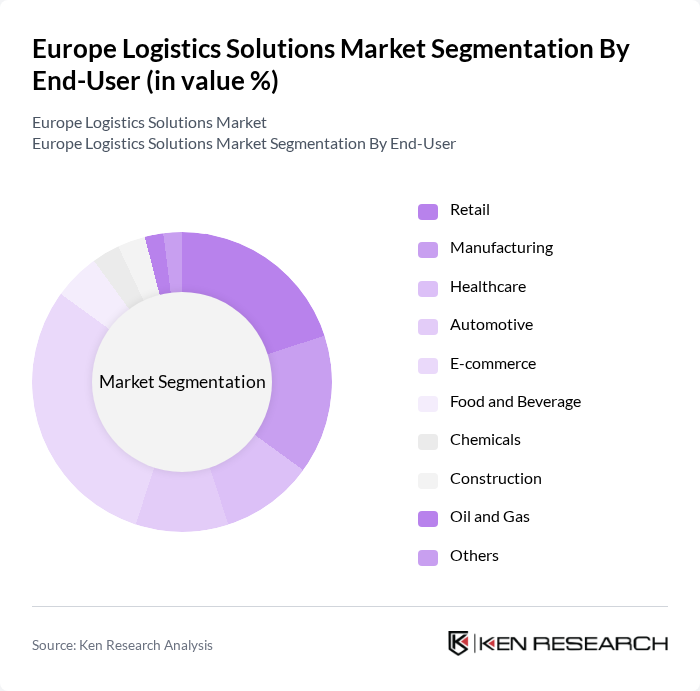

By End-User:The logistics solutions market is also segmented by end-user industries, including Retail, Manufacturing, Healthcare, Automotive, E-commerce, Food and Beverage, Chemicals, Construction, Oil and Gas, and Others. The E-commerce sector is currently the leading end-user, as the surge in online shopping and omnichannel retail has necessitated efficient logistics solutions to meet consumer expectations for fast and reliable delivery. This trend has prompted logistics providers to enhance their service offerings, invest in last-mile delivery infrastructure, and adopt advanced technologies for real-time tracking and fulfillment .

The Europe Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post AG), Kuehne + Nagel International AG, DB Schenker (Deutsche Bahn AG), XPO Inc., UPS Supply Chain Solutions (United Parcel Service, Inc.), DSV A/S, CEVA Logistics (CMA CGM Group), Geodis (SNCF Group), FedEx Logistics (FedEx Corporation), SNCF Logistics, Yusen Logistics (Nippon Yusen Kabushiki Kaisha), GXO Logistics, Inc., Agility Logistics, Hellmann Worldwide Logistics SE & Co. KG, Rhenus SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Europe logistics solutions market is poised for transformation, driven by digitalization and sustainability initiatives. As companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Furthermore, the emphasis on green logistics will lead to innovative practices that reduce carbon footprints. The integration of smart technologies in warehousing and transportation will enhance supply chain resilience, enabling logistics providers to adapt to changing consumer demands and regulatory landscapes effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Services Inventory Management Last-Mile Delivery Cold Chain Logistics Reverse Logistics Value-Added Logistics Services (VALs) |

| By End-User | Retail Manufacturing Healthcare Automotive E-commerce Food and Beverage Chemicals Construction Oil and Gas Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Pipeline Transport Others |

| By Service Type | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Supply Chain Management Others |

| By Technology | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Internet of Things (IoT) Blockchain Technology Artificial Intelligence (AI) & Advanced Analytics Automation & Robotics Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Solutions | 100 | Logistics Coordinators, Supply Chain Analysts |

| Pharmaceutical Distribution | 60 | Operations Directors, Compliance Managers |

| Food and Beverage Supply Chain | 50 | Warehouse Supervisors, Quality Assurance Managers |

| Automotive Logistics Management | 40 | Procurement Managers, Logistics Engineers |

| E-commerce Fulfillment Strategies | 80 | eCommerce Operations Managers, Logistics Analysts |

The Europe Logistics Solutions Market is valued at approximately USD 2.35 trillion, reflecting significant growth driven by e-commerce expansion, efficient supply chain management, and advancements in digitalization and automation.