Region:Global

Author(s):Geetanshi

Product Code:KRAA2050

Pages:94

Published On:August 2025

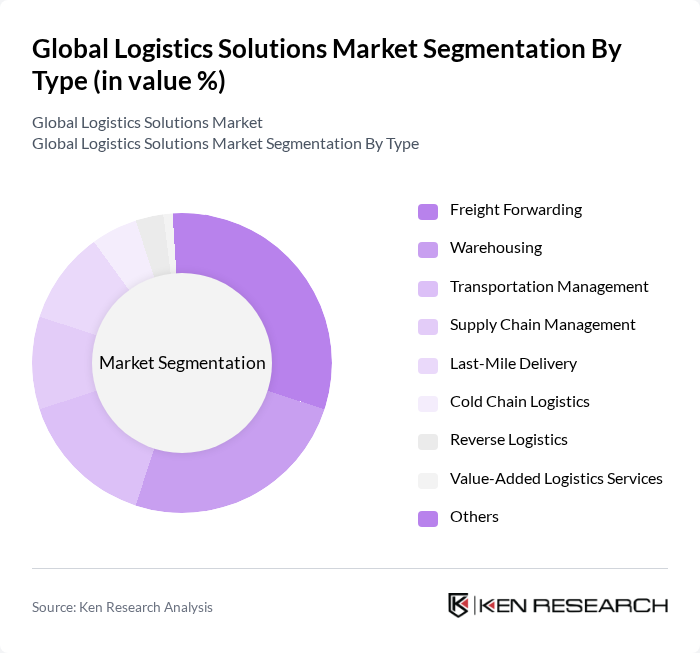

By Type:The logistics solutions market is segmented into various types, including Freight Forwarding, Warehousing, Transportation Management, Supply Chain Management, Last-Mile Delivery, Cold Chain Logistics, Reverse Logistics, Value-Added Logistics Services, and Others. Among these, Freight Forwarding remains a dominant segment, driven by the globalization of trade and the need for efficient cross-border transportation solutions. The surge in e-commerce has significantly boosted Last-Mile Delivery services, as businesses strive to meet consumer expectations for rapid, flexible delivery. Warehousing and Transportation Management are also critical, reflecting the need for integrated, technology-enabled logistics networks .

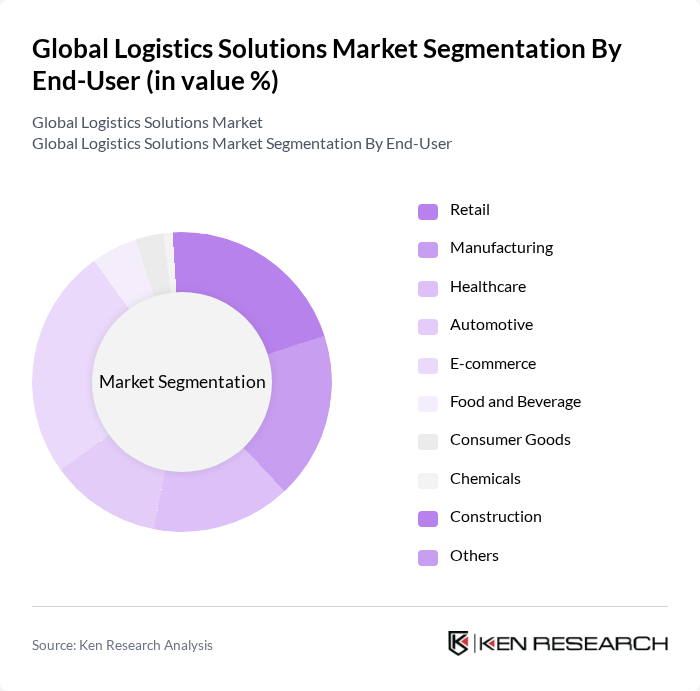

By End-User:The logistics solutions market is also categorized by end-users, including Retail, Manufacturing, Healthcare, Automotive, E-commerce, Food and Beverage, Consumer Goods, Chemicals, Construction, and Others. The E-commerce sector is currently the leading end-user, propelled by the global surge in online shopping and the demand for seamless, fast delivery services. Retail and Manufacturing follow, as both sectors require robust logistics solutions for inventory management, distribution, and supply chain optimization. Healthcare and Food & Beverage are also experiencing increased logistics demand, particularly for cold chain and time-sensitive deliveries .

The Global Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel International AG, XPO Logistics, Inc., C.H. Robinson Worldwide, Inc., DB Schenker, UPS Supply Chain Solutions, FedEx Logistics, J.B. Hunt Transport Services, Inc., CEVA Logistics, Ryder Supply Chain Solutions, Geodis, DSV A/S, Nippon Express Holdings, Inc., Expeditors International of Washington, Inc., and Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The logistics industry is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly focus on automation and data analytics to enhance efficiency. Additionally, sustainability will play a crucial role, with companies adopting green logistics practices to meet regulatory demands and consumer preferences. The integration of innovative technologies, such as blockchain, will further streamline operations, ensuring transparency and security in supply chains, ultimately shaping the future of logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Transportation Management Supply Chain Management Last-Mile Delivery Cold Chain Logistics Reverse Logistics Value-Added Logistics Services Others |

| By End-User | Retail Manufacturing Healthcare Automotive E-commerce Food and Beverage Consumer Goods Chemicals Construction Others |

| By Distribution Mode | Road Rail Air Sea Intermodal Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Dedicated Contract Carriage Inventory Management Services Integration & Consulting Services Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Technology Integration | IoT Integration AI and Machine Learning Blockchain Technology Automation & Robotics Data Analytics Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Third-Party Logistics Providers | 120 | Operations Managers, Business Development Executives |

| Freight Forwarding Services | 90 | Logistics Coordinators, Supply Chain Analysts |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Fleet Operations Supervisors |

| Cold Chain Logistics | 50 | Quality Assurance Managers, Supply Chain Directors |

| Warehouse Management Systems | 70 | IT Managers, Warehouse Operations Managers |

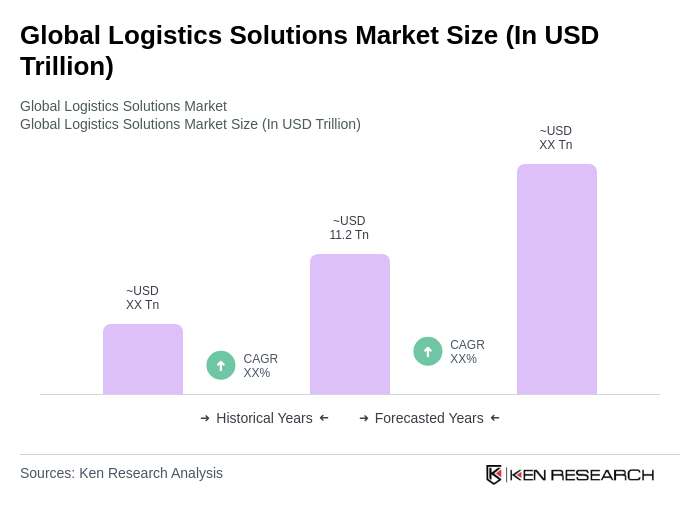

The Global Logistics Solutions Market is valued at approximately USD 11.2 trillion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and technological advancements in logistics operations.