Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA6817

Pages:87

Published On:September 2025

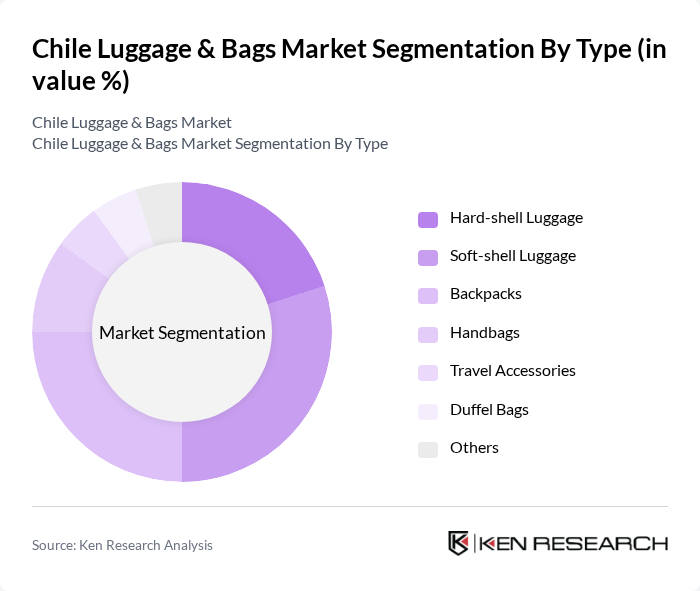

By Type:The luggage and bags market can be segmented into various types, including hard-shell luggage, soft-shell luggage, backpacks, handbags, travel accessories, duffel bags, and others. Among these, backpacks and soft-shell luggage are particularly popular due to their versatility and convenience for travelers. The increasing trend of adventure travel and outdoor activities has further boosted the demand for these segments.

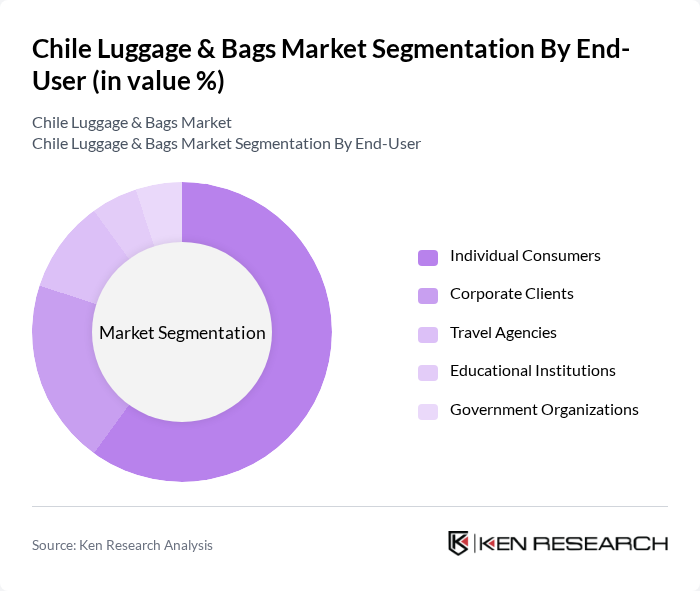

By End-User:The end-user segmentation includes individual consumers, corporate clients, travel agencies, educational institutions, and government organizations. Individual consumers dominate the market, driven by the increasing trend of personal travel and the growing influence of social media on travel choices. Corporate clients also represent a significant segment, as business travel continues to rise.

The Chile Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., American Tourister, Targus Group International, Inc., Osprey Packs, Inc., The North Face, Inc., Eastpak, Herschel Supply Co., Adidas AG, Nike, Inc., Under Armour, Inc., Travelpro International, Inc., Briggs & Riley Travelware, Delsey S.A., RIMOWA GmbH, Victorinox AG contribute to innovation, geographic expansion, and service delivery in this space.

The Chile luggage and bags market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. The shift towards smart luggage, which integrates technology for enhanced travel experiences, is expected to gain traction. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly products, as consumers become more conscious of their environmental impact. Brands that adapt to these trends will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-shell Luggage Soft-shell Luggage Backpacks Handbags Travel Accessories Duffel Bags Others |

| By End-User | Individual Consumers Corporate Clients Travel Agencies Educational Institutions Government Organizations |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Specialty Stores Department Stores Direct Sales |

| By Price Range | Budget Mid-range Premium |

| By Material | Polyester Nylon Leather Canvas Others |

| By Occasion | Business Travel Leisure Travel Adventure Travel Daily Commute |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Focused Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Travel Bags | 200 | Frequent Travelers, Tourists |

| Online Shopping Behavior for Luggage | 120 | E-commerce Shoppers, Digital Marketing Analysts |

| Brand Loyalty and Perception | 100 | Brand Managers, Marketing Executives |

| Trends in Sustainable Luggage | 80 | Sustainability Advocates, Product Designers |

The Chile Luggage & Bags Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased travel activities and rising disposable incomes among consumers.