Italy Luggage & Bags Market Overview

- The Italy Luggage & Bags Market is valued at USD 1.2 billion, based on a five-year historical analysis. This market is driven by the increasing trend of travel and tourism, a rising demand for stylish and functional luggage options, and a notable shift towards online retailing, which has expanded sales channels and accessibility for a wider audience. The adoption of lightweight, durable, and eco-friendly materials, as well as the emergence of smart luggage with features such as GPS tracking and charging ports, are key growth drivers in the Italian market. The prominence of e-commerce and digitalization continues to fuel market expansion and innovation .

- Key cities such asMilan, Rome, and Florencedominate the market due to their status as fashion capitals and major tourist destinations. The strong presence of luxury brands and robust retail infrastructure in these cities attract both local and international consumers seeking high-quality luggage and bags. The association of Italian cities with craftsmanship and luxury design further enhances their market leadership .

- The Italian luggage and bags industry is subject to theEU Regulation (EU) 2019/1021 on Persistent Organic Pollutants, enforced by the Ministry of Ecological Transition. This regulation mandates that manufacturers restrict the use of harmful chemicals in production, provide clear labeling on product origin and materials, and comply with environmental sustainability criteria. The regulation promotes the use of eco-friendly materials and processes, incentivizing a shift towards more sustainable production methods in alignment with European and global environmental objectives .

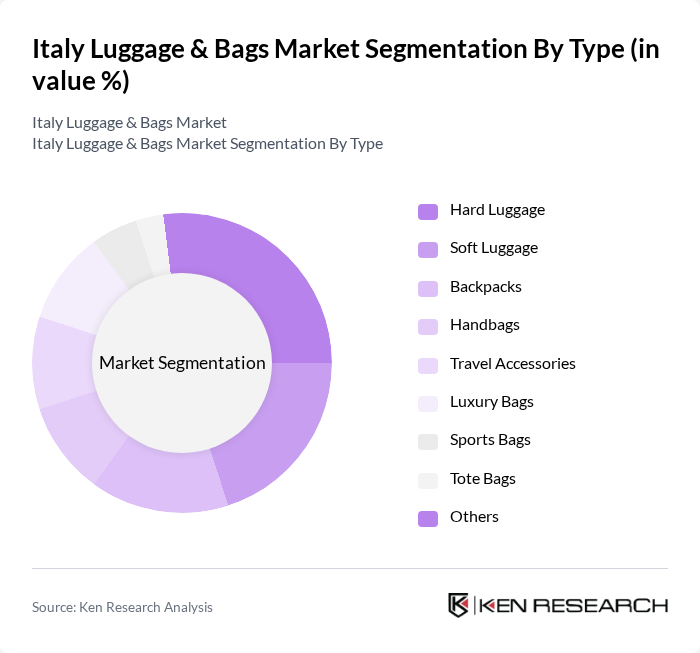

Italy Luggage & Bags Market Segmentation

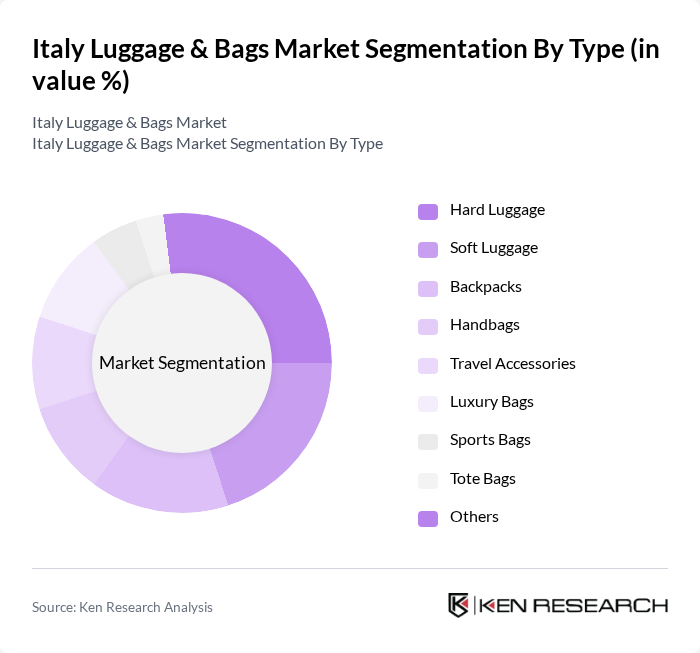

By Type:The luggage and bags market is segmented into hard luggage, soft luggage, backpacks, handbags, travel accessories, luxury bags, sports bags, tote bags, and others. Each subsegment addresses distinct consumer needs: hard and soft luggage for travel durability, backpacks for versatility and daily use, handbags and luxury bags for fashion and status, travel accessories for convenience, sports bags for athletic use, and tote bags for casual and multipurpose needs. The market has seen increased demand for lightweight, durable, and eco-friendly products, with backpacks and travel bags being the most lucrative segments .

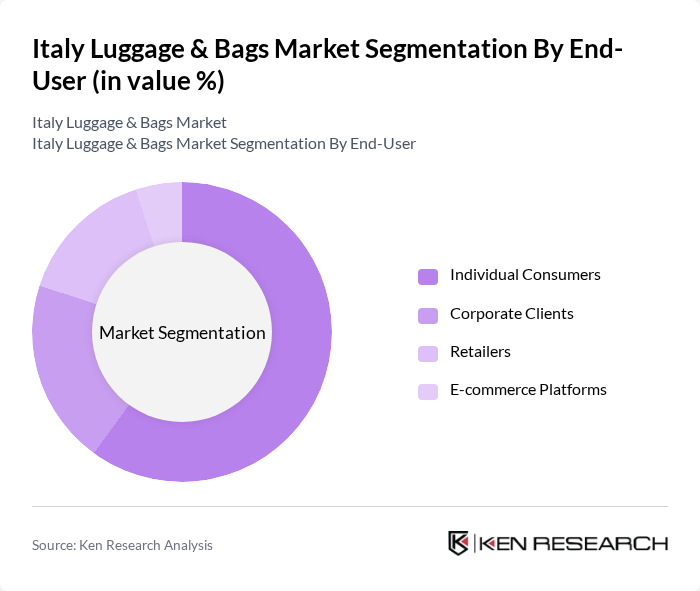

By End-User:The market is segmented by end-users into individual consumers, corporate clients, retailers, and e-commerce platforms. Individual consumers are the dominant segment, driven by personal travel and fashion consciousness. Corporate clients and retailers contribute through bulk procurement and brand partnerships, while e-commerce platforms are increasingly influential due to the convenience and variety they offer. The rise of online shopping has significantly shaped purchasing behavior and expanded market reach .

Italy Luggage & Bags Market Competitive Landscape

The Italy Luggage & Bags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Tumi Holdings, Inc., American Tourister, Rimowa GmbH, Eastpak, The North Face, Osprey Packs, Inc., Delsey S.A., Herschel Supply Co., Travelpro International, Inc., Briggs & Riley, Victorinox AG, Kipling, Piquadro S.p.A., Mandarina Duck, BRIC'S S.p.A., Gucci S.p.A., Prada S.p.A., Fendi S.r.l., Valigeria Roncato S.p.A., Longchamp, Montblanc, Valentino S.p.A., Ted Baker PLC contribute to innovation, geographic expansion, and service delivery in this space .

Italy Luggage & Bags Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism:In future, Italy is projected to welcome approximately 65 million international tourists, contributing significantly to the luggage and bags market. The tourism sector is expected to generate around €50 billion in revenue, driving demand for various travel accessories. This influx of travelers necessitates a diverse range of luggage options, from suitcases to backpacks, thereby propelling market growth. The resurgence of travel post-pandemic further amplifies this trend, as consumers prioritize quality and functionality in their travel gear.

- Rising Disposable Income:Italy's disposable income is anticipated to reach €25,000 per capita in future, reflecting a moderate increase from the previous year. This rise in disposable income enables consumers to invest in higher-quality luggage and bags, enhancing their travel experiences. As more individuals prioritize travel, the demand for premium products that combine style and functionality is expected to grow. This trend is particularly evident among millennials and Gen Z, who are increasingly willing to spend on travel-related products that reflect their lifestyle choices.

- E-commerce Growth:The Italian e-commerce market is projected to exceed €40 billion in future, with online sales of luggage and bags expected to account for a significant portion. The convenience of online shopping, coupled with the rise of digital payment methods, has transformed consumer purchasing behavior. Retailers are increasingly investing in their online platforms, offering a wider range of products and competitive pricing. This shift not only enhances accessibility for consumers but also allows brands to reach a broader audience, driving overall market growth.

Market Challenges

- Intense Competition:The Italian luggage and bags market is characterized by fierce competition, with numerous local and international brands vying for market share. In future, over 100 brands are expected to operate in this space, leading to price wars and reduced profit margins. Established brands face challenges from emerging players who offer innovative designs and competitive pricing. This saturation necessitates continuous innovation and effective marketing strategies to maintain brand loyalty and market presence.

- Fluctuating Raw Material Prices:The luggage industry is heavily reliant on raw materials such as plastics, metals, and textiles, which are subject to price volatility. In future, the cost of raw materials is projected to increase by moderate percentages due to supply chain disruptions and geopolitical tensions. This fluctuation can significantly impact production costs, forcing manufacturers to either absorb the costs or pass them onto consumers. Such challenges can hinder profitability and affect pricing strategies in a competitive market.

Italy Luggage & Bags Market Future Outlook

The future of the Italy luggage and bags market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to innovate with eco-friendly materials and production methods. Additionally, the integration of smart technology in luggage, such as GPS tracking and built-in charging ports, is expected to gain traction. These trends will not only enhance user experience but also attract tech-savvy consumers, ensuring sustained growth in the sector.

Market Opportunities

- Expansion of Online Retail:The ongoing growth of online retail presents a significant opportunity for luggage brands. With e-commerce sales projected to rise, companies can leverage digital marketing strategies to reach a wider audience. Enhanced online shopping experiences, including virtual try-ons and personalized recommendations, can further drive sales and customer engagement, positioning brands favorably in a competitive landscape.

- Customization and Personalization Trends:Consumers increasingly seek personalized products that reflect their individual styles. Offering customization options, such as monogramming or unique color choices, can attract discerning customers. This trend not only enhances customer satisfaction but also fosters brand loyalty, as consumers are more likely to return to brands that offer tailored experiences, creating a competitive edge in the market.