Spain Luggage & Bags Market Overview

- The Spain Luggage & Bags Market is valued at approximately USD 1 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing number of travelers, both domestic and international, as well as a rising trend in fashion-conscious consumers seeking stylish and functional luggage options. The market has also benefited from the expansion of e-commerce, which provides consumers with access to a wide variety of products. Additional growth drivers include urbanization, lifestyle changes, and demand for innovative products such as smart luggage with GPS trackers and eco-friendly materials.

- Key cities such as Madrid and Barcelona dominate the market due to their status as major travel hubs, attracting millions of tourists each year. These cities also feature vibrant retail environments with numerous shopping districts and international brands, further enhancing demand for luggage and bags. The presence of major airports and transport links in these urban areas continues to support market growth.

- The Spanish government has implemented binding regulations to reduce plastic waste, including the Royal Decree 1055/2022 on Packaging and Packaging Waste, issued by the Ministry for the Ecological Transition and the Demographic Challenge. This regulation mandates reduced use of single-use plastics and promotes eco-friendly materials in product manufacturing, directly affecting luggage and bag producers. Compliance includes thresholds for recycled content, labeling requirements, and extended producer responsibility, encouraging manufacturers to adopt sustainable practices and influencing consumer preferences toward environmentally friendly products.

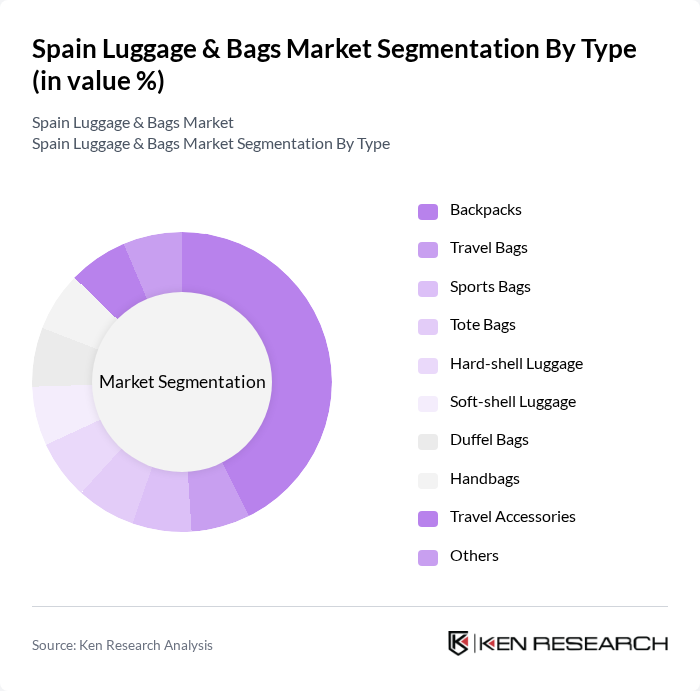

Spain Luggage & Bags Market Segmentation

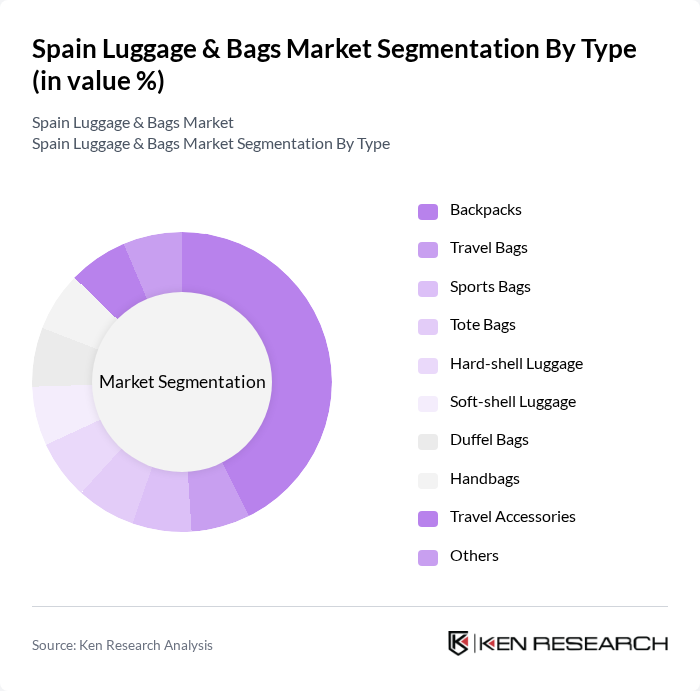

By Type:The luggage and bags market is segmented into backpacks, travel bags, sports bags, tote bags, hard-shell luggage, soft-shell luggage, duffel bags, handbags, travel accessories, and others. Backpacks are the largest segment, accounting for the highest revenue share, followed by travel bags, which are the fastest-growing category due to increased travel activity. Sports bags and duffel bags are gaining traction with the rise in adventure and fitness tourism. The market also sees demand for innovative designs, premium materials, and smart features such as integrated technology.

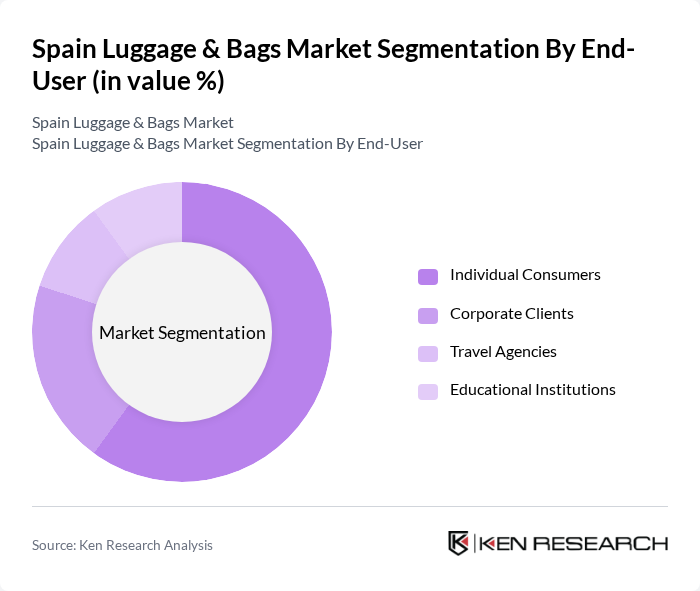

By End-User:The market is segmented into individual consumers, corporate clients, travel agencies, and educational institutions. Individual consumers represent the largest segment, driven by growing travel trends and the need for personal luggage solutions. Corporate clients also contribute significantly, as businesses require luggage for employee travel and events. Travel agencies and educational institutions represent smaller but notable segments.

Spain Luggage & Bags Market Competitive Landscape

The Spain Luggage & Bags Market features a dynamic mix of regional and international players. Leading participants include Samsonite International S.A., American Tourister, Tumi Holdings, Inc., Rimowa GmbH, Eastpak, Delsey S.A., The North Face, Osprey Packs, Inc., Herschel Supply Co., Kipling, Travelpro International, Inc., Briggs & Riley, Victorinox AG, Piquadro S.p.A., Valigeria Roncato S.p.A., BRIC'S S.p.A., LVMH Moët Hennessy Louis Vuitton SE, Antler Ltd, Nike, Inc., Ralph Lauren Corporation, Tommy Hilfiger, and VIP Industries Ltd. These companies drive innovation, geographic expansion, and service delivery in the market.

Spain Luggage & Bags Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism:In future, Spain is projected to welcome over 89 million international tourists, a significant increase from 83 million in previous years. This surge in travel is driven by Spain's rich cultural heritage and favorable climate, leading to higher demand for luggage and bags. The tourism sector contributes approximately €98 billion to the economy, representing 12% of GDP, thus fueling the growth of the luggage market as travelers seek quality and durable products for their journeys.

- Rising Disposable Income:The average disposable income in Spain is expected to reach €29,000 per capita in future, up from €27,000 in previous levels. This increase allows consumers to spend more on travel-related products, including luggage and bags. As disposable income rises, consumers are more inclined to invest in premium brands and innovative luggage solutions, driving market growth. The trend towards higher spending on travel accessories is evident, with a projected increase in sales of high-end luggage by 17% in future.

- Growing E-commerce Sales:E-commerce sales in Spain are anticipated to exceed €60 billion in future, reflecting a 20% increase from previous years. This growth is particularly beneficial for the luggage and bags market, as online platforms provide consumers with a wider selection and competitive pricing. The convenience of online shopping, coupled with the rise of mobile commerce, is expected to drive significant sales growth in the luggage sector, with online sales projected to account for 32% of total luggage sales in future.

Market Challenges

- Intense Competition:The Spanish luggage market is characterized by intense competition, with over 220 brands vying for market share. Major players like Samsonite and American Tourister dominate, but numerous local brands also compete aggressively. This saturation leads to price wars, which can erode profit margins. In future, the average profit margin in the luggage sector is expected to decline to 7%, down from 8% in previous years, as brands struggle to differentiate themselves in a crowded marketplace.

- Fluctuating Raw Material Prices:The luggage industry faces challenges from fluctuating raw material prices, particularly for plastics and metals. In future, the cost of raw materials is projected to rise by 12% due to supply chain disruptions and increased demand. This volatility can lead to higher production costs, which may be passed on to consumers, potentially reducing demand. Manufacturers must navigate these challenges while maintaining competitive pricing to sustain market share in a price-sensitive environment.

Spain Luggage & Bags Market Future Outlook

The future of the Spain luggage and bags market appears promising, driven by the increasing integration of technology in travel products and a growing emphasis on sustainability. As smart luggage technology gains traction, consumers are likely to seek innovative features that enhance travel convenience. Additionally, the rising awareness of environmental issues will push brands to adopt eco-friendly materials and practices, aligning with consumer preferences for sustainable products. This dual focus on innovation and sustainability is expected to shape the market landscape significantly in the coming years.

Market Opportunities

- Expansion of Online Retail:The rapid growth of online retail presents a significant opportunity for the luggage market. With e-commerce projected to account for 32% of total sales in future, brands can leverage digital platforms to reach a broader audience. Enhanced online marketing strategies and partnerships with e-commerce giants can further boost visibility and sales, tapping into the growing trend of online shopping among consumers.

- Customization and Personalization Trends:The demand for customized luggage solutions is on the rise, with consumers increasingly seeking personalized products. In future, brands that offer customization options are expected to capture a larger market share, as personalized items resonate more with consumers. This trend not only enhances customer satisfaction but also fosters brand loyalty, providing a competitive edge in a saturated market.