Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0222

Pages:90

Published On:August 2025

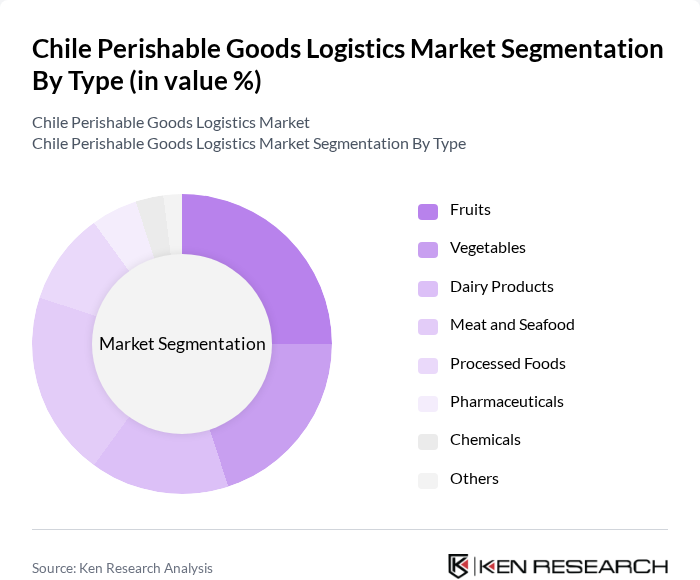

By Type:The market is segmented into various types of perishable goods, including fruits, vegetables, dairy products, meat and seafood, processed foods, pharmaceuticals, chemicals, and others. Each sub-segment plays a crucial role in the overall logistics framework, with specific requirements for handling, storage, and transportation. Fruits and vegetables represent the largest share, driven by Chile's export-oriented horticulture sector, while meat, seafood, and dairy also require advanced cold chain solutions to maintain quality and safety. Pharmaceuticals and chemicals, though smaller in volume, demand stringent temperature controls and compliance with regulatory standards .

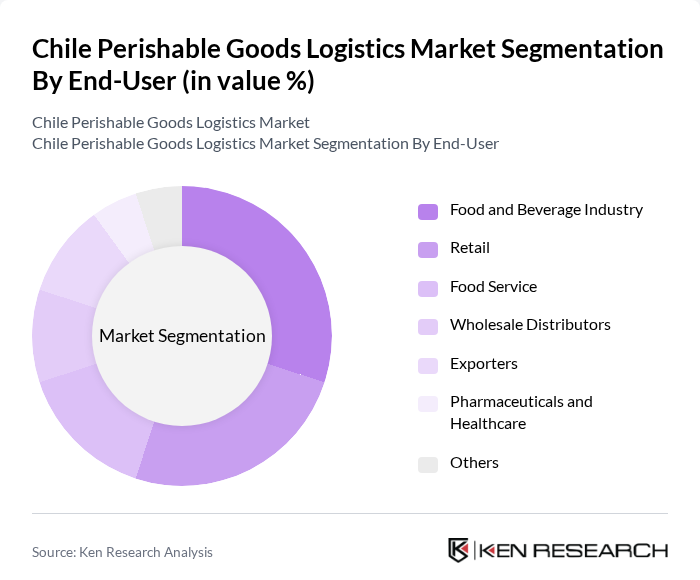

By End-User:The end-user segmentation includes the food and beverage industry, retail, food service, wholesale distributors, exporters, pharmaceuticals and healthcare, and others. Each of these sectors has distinct logistics needs, influencing the demand for perishable goods logistics services. The food and beverage industry and retail sectors are the primary end-users, driven by the need for timely and safe delivery of fresh and processed products. Exporters and wholesale distributors require robust cold chain solutions for international and large-scale domestic shipments, while the pharmaceutical and healthcare sector relies on specialized temperature-controlled logistics for sensitive products .

The Chile Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emergent Cold LatAm, Megafrio Chile SA, Empresas Taylor, DHL Supply Chain Chile, Kuehne + Nagel Chile, DB Schenker Chile, Agunsa, Frío Express, Logística Chile, Maersk Chile, Cencocal, Transportes Frío Sur, Andes Logistics, Ultramar, and Transportes Nazar contribute to innovation, geographic expansion, and service delivery in this space .

The Chilean perishable goods logistics market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As the demand for fresh produce and organic foods continues to rise, logistics providers are expected to enhance their cold chain capabilities. Additionally, the integration of smart logistics technologies will streamline operations, reduce waste, and improve efficiency. With government support for agricultural exports and a focus on sustainability, the market is likely to adapt to these trends, fostering a more resilient logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits Vegetables Dairy Products Meat and Seafood Processed Foods Pharmaceuticals Chemicals Others |

| By End-User | Food and Beverage Industry Retail Food Service Wholesale Distributors Exporters Pharmaceuticals and Healthcare Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics Providers (3PL) Cold Storage Facilities Value-Added Services (Packaging, Labeling) Others |

| By Temperature Control | Chilled Frozen Ambient Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Logistics Type | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Region | Santiago Valparaíso Concepción Antofagasta Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distribution | 100 | Logistics Coordinators, Supply Chain Managers |

| Dairy Product Logistics | 60 | Operations Managers, Quality Assurance Specialists |

| Meat and Seafood Transport | 50 | Procurement Managers, Cold Chain Supervisors |

| Frozen Goods Supply Chain | 40 | Warehouse Managers, Distribution Center Heads |

| Retail Perishable Goods Management | 70 | Store Managers, Inventory Control Analysts |

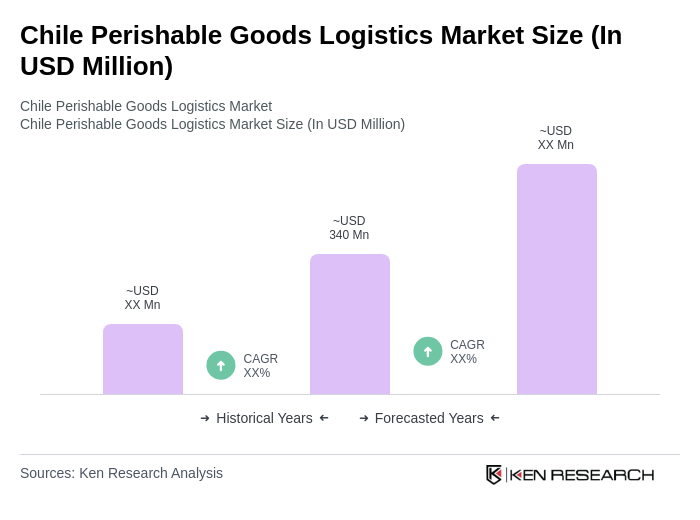

The Chile Perishable Goods Logistics Market is valued at approximately USD 340 million, reflecting a significant growth driven by the increasing demand for fresh produce, dairy, and meat products, as well as the expansion of e-commerce and retail sectors.