Region:Europe

Author(s):Geetanshi

Product Code:KRAA0233

Pages:90

Published On:August 2025

By Service Type:The service type segmentation includes Transportation, Warehousing/Storage, and Value-Added Services. Transportation is the leading segment, driven by the need for timely delivery of perishable goods, especially for food and pharmaceuticals. Warehousing/Storage follows closely, as efficient storage solutions with temperature control are crucial for maintaining product quality and safety. Value-Added Services, including packaging, labeling, and real-time tracking, are increasingly important as businesses seek to differentiate their offerings and enhance customer satisfaction .

By Temperature Range:The temperature range segmentation consists of Chilled and Frozen categories. The Chilled segment dominates the market, driven by the high demand for fresh produce, dairy, and ready-to-eat meals. The Frozen segment is also significant, catering to the growing consumer preference for frozen foods and the need for long-term storage solutions. Both segments are essential for ensuring the quality and safety of perishable goods throughout the supply chain .

The France Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sofrilog, IRIS Logistics, XPO Logistics, Mutual Logistics, Kuehne + Nagel, Geodis, DB Schenker, DHL Supply Chain, Norbert Dentressangle (now part of XPO Logistics), DSV, CMA CGM Logistics, Transports Dufour, TSE Express, STG Logistics, ID Logistics, Rhenus Logistics, and A.P. Moller - Maersk contribute to innovation, geographic expansion, and service delivery in this space .

The future of the perishable goods logistics market in France appears promising, driven by technological advancements and evolving consumer preferences. As the demand for fresh and organic products continues to rise, logistics providers will increasingly adopt automation and IoT solutions to enhance efficiency. Additionally, the focus on sustainability will likely lead to innovations in eco-friendly packaging and waste reduction strategies, positioning the market for significant growth and adaptation to changing consumer behaviors in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Warehousing/Storage Value-Added Services |

| By Temperature Range | Chilled Frozen |

| By End-Use Industry | Food and Beverages Pharmaceuticals Others |

| By Product Category | Fresh Fruits and Vegetables Dairy Products Meat and Seafood Processed Food Products Others |

| By Mode of Transportation | Road Rail Air Sea |

| By Geographic Region | Paris Region Lyon Region Marseille Region Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Produce Distribution | 100 | Logistics Coordinators, Supply Chain Managers |

| Dairy Product Logistics | 60 | Operations Managers, Quality Assurance Specialists |

| Meat and Seafood Supply Chain | 50 | Procurement Managers, Cold Chain Supervisors |

| Frozen Goods Transportation | 40 | Warehouse Managers, Distribution Directors |

| Retail Perishable Goods Management | 70 | Store Managers, Inventory Control Specialists |

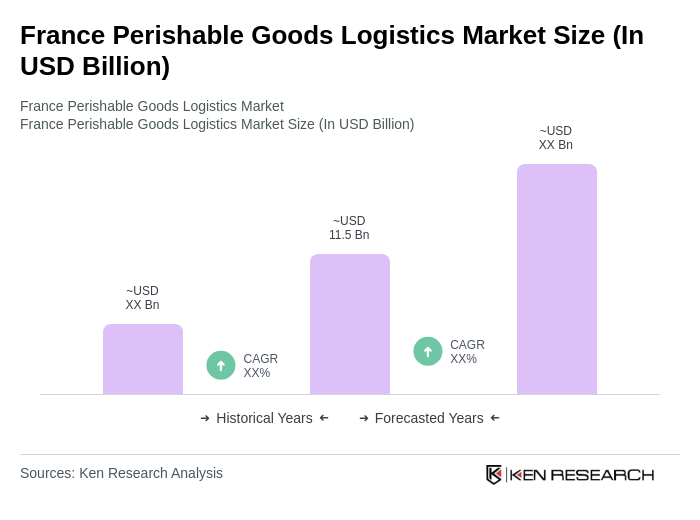

The France Perishable Goods Logistics Market is valued at approximately USD 11.5 billion, driven by increasing demand for fresh food products, e-commerce growth, and advancements in cold chain technologies.