Region:Africa

Author(s):Geetanshi

Product Code:KRAA0293

Pages:89

Published On:August 2025

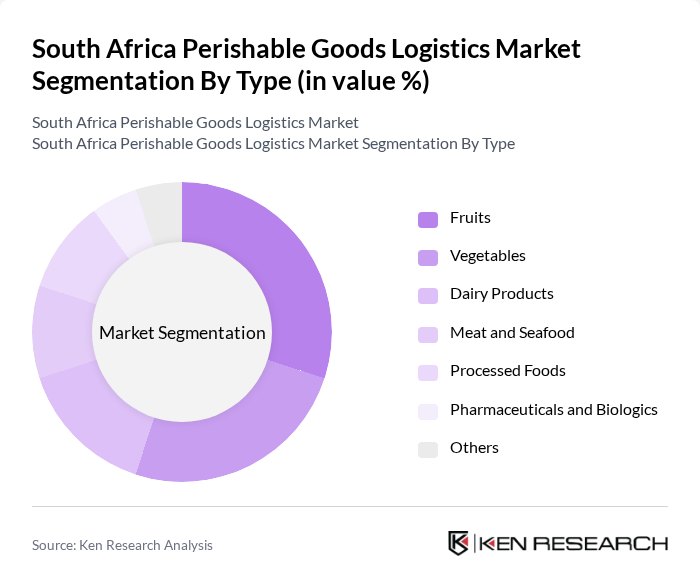

By Type:The market is segmented into various types of perishable goods, including fruits, vegetables, dairy products, meat and seafood, processed foods, pharmaceuticals and biologics, and others. Among these, fruits and vegetables dominate the market due to their high demand in both local and international markets. The increasing health consciousness among consumers, the rise of export-oriented agriculture, and the expansion of the pharmaceutical cold chain have led to a surge in the consumption and movement of fresh produce and sensitive goods, driving logistics solutions tailored for these products .

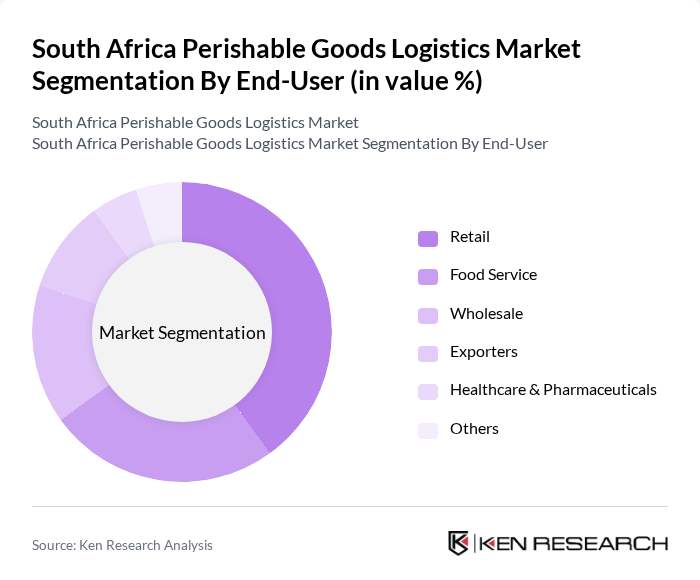

By End-User:The end-user segmentation includes retail, food service, wholesale, exporters, healthcare & pharmaceuticals, and others. The retail sector is the leading end-user, driven by the growing trend of online grocery shopping, the proliferation of supermarkets, and the demand for fresh produce. The food service industry, including restaurants and catering services, also plays a significant role, as these businesses require reliable logistics for perishable goods to maintain quality and safety. The healthcare and pharmaceutical sector is expanding rapidly, reflecting the increased movement of temperature-sensitive medical products .

The South Africa Perishable Goods Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DSV South Africa, Kuehne + Nagel South Africa, Transnet Freight Rail, Barloworld Logistics, DHL Supply Chain South Africa, Rhenus Logistics South Africa, CCS Logistics, Maersk South Africa, Grindrod Limited, Unitrans Supply Chain Solutions, Vector Logistics, SAA Cargo, and Africold Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The South African perishable goods logistics market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and IoT solutions to enhance efficiency and reduce spoilage. Additionally, sustainability will become a focal point, with companies investing in eco-friendly practices. The government's support for agricultural exports will further stimulate growth, creating a more robust logistics framework that meets the evolving demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits Vegetables Dairy Products Meat and Seafood Processed Foods Pharmaceuticals and Biologics Others |

| By End-User | Retail Food Service Wholesale Exporters Healthcare & Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics (3PL) Cold Storage Facilities Others |

| By Temperature Control | Chilled (2°C to 8°C) Frozen (below -18°C) Ambient Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Insulated Packaging Others |

| By Geographic Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Limpopo Others |

| By Service Type | Transportation Warehousing & Cold Storage Value-Added Services (e.g., packaging, labeling, customs clearance) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Chain Logistics Providers | 100 | Operations Managers, Logistics Coordinators |

| Perishable Goods Retailers | 80 | Supply Chain Directors, Procurement Managers |

| Agricultural Exporters | 60 | Export Managers, Quality Control Officers |

| Food Processing Companies | 70 | Production Managers, Supply Chain Analysts |

| Transport and Logistics Consultants | 40 | Consultants, Industry Analysts |

The South Africa Perishable Goods Logistics Market is valued at approximately USD 10.5 billion, reflecting a significant growth driven by increasing demand for fresh produce, dairy, meat products, and pharmaceuticals, alongside the expansion of e-commerce and retail sectors.