Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2011

Pages:86

Published On:August 2025

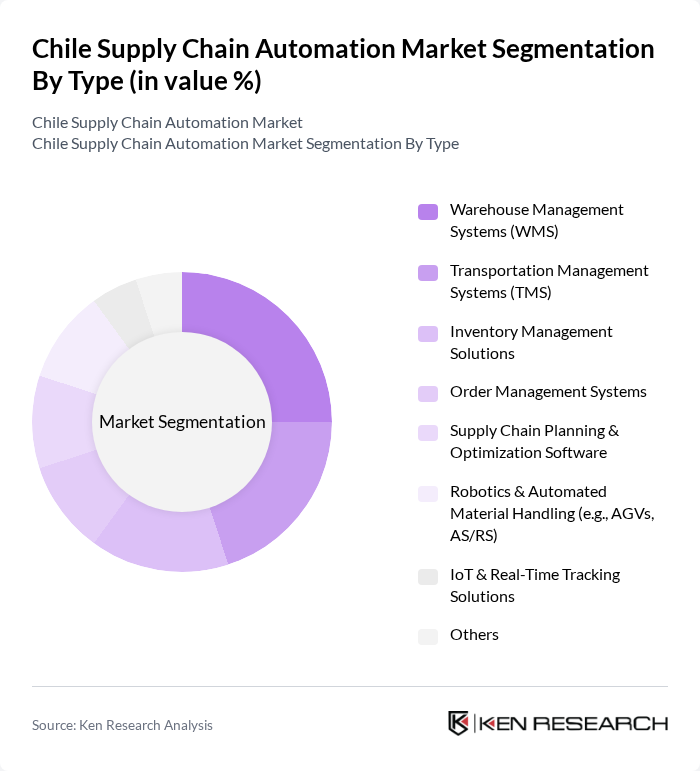

By Type:The market is segmented into various types of automation solutions that cater to different operational needs. The key subsegments include Warehouse Management Systems (WMS), Transportation Management Systems (TMS), Inventory Management Solutions, Order Management Systems, Supply Chain Planning & Optimization Software, Robotics & Automated Material Handling, IoT & Real-Time Tracking Solutions, and Others. Each of these subsegments plays a crucial role in enhancing efficiency and reducing operational costs. The rapid growth of e-commerce and the need for faster, more accurate order fulfillment are driving the adoption of warehouse automation and real-time tracking technologies .

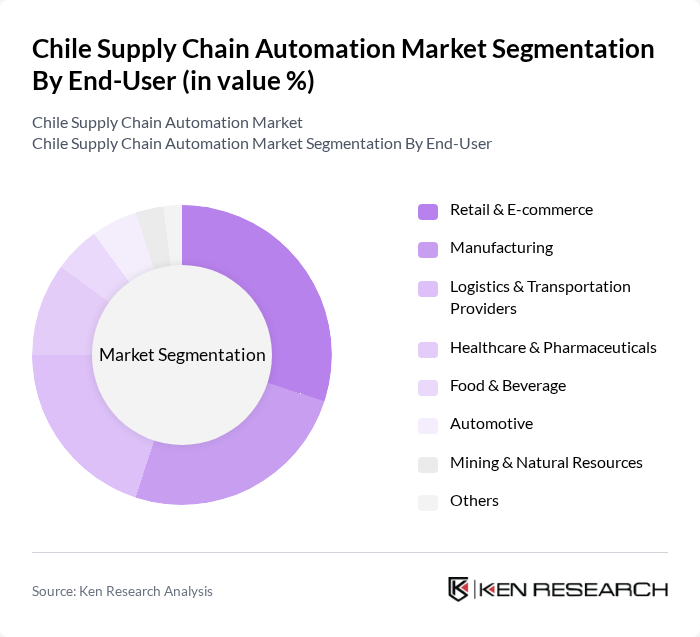

By End-User:The end-user segmentation includes various industries that utilize supply chain automation solutions. Key segments are Retail & E-commerce, Manufacturing, Logistics & Transportation Providers, Healthcare & Pharmaceuticals, Food & Beverage, Automotive, Mining & Natural Resources, and Others. Each sector has unique requirements that drive the adoption of automation technologies to improve efficiency and service delivery. The retail and e-commerce sector leads due to the surge in online shopping and the need for rapid order fulfillment, while manufacturing and logistics providers are investing in automation to optimize operations and meet rising customer expectations .

The Chile Supply Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, IBM Corporation, Kinaxis Inc., Siemens AG, Honeywell International Inc., Zebra Technologies Corporation, Rockwell Automation, Inc., Coupa Software Inc., C3.ai, Inc., Locus Robotics, Dematic (a KION Group company), Swisslog (a KUKA company), Beetrack (now part of DispatchTrack), Sonda S.A., Miebach Consulting, Honeywell Chile S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Chile supply chain automation market is poised for significant transformation as businesses increasingly recognize the importance of technology in enhancing operational efficiency. With the government’s commitment to digital transformation and the rising demand for e-commerce, companies are likely to invest more in automation solutions. Furthermore, the integration of AI and machine learning will enable real-time data utilization, fostering innovation and improving customer experiences. As these trends evolve, the market will likely witness accelerated growth and modernization.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Order Management Systems Supply Chain Planning & Optimization Software Robotics & Automated Material Handling (e.g., AGVs, AS/RS) IoT & Real-Time Tracking Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Logistics & Transportation Providers Healthcare & Pharmaceuticals Food & Beverage Automotive Mining & Natural Resources Others |

| By Component | Software Hardware (e.g., RFID, sensors, robotics) Services (Implementation, Consulting, Support) |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales |

| By Deployment Mode | Cloud-based Solutions On-premise Solutions |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Agriculture & Food Processing |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Automation | 100 | Operations Managers, Supply Chain Analysts |

| Retail Supply Chain Optimization | 60 | Logistics Coordinators, Inventory Managers |

| E-commerce Fulfillment Automation | 50 | eCommerce Operations Managers, IT Directors |

| Logistics Service Provider Automation | 40 | Business Development Managers, Technology Officers |

| Technology Vendor Insights | 45 | Product Managers, Sales Executives |

The Chile Supply Chain Automation Market is valued at approximately USD 1.8 billion, driven by the increasing demand for efficiency and transparency in supply chain operations, along with the adoption of advanced technologies like IoT and AI.