Region:Africa

Author(s):Geetanshi

Product Code:KRAA1969

Pages:97

Published On:August 2025

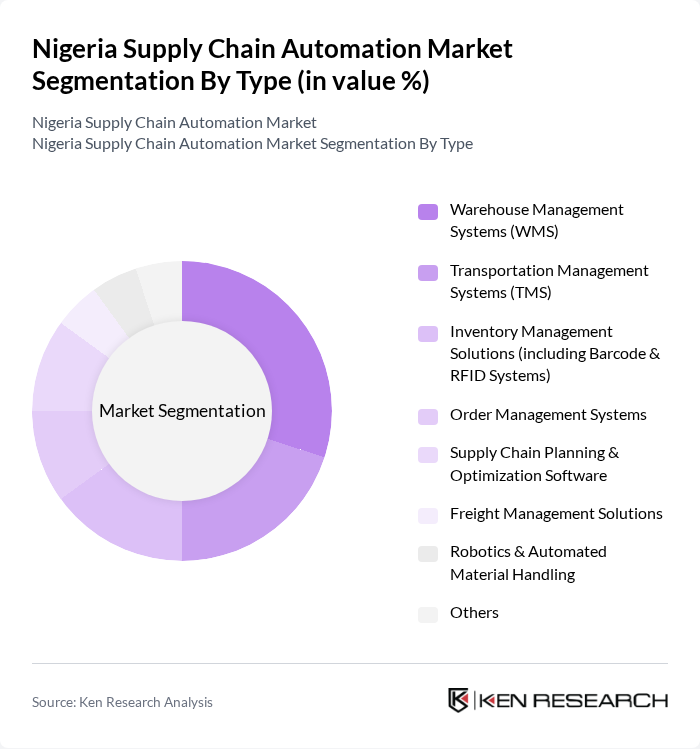

By Type:The market is segmented into various types of automation solutions that address different aspects of supply chain management. Key subsegments include Warehouse Management Systems (WMS), Transportation Management Systems (TMS), Inventory Management Solutions (including Barcode & RFID Systems), Order Management Systems, Supply Chain Planning & Optimization Software, Freight Management Solutions, Robotics & Automated Material Handling, and Others. Warehouse Management Systems (WMS) lead the market, driven by the need for efficient inventory management and space optimization in warehouses. The adoption of TMS is also accelerating due to the demand for real-time shipment tracking and route optimization, while Inventory Management Solutions are increasingly implemented to support e-commerce and omnichannel fulfillment.

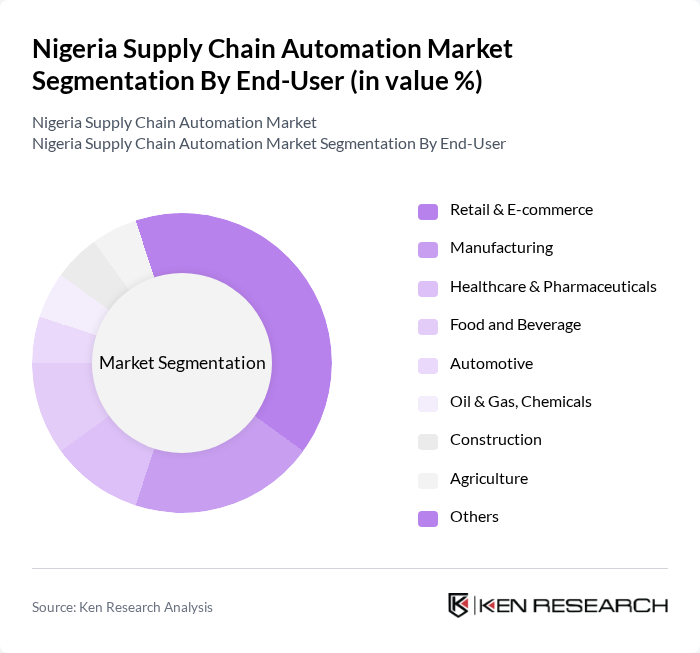

By End-User:The end-user segmentation includes industries utilizing supply chain automation solutions. Primary segments are Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Oil & Gas, Chemicals, Construction, Agriculture, and Others. Retail & E-commerce is the largest contributor, propelled by the rapid growth of online shopping and the need for efficient order fulfillment and inventory management. Manufacturing and healthcare sectors are also expanding their adoption of automation to improve operational efficiency and regulatory compliance, while oil & gas and chemicals require specialized logistics for hazardous and temperature-sensitive goods.

The Nigeria Supply Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Infor, Inc., Kinaxis Inc., C.H. Robinson Worldwide, Inc., DHL Supply Chain (DHL International Nigeria Ltd.), Kuehne + Nagel International AG, XPO Logistics, Inc., CEVA Logistics, Bolloré Transport & Logistics Nigeria, AGS Movers Nigeria, Red Star Express Plc (FedEx Nigeria) contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the Nigeria supply chain automation market appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace automation, the integration of artificial intelligence and IoT technologies is expected to enhance operational capabilities. Furthermore, the government's commitment to improving infrastructure will likely facilitate smoother logistics operations. By future, the market is anticipated to witness significant growth, with a focus on sustainable practices and innovative solutions that address current challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions (including Barcode & RFID Systems) Order Management Systems Supply Chain Planning & Optimization Software Freight Management Solutions Robotics & Automated Material Handling Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Oil & Gas, Chemicals Construction Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Retail Partnerships Others |

| By Component | Software Hardware (including IoT Devices, Sensors, Robotics) Services (Implementation, Consulting, Support) Others |

| By Application | Supply Chain Visibility & Tracking Demand Forecasting & Planning Order Fulfillment & Last-Mile Delivery Logistics & Fleet Management Warehouse Automation Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Automation | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Automation | 75 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 85 | Logistics Coordinators, Warehouse Managers |

| Transportation Management Systems | 60 | Fleet Managers, Procurement Officers |

| Technology Integration in Supply Chains | 50 | IT Specialists, Business Analysts |

The Nigeria Supply Chain Automation Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of technology in logistics and supply chain management, as well as the growth of e-commerce and digital payment solutions.