Region:Middle East

Author(s):Shubham

Product Code:KRAA0777

Pages:92

Published On:August 2025

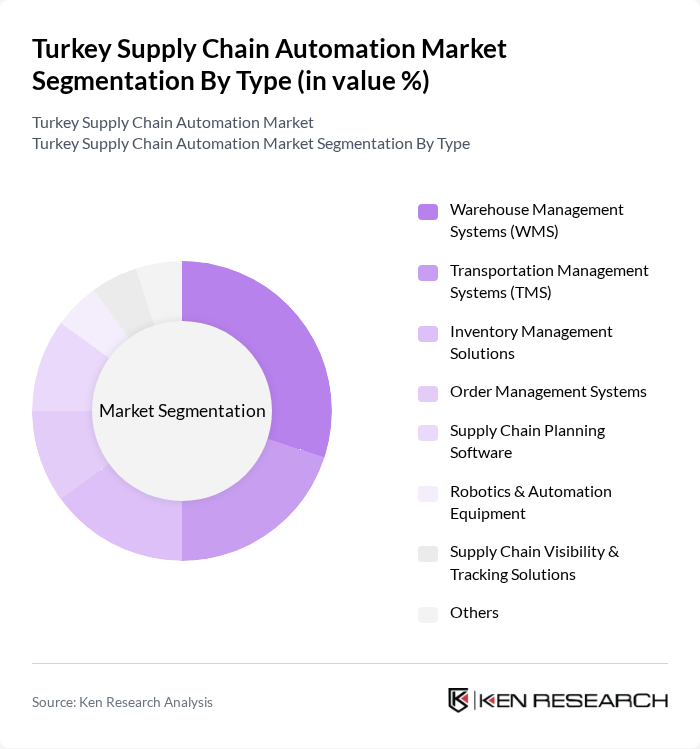

By Type:The segmentation by type covers a broad range of automation solutions tailored to various supply chain functions. The subsegments include Warehouse Management Systems (WMS), Transportation Management Systems (TMS), Inventory Management Solutions, Order Management Systems, Supply Chain Planning Software, Robotics & Automation Equipment (such as AGVs, AMRs, and Conveyor Systems), Supply Chain Visibility & Tracking Solutions, and Others. Among these, Warehouse Management Systems (WMS) maintain the largest market share, driven by the need for enhanced inventory accuracy, order fulfillment speed, and integration with e-commerce platforms. Robotics and automation equipment are also gaining traction as companies seek to optimize labor costs and improve operational safety .

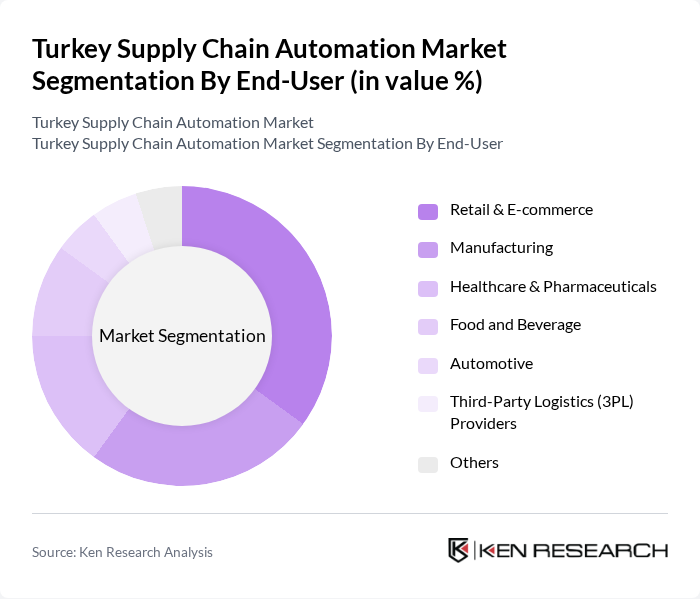

By End-User:The end-user segmentation reflects the diverse adoption of supply chain automation across industries. Key segments include Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Third-Party Logistics (3PL) Providers, and Others. The Retail & E-commerce sector leads this segment, propelled by the surge in online shopping, demand for rapid order fulfillment, and the integration of automation in warehousing and last-mile delivery. Manufacturing and healthcare sectors are also significant adopters, leveraging automation for process optimization and regulatory compliance .

The Turkey Supply Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, IBM, Siemens AG, Honeywell, Zebra Technologies, Dematic, SSI SCHAEFER, Swisslog (KUKA Group), Körber Supply Chain, Arvato Supply Chain Solutions, Netlog Logistics (Turkey), Borusan Lojistik (Turkey), Ekol Logistics (Turkey), DHL Supply Chain, Kuehne + Nagel, Geodis contribute to innovation, geographic expansion, and service delivery in this space.

As Turkey continues to embrace digital transformation, the supply chain automation market is poised for significant advancements. The integration of AI and IoT technologies will enhance operational efficiency and data-driven decision-making. Additionally, the government's commitment to improving logistics infrastructure will facilitate smoother supply chain operations. Companies that prioritize automation will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape, while addressing challenges related to workforce skills and investment costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Order Management Systems Supply Chain Planning Software Robotics & Automation Equipment (e.g., AGVs, AMRs, Conveyor Systems) Supply Chain Visibility & Tracking Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Third-Party Logistics (3PL) Providers Others |

| By Component | Software Hardware (e.g., sensors, robotics, barcode/RFID) Services (integration, consulting, maintenance) |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales |

| By Distribution Mode | B2B B2C |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Automation | 100 | Operations Managers, Supply Chain Analysts |

| Retail Supply Chain Automation | 60 | Logistics Coordinators, IT Managers |

| Food and Beverage Distribution | 50 | Warehouse Managers, Quality Control Supervisors |

| Pharmaceutical Supply Chain | 40 | Regulatory Affairs Managers, Distribution Managers |

| E-commerce Fulfillment Automation | 70 | eCommerce Operations Managers, Logistics Directors |

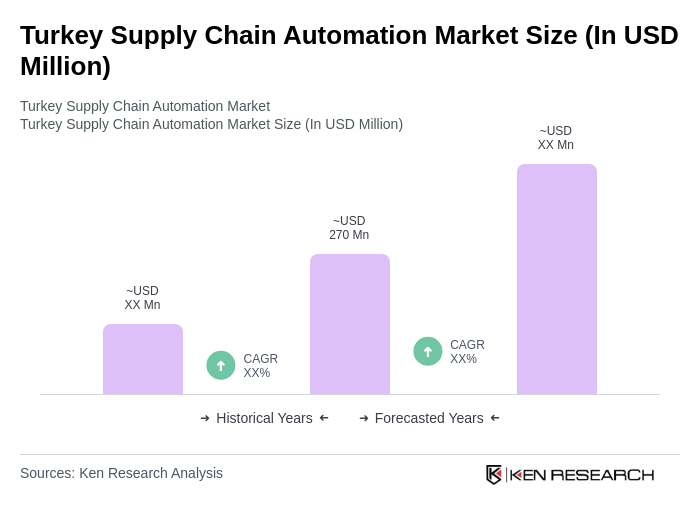

The Turkey Supply Chain Automation Market is valued at approximately USD 270 million, reflecting significant growth driven by the demand for efficiency and the adoption of advanced technologies like AI, IoT, and robotics in logistics and warehousing.