Region:Central and South America

Author(s):Shubham

Product Code:KRAA0934

Pages:90

Published On:August 2025

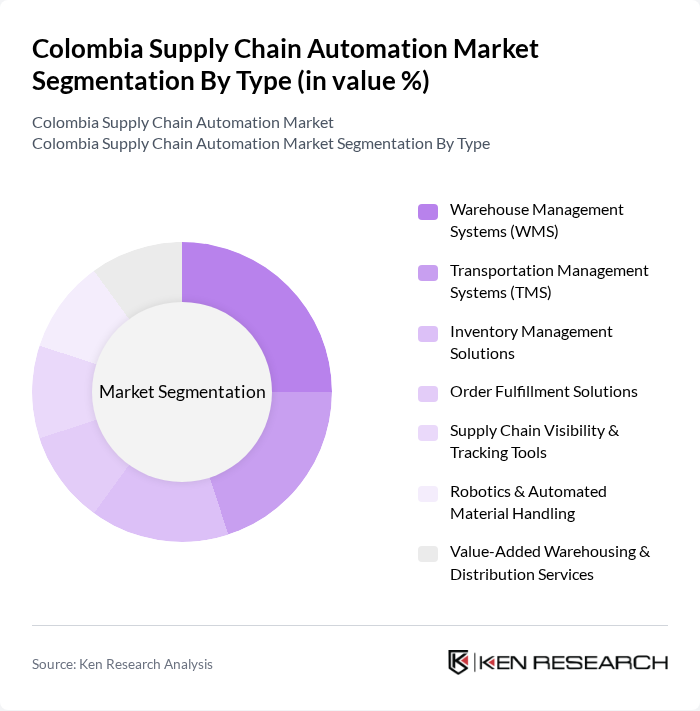

By Type:The market is segmented into Warehouse Management Systems (WMS), Transportation Management Systems (TMS), Inventory Management Solutions, Order Fulfillment Solutions, Supply Chain Visibility & Tracking Tools, Robotics & Automated Material Handling, and Value-Added Warehousing & Distribution Services. These solutions are increasingly adopted to improve inventory accuracy, reduce lead times, automate repetitive tasks, and enhance end-to-end supply chain visibility, reflecting the growing emphasis on digital transformation and operational agility in Colombian logistics .

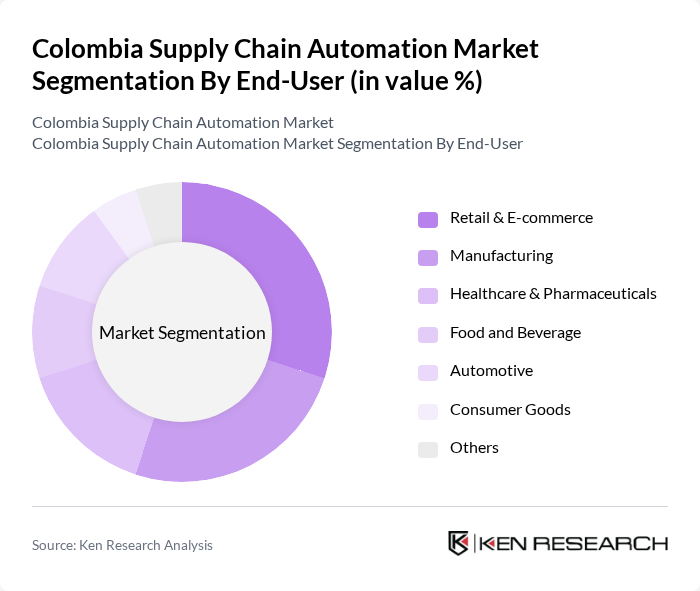

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Consumer Goods, and Others. Each sector faces unique supply chain challenges, such as the need for rapid order fulfillment in e-commerce, stringent quality control in pharmaceuticals, and traceability in food and beverage, driving the demand for tailored automation solutions across Colombia’s diverse industrial landscape .

The Colombia Supply Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, Siemens AG, Honeywell International Inc., Zebra Technologies, Rockwell Automation, Kuehne + Nagel, DHL Supply Chain, Grupo TCC, Coordinadora Mercantil, and Logyca contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Colombian supply chain automation market appears promising, driven by technological advancements and increasing consumer expectations. As companies continue to embrace automation, the integration of AI and machine learning will enhance operational efficiency and decision-making processes. Additionally, the ongoing development of smart cities will create a conducive environment for innovative logistics solutions, further propelling the market forward. The collaboration between businesses and technology providers will also play a crucial role in shaping the future landscape of supply chain automation in Colombia.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Order Fulfillment Solutions Supply Chain Visibility & Tracking Tools Robotics & Automated Material Handling Value-Added Warehousing & Distribution Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Consumer Goods Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales |

| By Distribution Mode | Cloud-based Solutions On-premise Solutions |

| By Industry Vertical | FMCG (Fast-Moving Consumer Goods) Pharmaceuticals Electronics & Electricals Apparel & Fashion |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Automation | 100 | Supply Chain Managers, Operations Directors |

| E-commerce Fulfillment Automation | 80 | Logistics Coordinators, IT Managers |

| Retail Inventory Management Solutions | 70 | Inventory Managers, Retail Operations Heads |

| Transportation Management Systems | 60 | Transport Managers, Fleet Operations Supervisors |

| Warehouse Automation Technologies | 90 | Warehouse Managers, Automation Engineers |

The Colombia Supply Chain Automation Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficiency in logistics, the rise of e-commerce, and the adoption of advanced technologies like AI and IoT.