Region:Central and South America

Author(s):Dev

Product Code:KRAA0439

Pages:87

Published On:August 2025

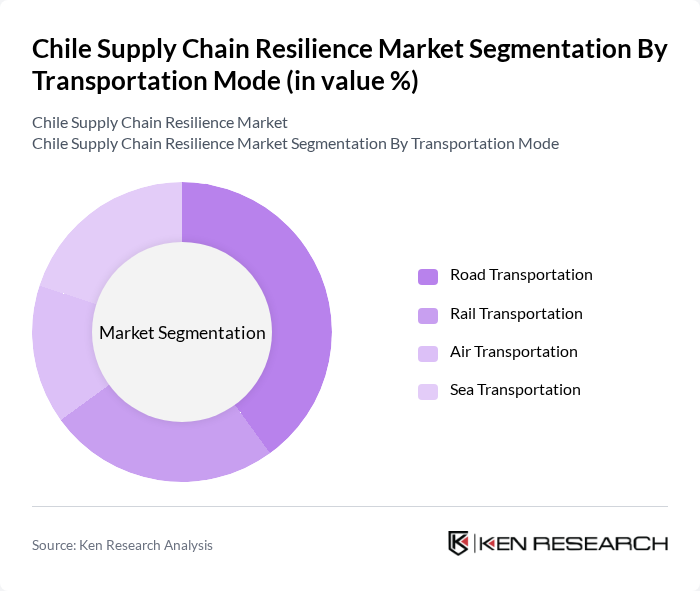

By Transportation Mode:The transportation mode segment encompasses the primary methods for moving goods, which are essential for maintaining supply chain efficiency. The subsegments include road transportation, rail transportation, air transportation, and sea transportation. Road transportation is the most flexible and widely used for domestic distribution, rail offers cost-effective bulk transport for commodities, air provides rapid delivery for high-value or time-sensitive goods, and sea is vital for international trade, especially bulk exports such as copper and agricultural products .

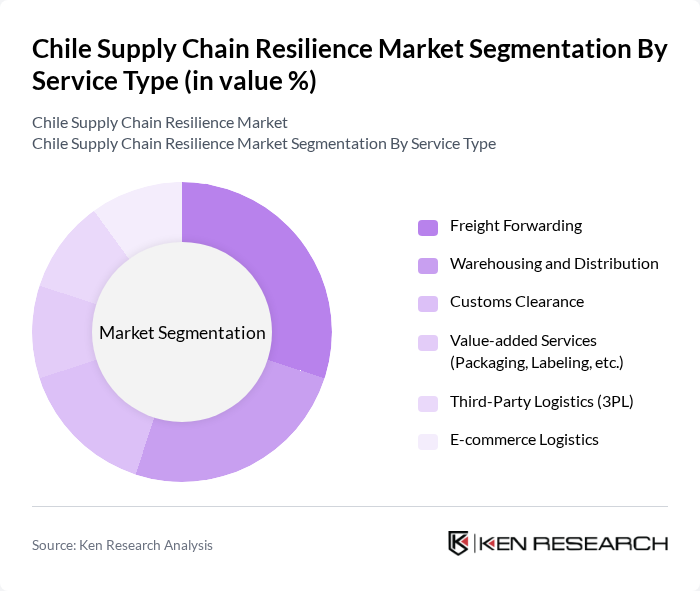

By Service Type:This segment covers the range of logistics services supporting supply chain operations. The subsegments include freight forwarding, warehousing and distribution, customs clearance, value-added services, third-party logistics (3PL), and e-commerce logistics. Freight forwarding coordinates international shipments, warehousing and distribution ensure storage and timely delivery, customs clearance manages regulatory compliance, value-added services include packaging and labeling, 3PL providers offer integrated logistics solutions, and e-commerce logistics is expanding rapidly due to the growth of online retail .

The Chile Supply Chain Resilience Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maersk Chile, DHL Supply Chain Chile, Kuehne + Nagel Chile, DB Schenker Chile, Agunsa, Sitrans, SAAM Logistics, Cencosud Logistics, Blue Express, FedEx Express Chile, UPS Chile, Geodis Chile, CEVA Logistics Chile, Ransa Chile, and TCC Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean supply chain resilience market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital solutions, the focus will shift towards enhancing operational efficiency and risk management. Furthermore, the integration of real-time data analytics will enable businesses to respond swiftly to disruptions. This proactive approach will not only improve resilience but also align with consumer expectations for transparency and sustainability in supply chains, fostering long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Service Type | Freight Forwarding Warehousing and Distribution Customs Clearance Value-added Services (Packaging, Labeling, etc.) Third-Party Logistics (3PL) E-commerce Logistics |

| By Industry Vertical | Mining and Minerals Agriculture and Food Manufacturing Automotive Retail and Consumer Goods Pharmaceuticals and Healthcare |

| By Technology | Cloud-based Solutions IoT Integration Blockchain Technology AI and Machine Learning Big Data Analytics |

| By Geographic Focus | Urban Areas Rural Areas Coastal Regions Inland Regions |

| By Policy Support | Government Grants Tax Incentives Public-Private Partnerships Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Resilience | 100 | Supply Chain Managers, Operations Directors |

| Manufacturing Sector Logistics | 80 | Production Managers, Logistics Coordinators |

| Agricultural Supply Chain Strategies | 70 | Agribusiness Executives, Procurement Managers |

| Mining Industry Supply Chain Practices | 60 | Logistics Managers, Safety and Compliance Managers |

| Technology Adoption in Logistics | 90 | IT Managers, Digital Transformation Leads |

The Chile Supply Chain Resilience Market is valued at approximately USD 21 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient logistics solutions and the need for enhanced supply chain capabilities.