Region:Central and South America

Author(s):Shubham

Product Code:KRAA0796

Pages:98

Published On:August 2025

By Type:The market is segmented into Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Supply Chain Analytics & Visibility Solutions, Inventory & Order Management Solutions, Risk Management & Compliance Tools, Procurement & Sourcing Platforms, and Logistics Services (3PL, 4PL). Each segment is critical for enhancing supply chain efficiency and resilience, with TMS and WMS supporting logistics coordination, analytics platforms improving visibility, and risk management tools helping companies anticipate and mitigate disruptions .

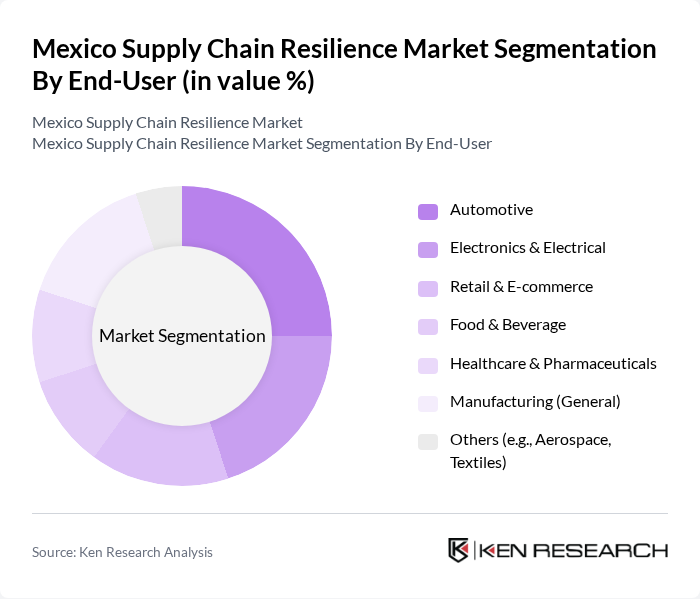

By End-User:End-user segmentation includes Automotive, Electronics & Electrical, Retail & E-commerce, Food & Beverage, Healthcare & Pharmaceuticals, Manufacturing (General), and Others (e.g., Aerospace, Textiles). Each sector has unique requirements and challenges that drive demand for tailored supply chain solutions. Automotive and electronics are particularly prominent, reflecting Mexico’s role as a manufacturing and export hub for these industries .

The Mexico Supply Chain Resilience Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Mexico, Kuehne + Nagel Mexico, C.H. Robinson Mexico, XPO Logistics Mexico, DB Schenker Mexico, FedEx Logistics Mexico, UPS Supply Chain Solutions Mexico, Grupo Traxión, Estafeta Mexicana, Geodis Mexico, Solistica, CEVA Logistics Mexico, Ryder Supply Chain Solutions Mexico, Expeditors International Mexico, and DSV Mexico contribute to innovation, geographic expansion, and service delivery in this space .

The future of Mexico's supply chain resilience market appears promising, driven by technological advancements and a focus on sustainability. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Additionally, the rise of e-commerce will further necessitate agile supply chains. In future, the integration of sustainable practices is anticipated to become a standard, aligning with global trends and consumer expectations, ultimately enhancing the resilience and competitiveness of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Supply Chain Analytics & Visibility Solutions Inventory & Order Management Solutions Risk Management & Compliance Tools Procurement & Sourcing Platforms Logistics Services (3PL, 4PL) |

| By End-User | Automotive Electronics & Electrical Retail & E-commerce Food & Beverage Healthcare & Pharmaceuticals Manufacturing (General) Others (e.g., Aerospace, Textiles) |

| By Component | Software Hardware Services (Consulting, Managed Services) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| By Enterprise Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Resilience | 100 | Supply Chain Managers, Operations Directors |

| Logistics Service Provider Insights | 60 | Logistics Coordinators, Business Development Managers |

| Retail Sector Supply Chain Strategies | 50 | Retail Operations Managers, Inventory Control Specialists |

| Food & Beverage Distribution Challenges | 40 | Distribution Managers, Quality Assurance Officers |

| Technology Adoption in Supply Chains | 50 | IT Managers, Digital Transformation Leads |

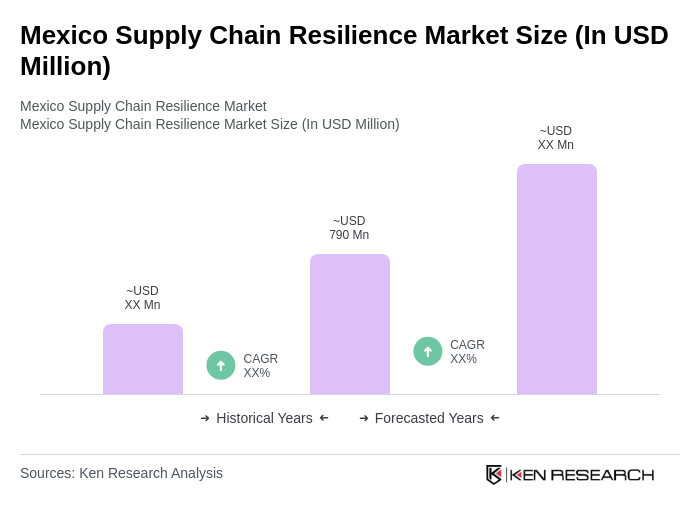

The Mexico Supply Chain Resilience Market is valued at approximately USD 790 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient logistics and supply chain management solutions, particularly in response to global disruptions.