Region:Asia

Author(s):Rebecca

Product Code:KRAA0334

Pages:100

Published On:August 2025

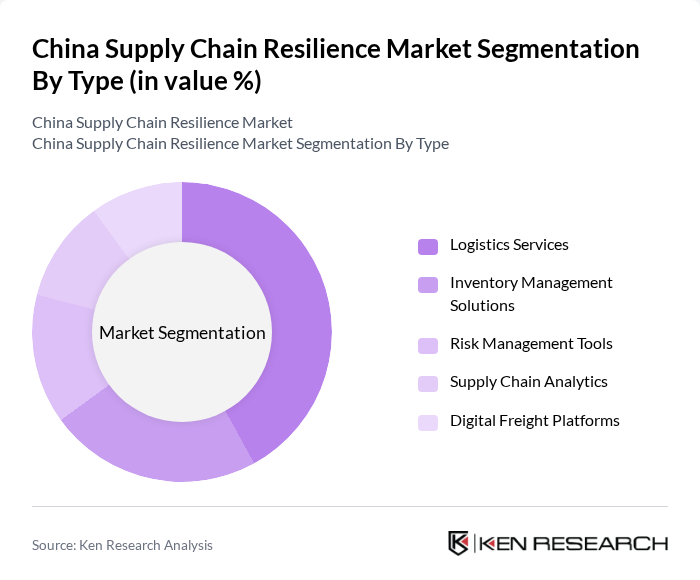

By Type:The market is segmented into logistics services, inventory management solutions, risk management tools, supply chain analytics, and digital freight platforms. Among these, logistics services are the most dominant segment, driven by the increasing demand for efficient transportation, warehousing, and last-mile delivery solutions. The rapid expansion of e-commerce and the integration of digital logistics technologies have further accelerated the need for robust logistics capabilities, making this segment a critical component of supply chain resilience .

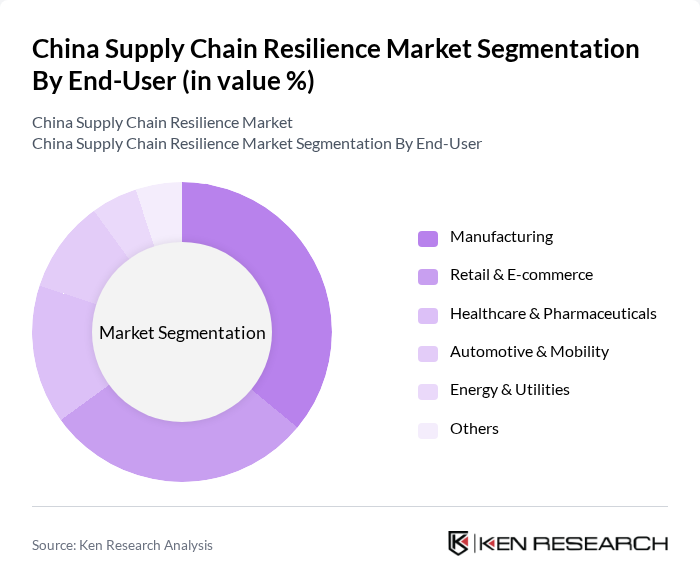

By End-User:The end-user segmentation includes manufacturing, retail & e-commerce, healthcare & pharmaceuticals, automotive & mobility, energy & utilities, and others. The manufacturing sector remains the leading end-user, as it relies heavily on efficient and resilient supply chain management to optimize production, minimize disruptions, and reduce costs. The ongoing focus on automation, smart manufacturing, and digital transformation has further reinforced the manufacturing sector’s position as a primary driver in the market .

The China Supply Chain Resilience Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group, JD Logistics (JD.com), SF Express, ZTO Express, China COSCO Shipping Corporation, Sinotrans Limited, YTO Express Group, China National Petroleum Corporation (CNPC), Huawei Technologies, Tencent Holdings, China Merchants Group, China Railway Group, China Minmetals Corporation, Geely Holding Group, BYD Company, Cainiao Network, Lenovo Group, Inspur Group, BEST Inc., SF Technology contribute to innovation, geographic expansion, and service delivery in this space.

As the China Supply Chain Resilience Market evolves, the focus will increasingly shift towards digital transformation and sustainability. Companies are expected to invest heavily in automation and AI technologies, enhancing operational efficiency and responsiveness. Additionally, the growing emphasis on sustainable practices will drive innovation in supply chain management. In future, it is anticipated that 52% of supply chains will incorporate sustainable practices, reflecting a significant shift towards environmentally responsible operations that align with consumer expectations and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Logistics Services Inventory Management Solutions Risk Management Tools Supply Chain Analytics Digital Freight Platforms |

| By End-User | Manufacturing Retail & E-commerce Healthcare & Pharmaceuticals Automotive & Mobility Energy & Utilities Others |

| By Region | North China South China East China West China |

| By Technology | Blockchain Solutions IoT Applications Cloud Computing AI and Machine Learning Robotics & Automation Others |

| By Application | Supply Chain Planning Order Fulfillment Transportation Management Supplier Collaboration Demand Forecasting Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Foreign Direct Investment Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Research Grants Export Facilitation Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Resilience | 120 | Supply Chain Managers, Operations Directors |

| Retail Logistics and Distribution | 90 | Logistics Coordinators, Inventory Managers |

| Technology and Automation in Supply Chains | 60 | IT Managers, Automation Specialists |

| Risk Management in Supply Chains | 50 | Risk Analysts, Compliance Officers |

| Transportation and Freight Services | 70 | Freight Managers, Transportation Planners |

The China Supply Chain Resilience Market is valued at approximately USD 165 billion, reflecting a significant growth driven by the increasing complexity of global supply chains and the adoption of advanced technologies for enhanced risk management and operational efficiency.