Region:Europe

Author(s):Geetanshi

Product Code:KRAA2027

Pages:87

Published On:August 2025

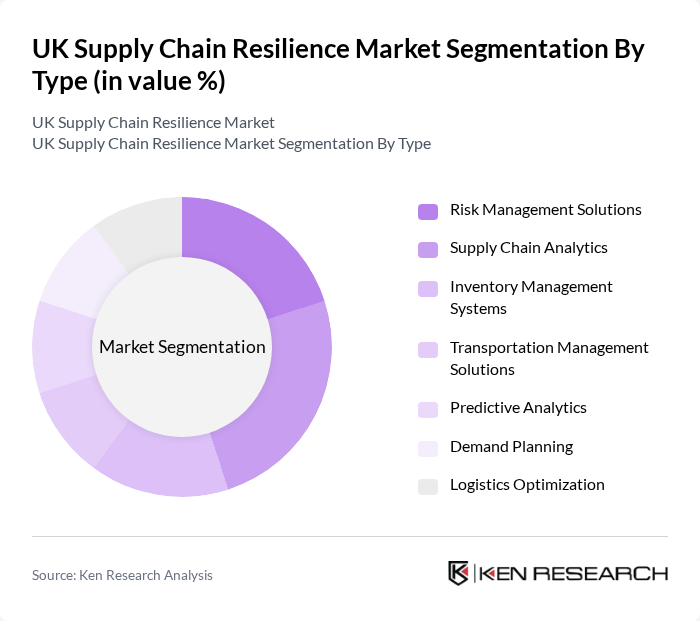

By Type:The market is segmented into various types, includingRisk Management Solutions, Supply Chain Analytics, Inventory Management Systems, Transportation Management Solutions, Predictive Analytics, Demand Planning, and Logistics Optimization. Each segment plays a crucial role in enhancing supply chain efficiency and resilience. Risk management and analytics are increasingly prioritized as businesses seek to anticipate and mitigate disruptions, while logistics optimization and predictive analytics support adaptive, data-driven decision-making .

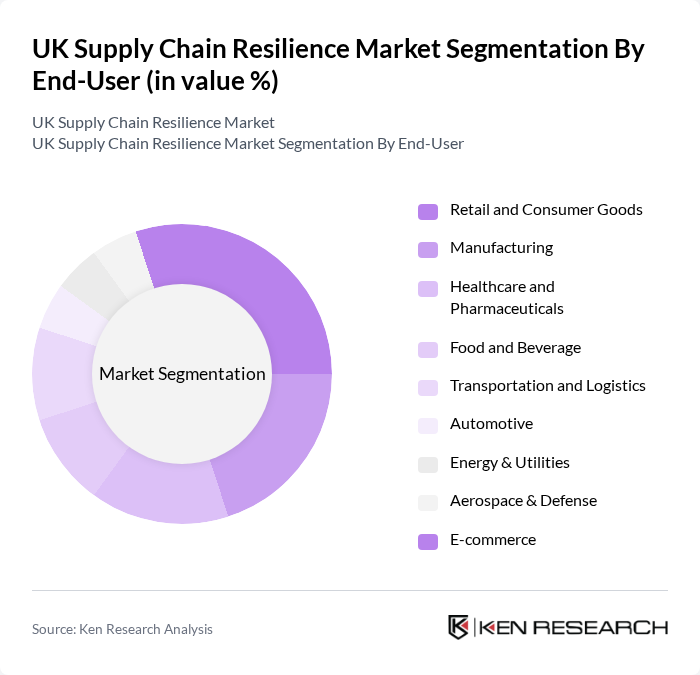

By End-User:The end-user segmentation includesRetail and Consumer Goods, Manufacturing, Healthcare and Pharmaceuticals, Food and Beverage, Transportation and Logistics, Automotive, Energy & Utilities, Aerospace & Defense, and E-commerce. Each sector faces unique supply chain risks and regulatory requirements, driving demand for tailored resilience solutions. Manufacturing and retail sectors are particularly focused on digital transformation and adaptive logistics to manage inventory volatility and ensure customer satisfaction .

The UK Supply Chain Resilience Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, CEVA Logistics, DB Schenker, UPS Supply Chain Solutions, FedEx Logistics, Agility Logistics, Ryder Supply Chain Solutions, C.H. Robinson, J.B. Hunt Transport Services, Penske Logistics, Geodis, DSV A/S, SNCF Logistics, Yusen Logistics, Wincanton plc, GXO Logistics, Aramex, Unipart Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK supply chain resilience market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable practices will likely lead to innovative solutions that address environmental concerns. The market is poised for transformation, with businesses prioritizing resilience and adaptability to navigate future challenges effectively, ensuring long-term growth and stability.

| Segment | Sub-Segments |

|---|---|

| By Type | Risk Management Solutions Supply Chain Analytics Inventory Management Systems Transportation Management Solutions Predictive Analytics Demand Planning Logistics Optimization |

| By End-User | Retail and Consumer Goods Manufacturing Healthcare and Pharmaceuticals Food and Beverage Transportation and Logistics Automotive Energy & Utilities Aerospace & Defense E-commerce |

| By Component | Software Services Hardware |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Air Freight Sea Freight Road Transport Rail Freight |

| By Price Range | Low Medium High |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Deployment Mode | On-premises Cloud-based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Resilience | 100 | Supply Chain Managers, Operations Directors |

| Manufacturing Sector Risk Management | 80 | Production Managers, Quality Assurance Leads |

| Healthcare Logistics Strategies | 60 | Logistics Coordinators, Procurement Specialists |

| Food Supply Chain Integrity | 50 | Supply Chain Analysts, Compliance Officers |

| Technology Adoption in Supply Chains | 40 | IT Managers, Digital Transformation Leads |

The UK Supply Chain Resilience Market is valued at approximately USD 13 billion, reflecting significant growth driven by the complexity of global supply chains and the demand for advanced data analytics and real-time monitoring to enhance operational efficiency.