Region:Global

Author(s):Geetanshi

Product Code:KRAA0193

Pages:84

Published On:August 2025

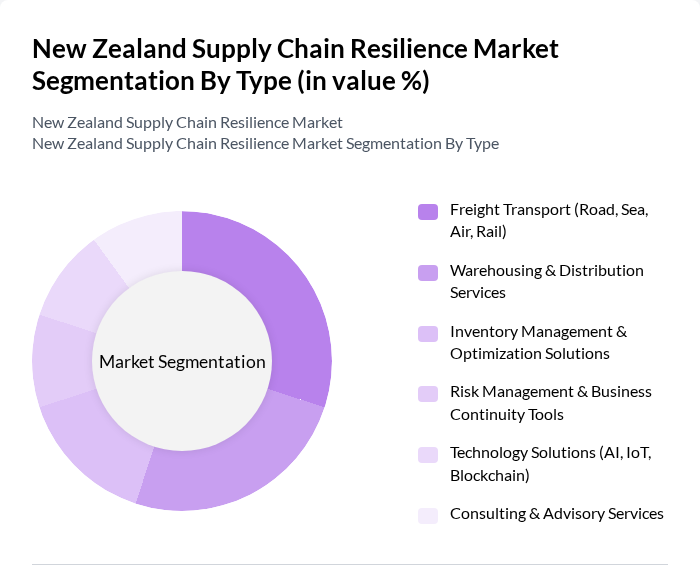

By Type:The market is segmented into various types, including Freight Transport (Road, Sea, Air, Rail), Warehousing & Distribution Services, Inventory Management & Optimization Solutions, Risk Management & Business Continuity Tools, Technology Solutions (AI, IoT, Blockchain), and Consulting & Advisory Services. Each of these segments plays a crucial role in enhancing supply chain efficiency, resilience, and the ability to respond to disruptions through digital transformation, automation, and advanced analytics .

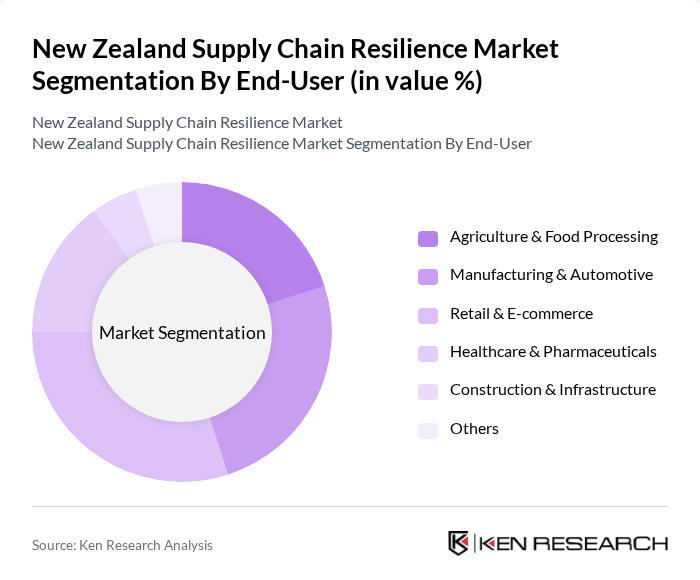

By End-User:The end-user segmentation includes Agriculture & Food Processing, Manufacturing & Automotive, Retail & E-commerce, Healthcare & Pharmaceuticals, Construction & Infrastructure, and Others. Each sector has unique supply chain needs, driving demand for tailored solutions that address sector-specific risks, regulatory requirements, and the need for digital and sustainable practices .

The New Zealand Supply Chain Resilience Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Freightways Limited, DHL Supply Chain (New Zealand), Kuehne + Nagel New Zealand, Toll Group (New Zealand), Move Logistics Group, NZ Post (New Zealand Post Limited), Fliway Group, Mondiale VGL, Linfox New Zealand, Coda Group, Owens Transport, Sorted Logistics, Cardinal Logistics, Online Distribution contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand supply chain resilience market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital solutions, the focus will shift towards enhancing operational efficiency and reducing environmental impact. Additionally, collaboration with local suppliers is expected to strengthen supply chain networks, making them more resilient to disruptions. These trends will likely shape the market landscape, fostering innovation and adaptability in the face of evolving consumer demands and global challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transport (Road, Sea, Air, Rail) Warehousing & Distribution Services Inventory Management & Optimization Solutions Risk Management & Business Continuity Tools Technology Solutions (AI, IoT, Blockchain) Consulting & Advisory Services |

| By End-User | Agriculture & Food Processing Manufacturing & Automotive Retail & E-commerce Healthcare & Pharmaceuticals Construction & Infrastructure Others |

| By Industry Vertical | FMCG (Fast-Moving Consumer Goods) Oil & Gas Electronics & Electricals Logistics & Transportation Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-house Logistics Technology Integration Services Others |

| By Technology | Cloud-based Supply Chain Platforms On-premise Solutions Hybrid Solutions Automation & Robotics Data Analytics & AI Others |

| By Geographic Distribution | North Island South Island Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Supply Chain Resilience | 100 | Farm Managers, Supply Chain Coordinators |

| Manufacturing Sector Logistics | 70 | Operations Managers, Production Supervisors |

| Retail Supply Chain Strategies | 80 | Retail Managers, Inventory Control Specialists |

| Healthcare Supply Chain Management | 60 | Pharmacy Managers, Supply Chain Analysts |

| Logistics Service Providers | 75 | Logistics Directors, Business Development Managers |

The New Zealand Supply Chain Resilience Market is valued at approximately USD 5.5 billion, reflecting a significant growth driven by the need for efficient logistics solutions and advancements in digital transformation, particularly following disruptions like the COVID-19 pandemic.