Region:Asia

Author(s):Shubham

Product Code:KRAA1854

Pages:95

Published On:August 2025

By Type:The commercial real estate market can be segmented into various types, including office spaces, retail properties, industrial and logistics facilities, mixed-use developments, hospitality assets, data centers, and alternative assets. Each of these segments caters to different consumer needs and market demands, reflecting the diverse nature of commercial real estate in China.

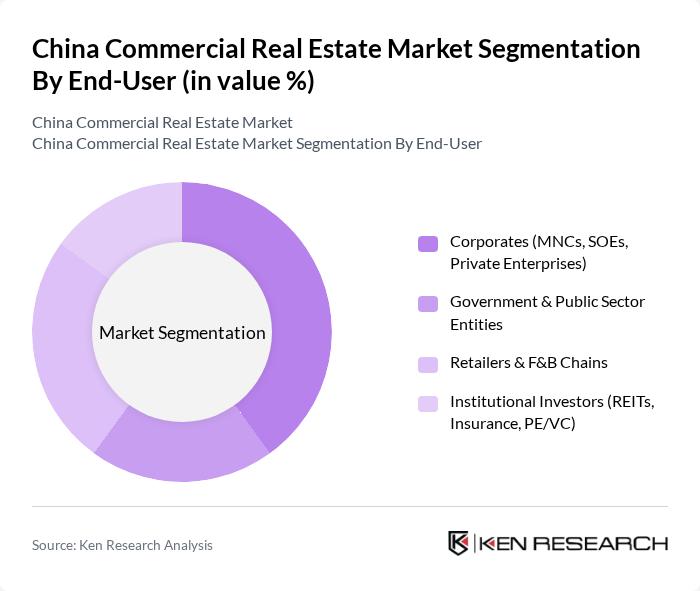

By End-User:The end-user segmentation of the commercial real estate market includes corporates, government entities, retailers, and institutional investors. Each of these end-users has distinct requirements and preferences, influencing the types of properties they seek and the overall market dynamics.

The China Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Resources Land Limited, China Overseas Land & Investment Limited, China Jinmao Holdings Group Limited, China Merchants Shekou Industrial Zone Holdings Co., Ltd., Dalian Wanda Group Co., Ltd., Longfor Group Holdings Limited, Poly Developments and Holdings Group Co., Ltd., Gemdale Properties and Investment Corporation Limited, Greenland Holdings Corporation Limited, Sunac China Holdings Limited, Sino-Ocean Group Holding Limited, China Vanke Co., Ltd., Country Garden Holdings Company Limited, Shanghai Shimao Co., Ltd. (Shimao Group), Guangzhou R&F Properties Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of China's commercial real estate market appears promising, driven by ongoing urbanization and economic recovery. As the government continues to invest in infrastructure and technology, new opportunities will emerge, particularly in Tier 2 and Tier 3 cities. Additionally, the increasing focus on sustainability and smart building technologies will reshape the market landscape, encouraging developers to innovate and adapt to changing consumer preferences, ultimately enhancing property value and market resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Office (Grade A, Grade B) Retail (Shopping Malls, Community Retail, Outlet Malls) Industrial & Logistics (Warehouses, Cold Chain, Manufacturing Parks) Mixed-Use Developments Hospitality (Hotels & Serviced Apartments) Data Centers & Business Parks Alternative Assets (Senior Living, Student Housing, Long-term Rental Apartments) |

| By End-User | Corporates (MNCs, SOEs, Private Enterprises) Government & Public Sector Entities Retailers & F&B Chains Institutional Investors (REITs, Insurance, PE/VC) |

| By Region | Eastern China (Shanghai, Jiangsu, Zhejiang) Southern China (Guangdong, Shenzhen, Guangzhou) Northern China (Beijing, Tianjin, Hebei) Western & Central China (Chengdu-Chongqing, Wuhan, Xi’an) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| By Financing Type | Equity Financing (Including C-REITs) Debt Financing (Loans, Bonds, ABS) Private Credit & Alternative Financing |

| By Property Management Type | In-House Management Third-Party Management Self-Managed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Development | 120 | Project Managers, Real Estate Developers |

| Commercial Property Management | 100 | Property Managers, Leasing Agents |

| Investment in Real Estate Funds | 80 | Investment Analysts, Fund Managers |

| Urban Planning and Development | 70 | Urban Planners, Government Officials |

| Real Estate Market Trends | 90 | Market Researchers, Economic Analysts |

The China Commercial Real Estate Market is valued at approximately USD 860 billion, driven by urbanization, foreign investment, and a growing middle class seeking modern commercial spaces, particularly in office, retail, and industrial/logistics sectors.