Region:Middle East

Author(s):Shubham

Product Code:KRAD0673

Pages:95

Published On:August 2025

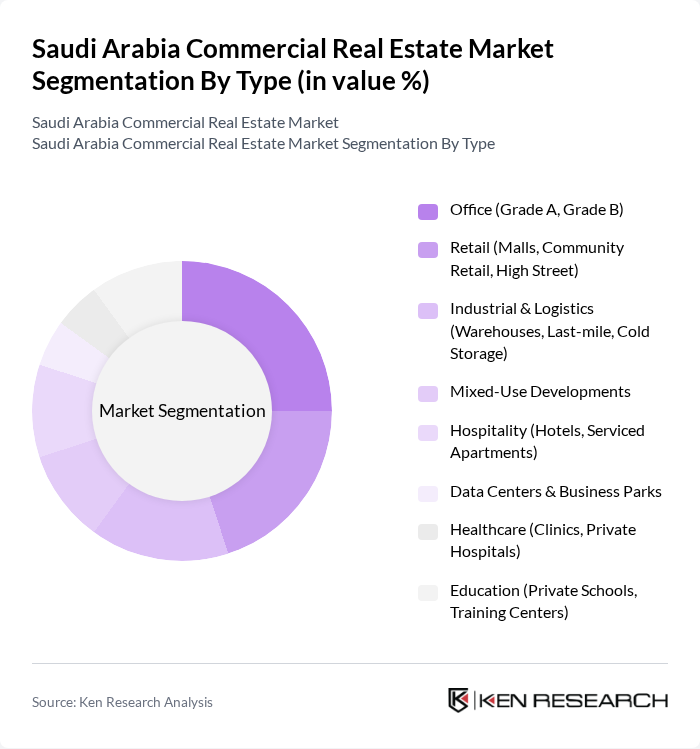

By Type:The commercial real estate market in Saudi Arabia can be segmented into various types, including office spaces, retail, industrial and logistics, mixed-use developments, hospitality, data centers, healthcare, and education. Each of these segments caters to different occupier needs and investment profiles, with demand supported by population growth, corporate expansions, tourism initiatives, and e-commerce-driven logistics requirements .

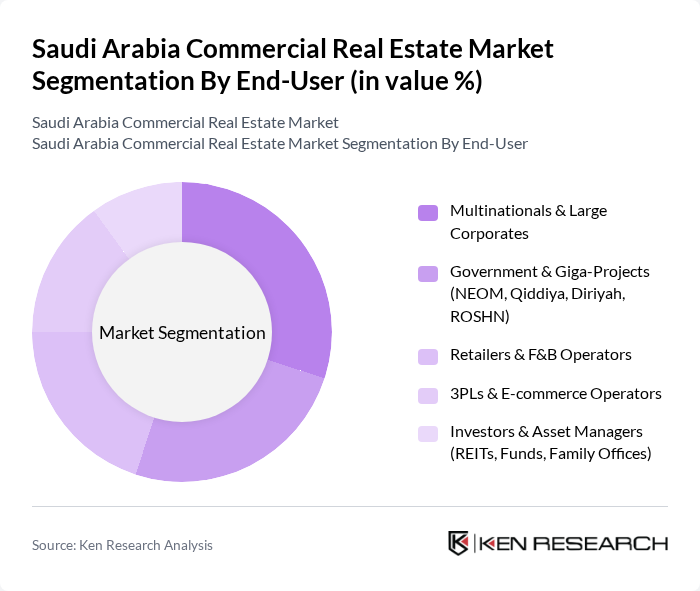

By End-User:The end-user segmentation of the commercial real estate market includes multinationals and large corporates, government and giga-projects, retailers and F&B operators, 3PLs and e-commerce operators, and investors and asset managers. Each end-user category has distinct requirements and preferences, influencing the types of commercial properties being developed and leased—such as Grade A office demand from corporates, destination retail/hospitality aligned to tourism initiatives, and modern logistics facilities for 3PLs and e-commerce .

The Saudi Arabia Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Real Estate Company (Al Akaria), ROSHN Group (PIF), Dar Al Arkan Real Estate Development Company, Jabal Omar Development Company, Emaar The Economic City (KAEC), Red Sea Global, Diriyah Company, Arabian Centres Company (Cenomi Centers), Savola Group – Retail Real Estate (Panda centers), SEDCO Holding – Real Estate, Al Rajhi Capital – REITs and Real Estate Investments, Jadwa Investment – Real Estate Funds, Riyad Capital – Riyad REIT, Derayah REIT, Alinma Investment – Alinma REIT, Alkhabeer Capital – Alkhabeer REIT, Makkah Construction & Development Company, Taiba Investments Company, Knowledge Economic City (KEC), Saudi Arabian Amiantit Co. – Industrial Real Estate (JV holdings), Ajdan Real Estate Development Company, Rafal Real Estate Development Company, Hamat Holding, Wadi Al Safa Holding – Real Estate, CBRE Saudi Arabia, JLL Saudi Arabia, Colliers Saudi Arabia, Knight Frank Saudi Arabia, Cushman & Wakefield Echinox Saudi Operations, Savills Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi commercial real estate market is poised for significant transformation driven by ongoing economic diversification and urbanization efforts. As the government continues to invest in infrastructure and smart city initiatives, demand for modern commercial spaces is expected to rise. Additionally, the integration of technology in real estate operations will enhance efficiency and attract new investors. The focus on sustainability will further shape the market, aligning with global trends and consumer preferences for eco-friendly developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Office (Grade A, Grade B) Retail (Malls, Community Retail, High Street) Industrial & Logistics (Warehouses, Last-mile, Cold Storage) Mixed-Use Developments Hospitality (Hotels, Serviced Apartments) Data Centers & Business Parks Healthcare (Clinics, Private Hospitals) Education (Private Schools, Training Centers) |

| By End-User | Multinationals & Large Corporates Government & Giga-Projects (NEOM, Qiddiya, Diriyah, ROSHN) Retailers & F&B Operators PLs & E-commerce Operators Investors & Asset Managers (REITs, Funds, Family Offices) |

| By Investment Source | Domestic Institutional (PIF, REITs, Banks) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs & Development Funds |

| By Property Class | Class A Class B Class C |

| By Location | Riyadh Jeddah Dammam/Khobar (Eastern Province) Makkah & Madinah Emerging Cities (e.g., Al-Ula, Abha, Tabuk) |

| By Lease Type | Long-term (5–10 years) Short-term (?3 years) Flexible/Managed (Coworking, Serviced Offices) |

| By Development Stage | Pre-Construction Under Construction Completed & Stabilized |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Leasing | 120 | Property Managers, Corporate Real Estate Executives |

| Retail Space Demand | 100 | Retail Managers, Franchise Owners |

| Industrial Property Trends | 80 | Logistics Managers, Supply Chain Directors |

| Investment in Commercial Real Estate | 70 | Real Estate Investors, Financial Analysts |

| Market Entry Strategies for Foreign Investors | 60 | International Business Development Managers, Legal Advisors |

The Saudi Arabia Commercial Real Estate Market is valued at approximately USD 67 billion, reflecting significant growth across various sectors, including office, retail, logistics, hospitality, and mixed-use assets, driven by the Vision 2030 initiative and increased foreign investment.