Region:Asia

Author(s):Rebecca

Product Code:KRAC0244

Pages:90

Published On:August 2025

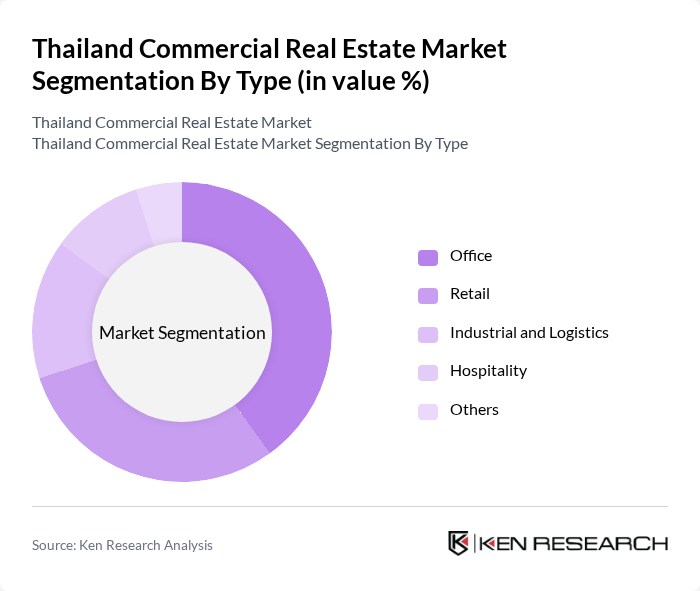

By Type:

The commercial real estate market in Thailand is segmented into office, retail, industrial and logistics, hospitality, and others. The office segment remains the most dominant, supported by demand for flexible workspaces and co-working environments, especially in Bangkok. The transformation in office space requirements is driven by hybrid and remote work trends, with businesses seeking modern, adaptable spaces. Retail spaces are significant in urban centers, but their growth is moderated by the expansion of e-commerce. The industrial and logistics segment is expanding rapidly, fueled by the rise of e-commerce and the need for advanced warehousing and distribution facilities. Hospitality properties continue to benefit from the recovery in tourism and increased domestic travel .

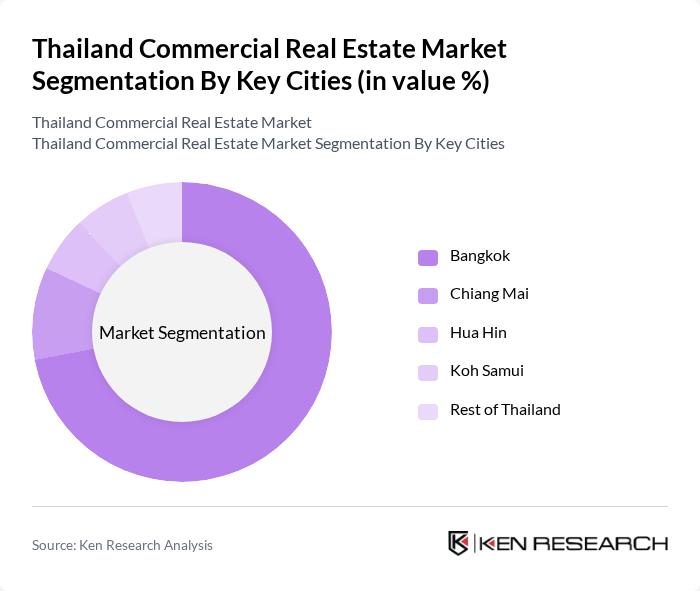

By Key Cities:

The commercial real estate market is significantly influenced by key cities such as Bangkok, Chiang Mai, Hua Hin, Koh Samui, and the rest of Thailand. Bangkok leads the market due to its status as the economic center, attracting both local and international businesses. Chiang Mai is known for its tourism and retail opportunities, while Hua Hin and Koh Samui are popular for hospitality investments. The rest of Thailand also contributes to the market, with emerging cities showing potential for growth in commercial real estate .

The Thailand Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Land and Houses Public Company Limited, Central Pattana Public Company Limited, Frasers Property (Thailand) Public Company Limited, Siam Future Development Public Company Limited, Ananda Development Public Company Limited, Property Perfect Public Company Limited, SC Asset Corporation Public Company Limited, TCC Land Company Limited, Minor International Public Company Limited, Bangkok Land Public Company Limited, AP (Thailand) Public Company Limited, Quality Houses Public Company Limited, Charn Issara Development Public Company Limited, Singha Estate Public Company Limited, Rojana Industrial Park Public Company Limited, Supalai Public Company Limited, WHA Corporation Public Company Limited, CBRE (Thailand) Co., Ltd., JLL (Jones Lang LaSalle) Thailand, Savills (Thailand) Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand commercial real estate market is expected to evolve significantly in future, driven by urbanization, technological advancements, and sustainability trends. As businesses increasingly seek flexible workspaces and eco-friendly buildings, the demand for co-working spaces and green developments will rise. Additionally, the logistics sector will continue to expand, fueled by e-commerce growth and the need for efficient supply chain solutions. These trends will shape the market landscape, presenting new opportunities for investors and developers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Retail Industrial and Logistics Hospitality Others |

| By Key Cities | Bangkok Chiang Mai Hua Hin Koh Samui Rest of Thailand |

| By Pricing Scheme | Cash Digital Payment Buy Now Pay Later (BNPL) |

| By Distribution Channel | Offline Online Omnichannel |

| By End-User | Corporates Government Entities Retailers Investors Developers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Demand Analysis | 100 | Corporate Real Estate Managers, Facility Managers |

| Retail Market Trends | 80 | Retail Property Owners, Store Managers |

| Industrial Property Utilization | 60 | Logistics Managers, Warehouse Operators |

| Investment Sentiment Survey | 90 | Real Estate Investors, Financial Analysts |

| Tenant Satisfaction Assessment | 70 | Business Owners, Office Managers |

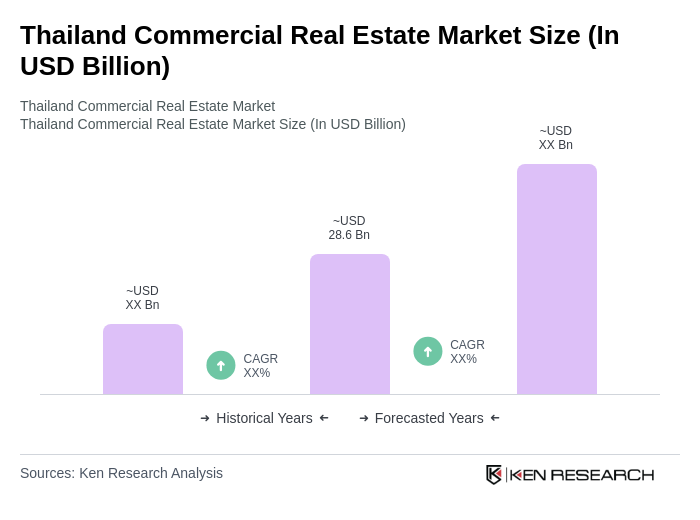

The Thailand Commercial Real Estate Market is valued at approximately USD 28.6 billion, driven by urbanization, foreign direct investment, and a growing middle class seeking modern commercial spaces. This market reflects the country's economic resilience and strategic location in Southeast Asia.