Region:Asia

Author(s):Dev

Product Code:KRAB0404

Pages:86

Published On:August 2025

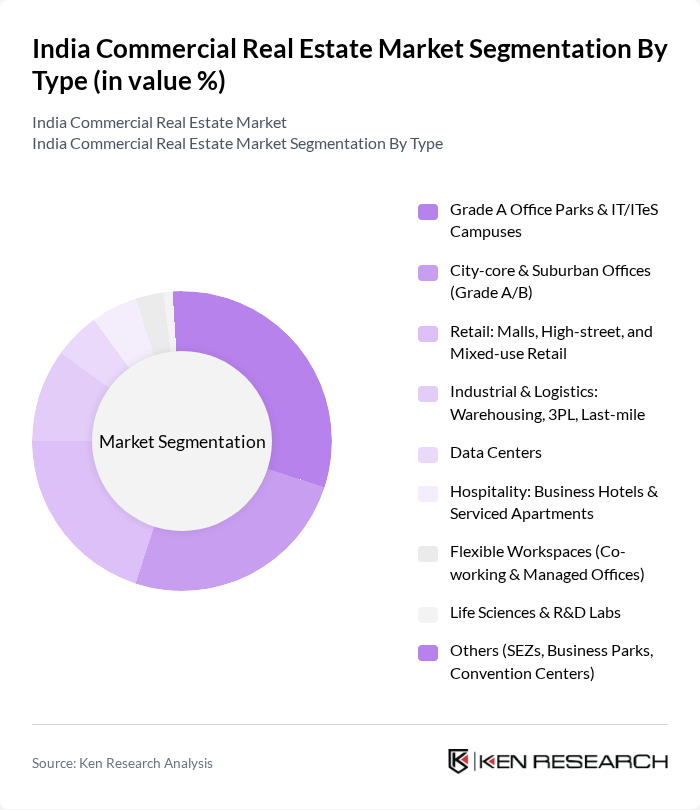

By Type:The commercial real estate market can be segmented into various types, including Grade A Office Parks & IT/ITeS Campuses, City-core & Suburban Offices (Grade A/B), Retail (Malls, High-street, and Mixed-use Retail), Industrial & Logistics (Warehousing, 3PL, Last-mile), Data Centers, Hospitality (Business Hotels & Serviced Apartments), Flexible Workspaces (Co-working & Managed Offices), Life Sciences & R&D Labs, and Others (SEZs, Business Parks, Convention Centers). Each of these segments caters to specific market needs and tenant preferences such as campus-style office demand from GCCs and IT/ITeS, omnichannel-led retail formats, and e-commerce–driven warehousing/logistics expansion .

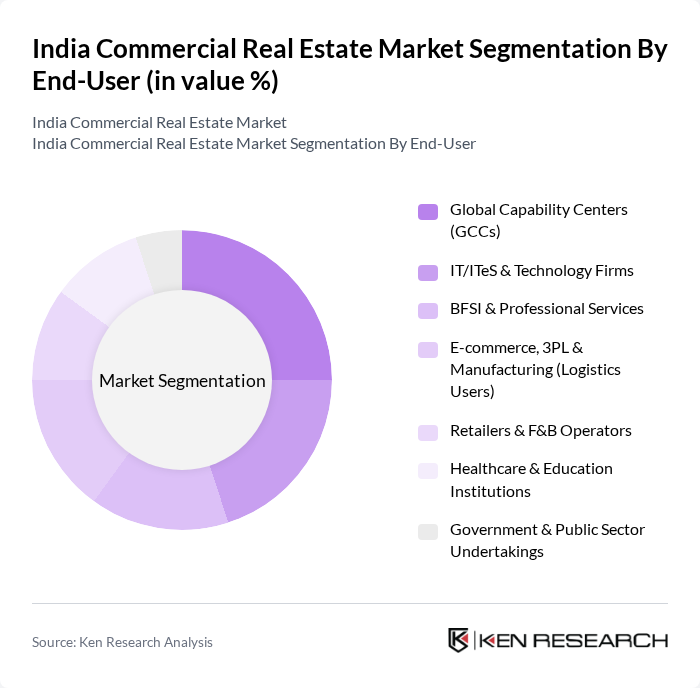

By End-User:The end-user segmentation includes Global Capability Centers (GCCs), IT/ITeS & Technology Firms, BFSI & Professional Services, E-commerce, 3PL & Manufacturing (Logistics Users), Retailers & F&B Operators, Healthcare & Education Institutions, and Government & Public Sector Undertakings. Each of these end-users has distinct requirements and preferences that influence their choice of commercial real estate, with GCCs and IT/ITeS driving large-format Grade A office take-up, retailers favoring experiential malls and high streets, and e-commerce/3PL supporting warehousing demand .

The India Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DLF Limited, Godrej Properties, Oberoi Realty, Brigade Enterprises, The Phoenix Mills Ltd, Prestige Estates Projects Ltd, Sobha Limited, K Raheja Corp (Mindspace REIT / Chalet Hotels), Indiabulls Real Estate, Sunteck Realty, Brookfield India Real Estate Trust (Brookfield REIT), Embassy Office Parks REIT, Nexus Select Trust (Retail REIT), RMZ Corp, Hiranandani Group, Tata Realty and Infrastructure Ltd (TRIL), Blackstone India (Nucleus Office Parks), CapitaLand India (CapitaLand Investment / Ascendas India), Mapletree Investments, Bharti Realty contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India commercial real estate market appears promising, driven by ongoing urbanization and technological advancements. As businesses adapt to hybrid work models, demand for flexible office spaces is expected to rise. Additionally, the government's commitment to sustainable development will likely encourage investments in green buildings, aligning with global trends. The integration of digital technologies in property management and transactions will further enhance operational efficiency, making the market more attractive to investors and developers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Grade A Office Parks & IT/ITeS Campuses City-core & Suburban Offices (Grade A/B) Retail: Malls, High-street, and Mixed-use Retail Industrial & Logistics: Warehousing, 3PL, Last-mile Data Centers Hospitality: Business Hotels & Serviced Apartments Flexible Workspaces (Co-working & Managed Offices) Life Sciences & R&D Labs Others (SEZs, Business Parks, Convention Centers) |

| By End-User | Global Capability Centers (GCCs) IT/ITeS & Technology Firms BFSI & Professional Services E-commerce, 3PL & Manufacturing (Logistics Users) Retailers & F&B Operators Healthcare & Education Institutions Government & Public Sector Undertakings |

| By Region | Delhi-NCR Mumbai Metropolitan Region (MMR) Bengaluru Hyderabad Pune Chennai Kolkata Tier-2/3 Cities (Ahmedabad, Coimbatore, Kochi, Jaipur, etc.) |

| By Investment Source | Domestic Institutional Capital Foreign Direct Investment (FDI) Real Estate Investment Trusts (REITs) Public-Private Partnerships (PPP) Private Equity & Sovereign Wealth Funds Developer/Promoter Capital Others |

| By Application | Commercial Leasing Development & Asset Monetization Real Estate Investment (Direct & via REITs/InvITs) Facility & Property Management Fit-outs & Workplace Strategy Others |

| By Policy Support | SEZ/IT Park Policies & State Industrial Policies Tax Incentives and Stamp Duty Rebates Incentives for Green Buildings (IGBC/LEED) Infrastructure & Logistics Park Schemes Data Center & Electronics Manufacturing Policies Others |

| By Pricing Strategy | Premium Grade A CBD Pricing Suburban/Peripheral Grade A/B Pricing Flexible Workspace Pricing (Seat/Desk) Warehousing Rentals (Per sq. ft./Per pallet) Revenue Share/Rent-plus-Revenue Models (Retail) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Demand Analysis | 120 | Corporate Real Estate Managers, Facilities Directors |

| Retail Market Trends | 100 | Retail Chain Managers, Property Acquisition Specialists |

| Industrial Property Insights | 80 | Logistics Managers, Industrial Park Developers |

| Hospitality Sector Recovery | 70 | Hotel General Managers, Investment Analysts |

| Commercial Real Estate Investment | 90 | Institutional Investors, Real Estate Fund Managers |

The India Commercial Real Estate Market is valued at approximately USD 50 billion, driven by factors such as urbanization, a growing middle class, and increased foreign direct investment, which has significantly boosted demand for commercial spaces across various sectors.