Region:Europe

Author(s):Dev

Product Code:KRAA3027

Pages:98

Published On:August 2025

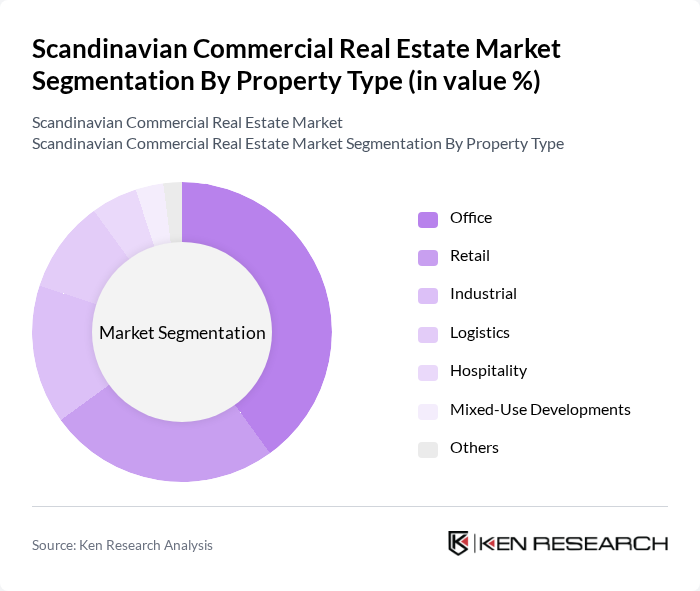

By Property Type:The property type segmentation includes Office, Retail, Industrial, Logistics, Hospitality, Mixed-Use Developments, and Others. The office segment remains the most dominant, driven by demand for high-quality, flexible workspaces and ongoing refurbishment of ageing stock to meet ESG standards. Retail properties are significant, especially in urban centers with strong consumer spending and last-mile logistics conversions. Industrial and logistics segments are expanding due to the rise of e-commerce, supply chain optimization, and record-low logistics vacancy rates in key corridors.

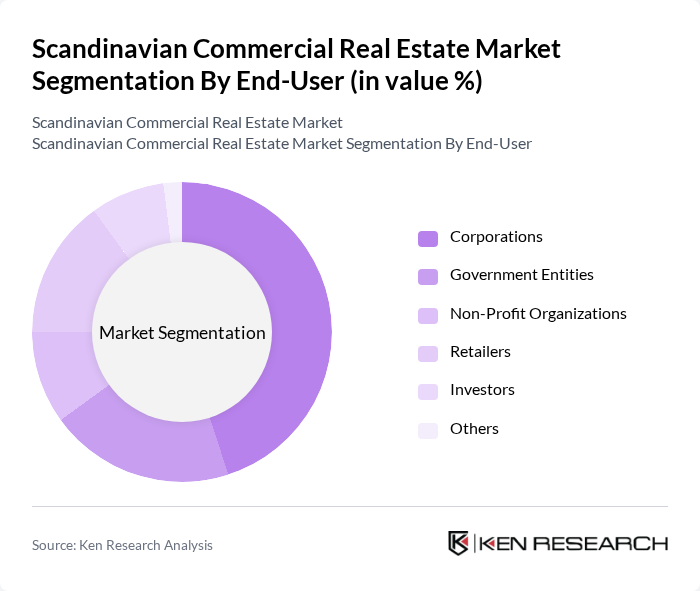

By End-User:The end-user segmentation includes Corporations, Government Entities, Non-Profit Organizations, Retailers, Investors, and Others. Corporations are the leading end-users, driven by the need for modern office spaces and flexible work environments. Government entities play a significant role, often leasing large spaces for administrative and public functions. Retailers are adapting to evolving consumer behaviors and omnichannel strategies, while investors are increasingly targeting mixed-use developments and logistics assets for portfolio diversification.

The Scandinavian Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Skanska AB, Vasakronan AB, Castellum AB, Fabege AB, Hufvudstaden AB, Kungsleden AB, Atrium Ljungberg AB, Niam AB, Pandox AB, Fastighets AB Balder, Catena AB, Heimstaden AB, Samhällsbyggnadsbolaget i Norden AB (SBB), Nordic Real Estate Partners (NREP), DNB Eiendom AS contribute to innovation, geographic expansion, and service delivery in this space.

The Scandinavian commercial real estate market is poised for transformation as it adapts to evolving trends such as remote work and sustainability. By in future, the integration of smart technologies in buildings is expected to enhance operational efficiency and tenant satisfaction. Additionally, urban living will continue to gain traction, with mixed-use developments becoming increasingly popular. These trends will shape investment strategies and development priorities, ensuring the market remains resilient and attractive to both local and foreign investors.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Office Retail Industrial Logistics Hospitality Mixed-Use Developments Others |

| By End-User | Corporations Government Entities Non-Profit Organizations Retailers Investors Others |

| By Investment Type | Core Core-Plus Value-Add Opportunistic Others |

| By Geography | Sweden Denmark Norway Finland Others |

| By Property Class | Class A Class B Class C Others |

| By Lease Type | Full-Service Leases Gross Leases Net Leases Others |

| By Financing Type | Equity Financing Debt Financing Mezzanine Financing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Demand Analysis | 60 | Real Estate Developers, Corporate Real Estate Managers |

| Retail Market Trends | 50 | Retail Property Managers, Market Analysts |

| Industrial Property Insights | 40 | Logistics Managers, Industrial Property Owners |

| Investment Strategies in Real Estate | 55 | Institutional Investors, Real Estate Fund Managers |

| Urban Development and Zoning Regulations | 45 | Urban Planners, Local Government Officials |

The Scandinavian Commercial Real Estate Market is valued at approximately USD 90 billion, driven by urbanization, refurbishment of prime-office stock, and investments in sustainable properties, logistics, and data centers.