Region:Asia

Author(s):Geetanshi

Product Code:KRAC0043

Pages:91

Published On:August 2025

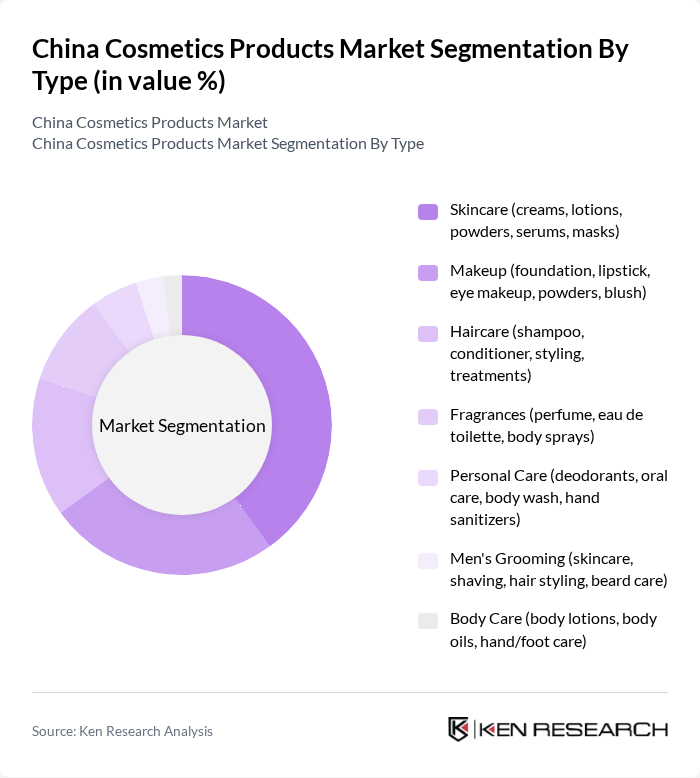

By Type:The cosmetics market is segmented into various types, including skincare, makeup, haircare, fragrances, personal care, men's grooming, and body care. Among these, skincare products—which encompass creams, lotions, powders, serums, and masks—dominate the market due to the increasing focus on skin health, efficacy, and beauty. Consumers are increasingly investing in multi-step skincare routines, driven by heightened awareness of skincare benefits, science-backed formulations, and the influence of social media beauty trends .

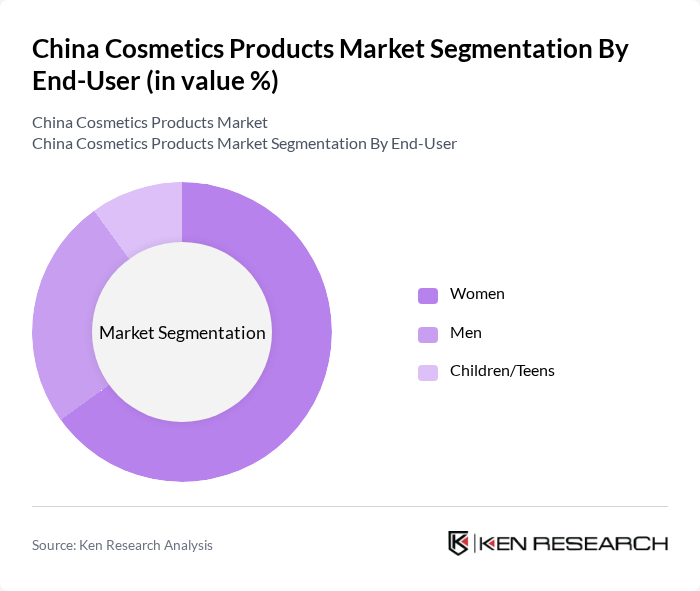

By End-User:The market is segmented by end-user demographics, including women, men, and children/teens. Women represent the largest segment, driven by their higher spending on beauty and personal care products. The increasing trend of self-care, beauty consciousness, and adoption of advanced skincare routines among women has led to a surge in demand for various cosmetics, particularly skincare and makeup products. Men’s grooming is also gaining traction, reflecting changing societal norms, increased awareness of personal grooming, and targeted marketing by brands .

The China Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal China, Estée Lauder Companies Inc., Procter & Gamble Co. (P&G), Shiseido Company, Limited, Unilever PLC, Amorepacific Group, Beiersdorf AG, Coty Inc., Mary Kay Inc., JALA Group (????), Shanghai Jahwa United Co., Ltd. (????????????), Proya Cosmetics Co., Ltd. (???), Pechoin (???), Perfect Diary (????, Yatsen Holding Ltd.), Inoherb (????) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. The trend towards clean beauty is expected to gain momentum, with consumers increasingly prioritizing products that are free from harmful chemicals. Additionally, the rise of digital retailing will continue to reshape the shopping experience, making it more personalized and accessible. Brands that adapt to these trends and invest in innovative marketing strategies will likely thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare (creams, lotions, powders, serums, masks) Makeup (foundation, lipstick, eye makeup, powders, blush) Haircare (shampoo, conditioner, styling, treatments) Fragrances (perfume, eau de toilette, body sprays) Personal Care (deodorants, oral care, body wash, hand sanitizers) Men's Grooming (skincare, shaving, hair styling, beard care) Body Care (body lotions, body oils, hand/foot care) |

| By End-User | Women Men Children/Teens |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites, social commerce) Offline Retail (department stores, specialty stores, supermarkets, pharmacies) Direct Sales (door-to-door, beauty consultants, MLM) |

| By Price Range | Premium (luxury brands, prestige) Mid-range (mass market, accessible brands) Economy (value brands, entry-level) |

| By Ingredient Type | Natural/Organic Synthetic/Inorganic |

| By Packaging Type | Tubes Bottles Jars Sachets/Pouches |

| By Brand Ownership | Local Brands (Chinese domestic brands) International Brands (foreign-invested brands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Consumers | 120 | Women aged 18-45, Skincare Enthusiasts |

| Makeup Product Users | 100 | Young Professionals, Beauty Bloggers |

| Hair Care Product Buyers | 80 | Men and Women aged 25-50, Salon Owners |

| Online Cosmetics Shoppers | 90 | Frequent Online Shoppers, E-commerce Users |

| Retail Store Managers | 40 | Store Managers, Sales Executives in Cosmetics |

The China cosmetics products market is valued at approximately USD 147 billion, reflecting significant growth driven by increasing consumer demand for beauty and personal care products, rising disposable incomes, and a growing middle class.