Region:Europe

Author(s):Dev

Product Code:KRAB0589

Pages:100

Published On:August 2025

By Type:The market is segmented into various types of cosmetics, including Facial Color Cosmetics, Eye Color Cosmetics, Lip Color Cosmetics, Nail Color Cosmetics, and Hair Coloring and Styling Products. Among these, Facial Color Cosmetics dominate the market due to their essential role in daily beauty routines and the growing trend of makeup artistry. Consumers are increasingly investing in high-quality foundations, concealers, and blushes, which are seen as must-have items for enhancing appearance. The segment is further supported by the popularity of personalized and dermatologically tested products, reflecting Swiss consumers' demand for both efficacy and safety .

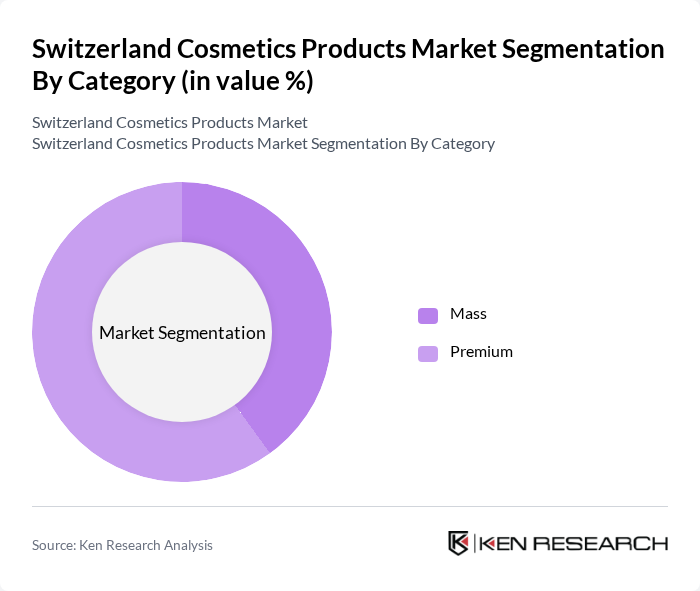

By Category:The cosmetics market is divided into Mass and Premium categories. The Premium segment is currently leading the market, driven by a growing consumer preference for high-end products that offer superior quality and unique formulations. Consumers are willing to pay a premium for brands that emphasize luxury, sustainability, and innovative ingredients, which has led to a significant increase in the sales of premium cosmetics. The trend is reinforced by the expansion of luxury brands and the introduction of eco-friendly, scientifically advanced products .

The Switzerland Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Suisse S.A., Estée Lauder Companies Inc., Procter & Gamble Switzerland Sàrl, Coty Switzerland Sàrl, Beiersdorf AG, Shiseido Switzerland AG, Unilever Schweiz GmbH, Henkel & Cie. AG, Avon Cosmetics (Schweiz) AG, Revlon Switzerland Sàrl, Clarins (Suisse) SA, Amway (Switzerland) GmbH, Mary Kay (Switzerland) GmbH, Oriflame Cosmetics S.A., Natura &Co contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Swiss cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value, brands are expected to innovate in eco-friendly formulations and packaging. Additionally, the integration of augmented reality in online shopping experiences is likely to enhance consumer engagement. With a projected increase in disposable income, the demand for premium and personalized products will continue to rise, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Facial Color Cosmetics Eye Color Cosmetics Lip Color Cosmetics Nail Color Cosmetics Hair Coloring and Styling Products |

| By Category | Mass Premium |

| By End-User | Women Men |

| By Distribution Channel | Specialist Retail Stores Supermarkets/Hypermarkets Convenience/Grocery Stores Online Retail Channels Other Distribution Channels |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients |

| By Packaging Technology | Sustainable Packaging Technology Conventional Packaging |

| By Application | Skin Care Hair Care |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Products | 100 | Skincare Users, Beauty Enthusiasts |

| Makeup Product Preferences | 90 | Makeup Users, Beauty Influencers |

| Hair Care Product Insights | 70 | Hair Care Users, Salon Professionals |

| Natural and Organic Cosmetics | 60 | Eco-conscious Consumers, Health & Wellness Advocates |

| Luxury Cosmetics Market | 40 | High-income Consumers, Luxury Brand Shoppers |

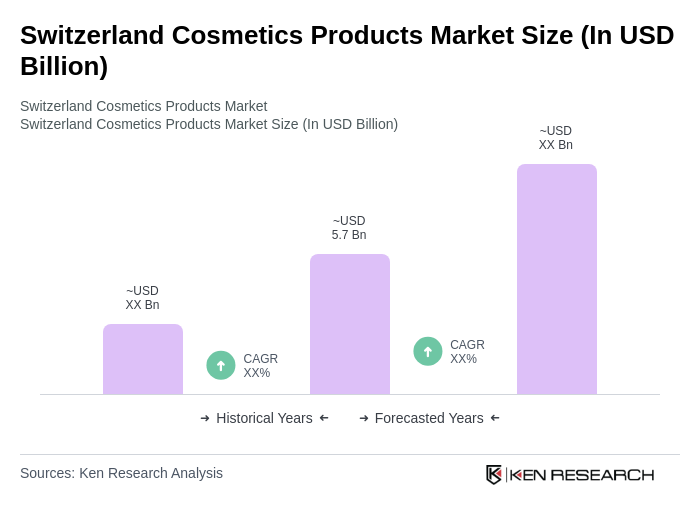

The Switzerland cosmetics products market is valued at approximately USD 5.7 billion, reflecting a robust growth driven by consumer demand for high-quality beauty products and the increasing popularity of natural and organic ingredients.