Region:Asia

Author(s):Shubham

Product Code:KRAC0878

Pages:85

Published On:August 2025

By Type:The market is segmented into various types, including Skincare, Haircare, Makeup, Fragrances, Personal Hygiene, Men's Grooming, Lip and Nail Care, and Others. Skincare products hold the largest share, driven by increasing focus on skin health, demand for anti-aging solutions, and the rising popularity of products with natural and organic ingredients. Consumers are seeking products that offer hydration, sun protection, and visible results, leading to strong demand for moisturizers, serums, and sunscreens. Haircare and makeup also represent significant segments, supported by evolving beauty routines and frequent product launches tailored to Indian consumers .

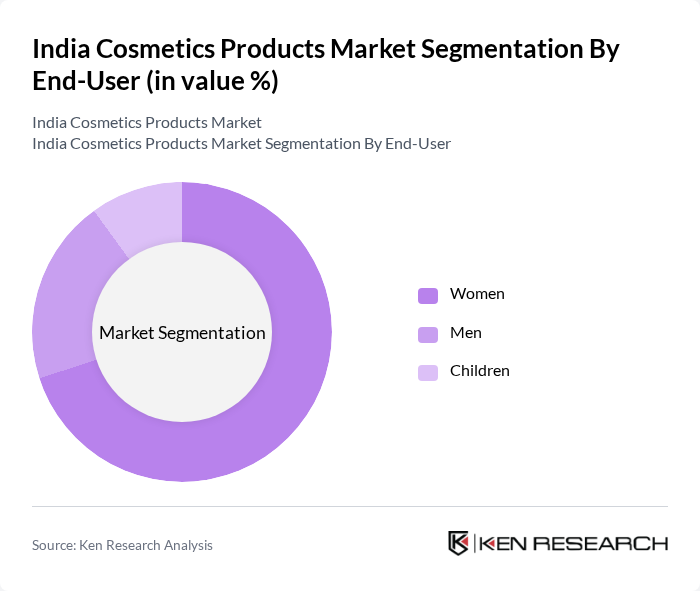

By End-User:The market is categorized into Women, Men, and Children. The Women segment holds the largest share, reflecting a strong inclination towards beauty and personal care products, with high engagement in skincare and makeup routines. Social media trends, influencer marketing, and increased awareness of self-care have further solidified this segment's dominance. The Men’s segment is also expanding, driven by growing acceptance of grooming products and targeted marketing campaigns .

The India Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hindustan Unilever Limited, L'Oréal India Pvt. Ltd., Procter & Gamble Hygiene and Health Care Ltd., Estée Lauder Companies Inc., Revlon India Pvt. Ltd., Oriflame India Pvt. Ltd., Nykaa E-Retail Pvt. Ltd., Lotus Herbals Pvt. Ltd., Colorbar Cosmetics Pvt. Ltd., Biotique Ayurvedic Pvt. Ltd., Avon Beauty Products India Pvt. Ltd., Shahnaz Husain Group, Kama Ayurveda Pvt. Ltd., The Body Shop India (Natura & Co.), Mamaearth (Honasa Consumer Ltd.), Emami Limited, Marico Limited, VLCC Personal Care Ltd., Lakmé (Hindustan Unilever Limited), Sugar Cosmetics (Vellvette Lifestyle Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indian cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to innovate in eco-friendly packaging and cruelty-free products. Additionally, the rise of social media influencers will continue to shape beauty trends, encouraging brands to engage with younger audiences. The market is expected to adapt to these changes, fostering a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Haircare Makeup Fragrances Personal Hygiene Men's Grooming Lip and Nail Care Others |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales Department Stores |

| By Price Range | Premium Mid-range Economy |

| By Ingredient Type | Natural/Organic Synthetic |

| By Packaging Type | Bottles Tubes Jars Sachets |

| By Brand Type | International Brands Domestic Brands Private Labels D2C (Direct-to-Consumer) Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 120 | Women aged 18-45, Skincare Enthusiasts |

| Haircare Product Retailers | 80 | Store Managers, Beauty Advisors |

| Makeup Product Consumers | 100 | Makeup Artists, Beauty Influencers |

| Organic Cosmetics Buyers | 60 | Health-Conscious Consumers, Eco-Friendly Advocates |

| Cosmetics Industry Experts | 40 | Market Analysts, Brand Strategists |

The India Cosmetics Products Market is valued at approximately USD 16 billion, driven by increasing disposable incomes, a growing middle class, and heightened consumer awareness regarding personal grooming and beauty standards.