Region:Europe

Author(s):Dev

Product Code:KRAC0523

Pages:86

Published On:August 2025

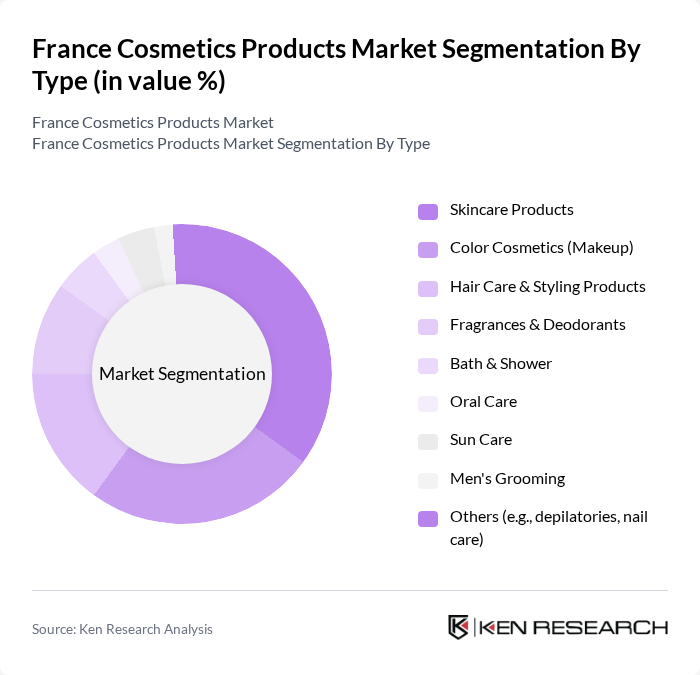

By Type:The market is segmented into various types of products, including skincare products, color cosmetics, hair care and styling products, fragrances and deodorants, bath and shower products, oral care, sun care, men's grooming, and others. Among these, skincare products dominate the market due to growing awareness of skin health, the popularity of anti-aging and dermocosmetics, and sustained demand for natural and clean formulations. Consumers are increasingly investing in structured skincare routines and multifunctional products, supporting demand for moisturizers, serums, cleansers, and SPF-led facial care. At the same time, prestige channels have recently seen a slowdown in skincare while fragrances remain resilient, indicating channel- and price-tier differences within categories .

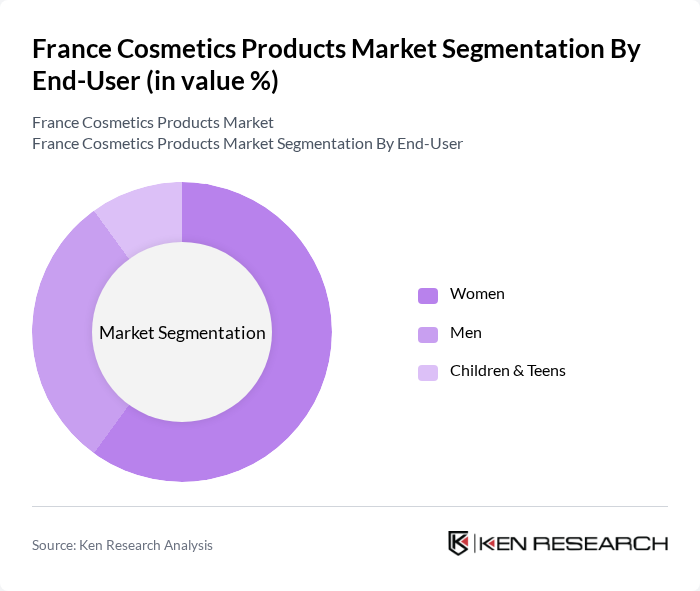

By End-User:The end-user segmentation includes women, men, and children & teens. Women represent the largest segment, driven by diverse needs across skincare, makeup, and personal grooming, with strong interest in efficacy-led, natural, and dermatological products. Men’s grooming continues to gain traction, influenced by broader acceptance of skincare and targeted solutions (e.g., beard care, anti-fatigue, SPF), while teens increasingly engage through social media and entry-priced brands and formats .

The France Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Groupe (France), LVMH Moët Hennessy Louis Vuitton (Parfums Christian Dior, Guerlain, Givenchy), Chanel SAS (Fragrance & Beauty), Coty Inc., Clarins Group, Pierre Fabre Dermo-Cosmétique, Laboratoires Dermatologiques Avène (Pierre Fabre), NAOS (Bioderma, Institut Esthederm, Etat Pur), L'Occitane Group (L'Occitane en Provence, Melvita), Yves Rocher (Groupe Rocher), Sisley Paris (c.f.e.b. Sisley), Natura &Co (The Body Shop, Aesop), Beiersdorf AG (NIVEA, La Prairie), Procter & Gamble Co. (Gillette, Olay, Oral-B), Shiseido Company, Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the French cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for personalized and sustainable products continues to rise, brands are likely to invest in innovative formulations and eco-friendly packaging solutions. Additionally, the integration of digital technologies in marketing and sales strategies will enhance customer engagement. Companies that adapt to these trends and prioritize transparency and ethical practices are expected to thrive in this dynamic market landscape, ensuring long-term growth and consumer loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Products Color Cosmetics (Makeup) Hair Care & Styling Products Fragrances & Deodorants Bath & Shower Oral Care Sun Care Men's Grooming Others (e.g., depilatories, nail care) |

| By End-User | Women Men Children & Teens |

| By Distribution Channel | Online Retail (Brand DTC, Marketplaces) Supermarkets/Hypermarkets Specialty Beauty Retailers (e.g., Sephora, Marionnaud) Pharmacies & Parapharmacies Department Stores & Perfumeries Direct Sales (MLM) Others |

| By Price Range | Premium/Luxury Mid-Range (Masstige) Mass/Budget |

| By Ingredient Type | Natural/Organic Conventional/Synthetic |

| By Packaging Type | Bottles Tubes Jars Sticks/Sprays/Aerosols Refill/Recharge Formats Others |

| By Brand Type | Established Global & French Heritage Brands Indie & Emerging Brands Private Labels (Retailer Brands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Preferences | 140 | Beauty Product Consumers, Dermatologists |

| Makeup Trends and Usage | 120 | Makeup Artists, Retail Beauty Advisors |

| Haircare Product Insights | 100 | Hair Stylists, Salon Owners |

| Consumer Attitudes towards Natural Cosmetics | 80 | Eco-conscious Consumers, Health & Wellness Influencers |

| Online Shopping Behavior for Cosmetics | 90 | E-commerce Managers, Digital Marketing Specialists |

The France Cosmetics Products Market is valued at approximately USD 17.5 billion, reflecting a comprehensive analysis of beauty and personal care retail revenues across both mass and prestige channels in the country.