Region:Asia

Author(s):Geetanshi

Product Code:KRAA0269

Pages:83

Published On:August 2025

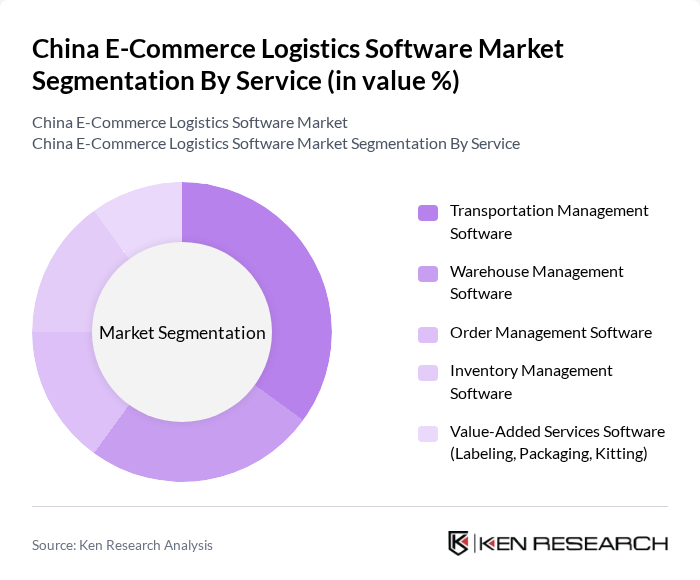

By Service:The service segment of the market includes various software solutions that facilitate logistics operations. The subsegments are Transportation Management Software, Warehouse Management Software, Order Management Software, Inventory Management Software, and Value-Added Services Software (Labeling, Packaging, Kitting). Among these, Transportation Management Software is currently leading the market due to the increasing need for efficient route planning, cost reduction, and real-time analytics in logistics operations. The rapid growth of value-added services such as sustainable packaging and labeling is also notable, reflecting the sector’s shift toward more environmentally friendly and customer-centric logistics solutions .

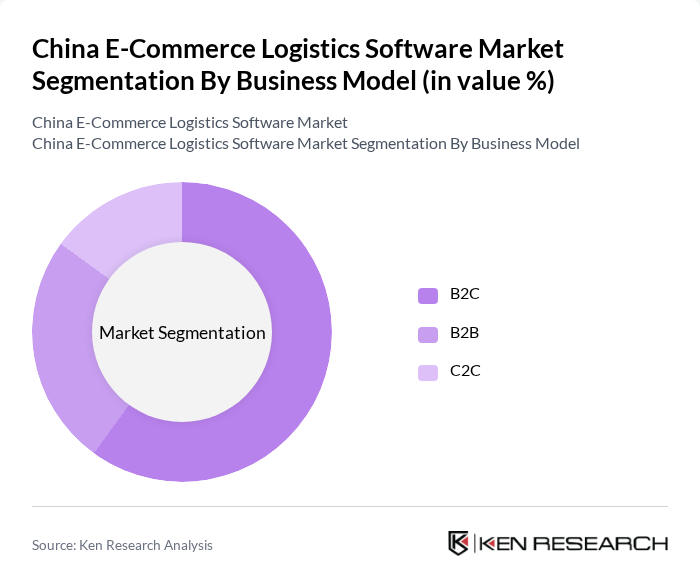

By Business Model:This segment encompasses various business models utilized in e-commerce logistics, including B2C, B2B, and C2C. The B2C model is currently the dominant segment, driven by the rapid growth of online shopping, consumer preferences for direct-to-consumer delivery options, and the proliferation of e-commerce platforms. The demand for fast and reliable delivery services, especially in urban areas, continues to drive innovation and investment in logistics software tailored for B2C operations .

The China E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group (Cainiao Network), JD Logistics, SF Technology (SF Express), YTO Express, ZTO Express, Best Inc., Deppon Logistics, STO Express, Yunda Express, 4PX Express, Dada Group (JDDJ), Suning Logistics, Lalamove, Geek+ (Warehouse Robotics & Automation), JD Cloud & AI (Logistics Software Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China e-commerce logistics software market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and automation, operational efficiencies will improve, leading to enhanced service delivery. Additionally, the integration of blockchain technology is expected to revolutionize supply chain transparency, fostering trust among consumers. These trends will likely shape the market landscape, encouraging innovation and investment in logistics software solutions to meet growing demands.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Management Software Warehouse Management Software Order Management Software Inventory Management Software Value-Added Services Software (Labeling, Packaging, Kitting) |

| By Business Model | B2C B2B C2C |

| By Destination | Domestic Cross-Border – Inbound Cross-Border – Outbound |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery (3-5 days) Economy Delivery (more than 5 days) Others |

| By Product Category | Fashion and Apparel Electronics and Household Appliances Food and Beverage Personal and Household Care Furniture Others |

| By City-Tier | Tier 1 Cities Tier 2 Cities Tier 3 and Below |

| By Geographic Region | East China South China North China Central China Northeast China Northwest China Southwest China |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Software Adoption | 100 | IT Managers, Logistics Coordinators |

| Supply Chain Optimization Tools | 60 | Supply Chain Analysts, Operations Managers |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, Fleet Coordinators |

| Inventory Management Systems | 40 | Warehouse Managers, Inventory Control Specialists |

| Returns Management Software | 45 | Customer Service Managers, Returns Analysts |

The China E-Commerce Logistics Software Market is valued at approximately USD 16 billion, driven by the rapid growth of online retail, cross-border e-commerce, and advancements in logistics technologies such as AI and real-time tracking.