Region:Asia

Author(s):Rebecca

Product Code:KRAB0170

Pages:82

Published On:August 2025

By Type:The freight and logistics market can be segmented into various types, including road freight, rail freight, air freight, sea freight, intermodal freight, warehousing services, project logistics, courier, express, and parcel (CEP), and others. Among these, road freight is the most dominant segment due to its flexibility and extensive network, catering to both urban and rural areas. Rail freight is also significant, especially for bulk goods and long-distance transport, while air freight is preferred for time-sensitive and high-value deliveries. The growing e-commerce sector has further boosted the demand for CEP services, making it a rapidly expanding segment with a focus on last-mile delivery and express solutions .

By End-User:The end-user segmentation includes manufacturing, consumer goods and retail, food and beverages, healthcare, automotive, IT hardware and telecom, chemicals, construction, agriculture, fishing, and forestry, e-commerce, and others. The manufacturing sector is the largest end-user, driven by the need for raw materials and finished goods transportation. E-commerce has also emerged as a significant contributor, with increasing online shopping trends necessitating efficient logistics solutions, especially in express and last-mile delivery. The cold chain segment is also growing due to rising demand for food safety and pharmaceutical logistics .

The China Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as China COSCO Shipping Corporation Limited, Sinotrans Limited, China Merchants Group, SF Express Co., Ltd., ZTO Express Inc., JD Logistics, Inc., YTO Express Group Co., Ltd., STO Express Co., Ltd., Best Inc., Deppon Logistics Co., Ltd., DHL Supply Chain (China), Kuehne + Nagel (China), DB Schenker (China), CEVA Logistics (China), Nippon Express (China) Co., Ltd., Geodis (China), UPS Supply Chain Solutions (China) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China freight and logistics market appears promising, driven by ongoing digital transformation and a shift towards sustainable practices. As companies increasingly adopt automation and data analytics, operational efficiencies are expected to improve significantly. Furthermore, the government's commitment to enhancing infrastructure and supporting green logistics initiatives will likely create a more resilient and environmentally friendly logistics ecosystem, positioning the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Warehousing Services Project Logistics Courier, Express, and Parcel (CEP) Others |

| By End-User | Manufacturing Consumer Goods and Retail Food and Beverages Healthcare Automotive IT Hardware and Telecom Chemicals Construction Agriculture, Fishing, and Forestry E-commerce Others |

| By Distribution Mode | Direct Distribution (1PL/2PL) Third-Party Logistics (3PL) Freight Forwarding Last-Mile Delivery Others |

| By Service Type | Freight Transportation Logistics Management Supply Chain Consulting Customs Brokerage Inventory Management Others |

| By Payload Capacity | Less than 1 Ton 5 Tons 10 Tons More than 10 Tons Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Directors, Operations Managers |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Supply Chain Coordinators |

| Cold Chain Logistics | 50 | Warehouse Managers, Quality Control Officers |

| Intermodal Transportation | 40 | Transport Planners, Freight Analysts |

| Logistics Technology Adoption | 45 | IT Managers, Digital Transformation Leads |

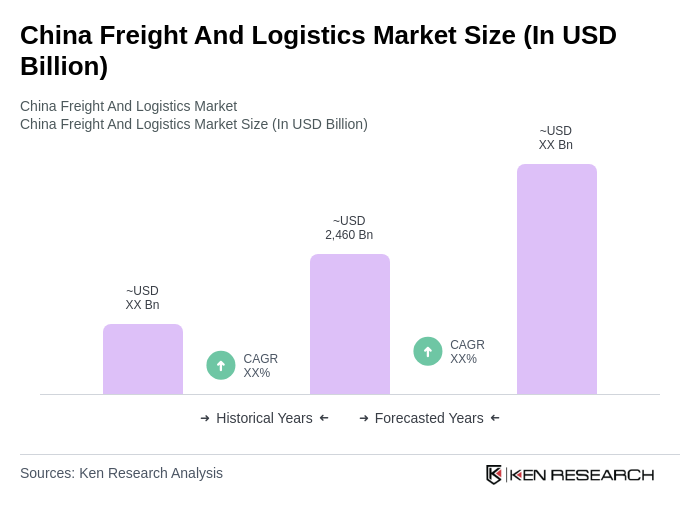

The China Freight and Logistics Market is valued at approximately USD 2,460 billion, driven by the rapid growth of e-commerce, increased manufacturing output, and significant infrastructure investments aimed at enhancing supply chain efficiency and operational capabilities.