Region:Asia

Author(s):Shubham

Product Code:KRAC0730

Pages:95

Published On:August 2025

By Type:The freight and logistics market can be segmented into various types, including road freight, air freight, sea and inland water freight, rail freight, warehousing and storage, freight forwarding, courier, express, and parcel (CEP), and value-added services. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different transportation needs and service requirements. Road and maritime modes carry the bulk of domestic and inter-island volumes, air freight serves high-value and time-sensitive cargo, domestic rail freight is minimal, and warehousing, forwarding, and CEP underpin last-mile and multimodal connectivity, increasingly enabled by digitization and cold-chain expansion for food and pharmaceuticals .

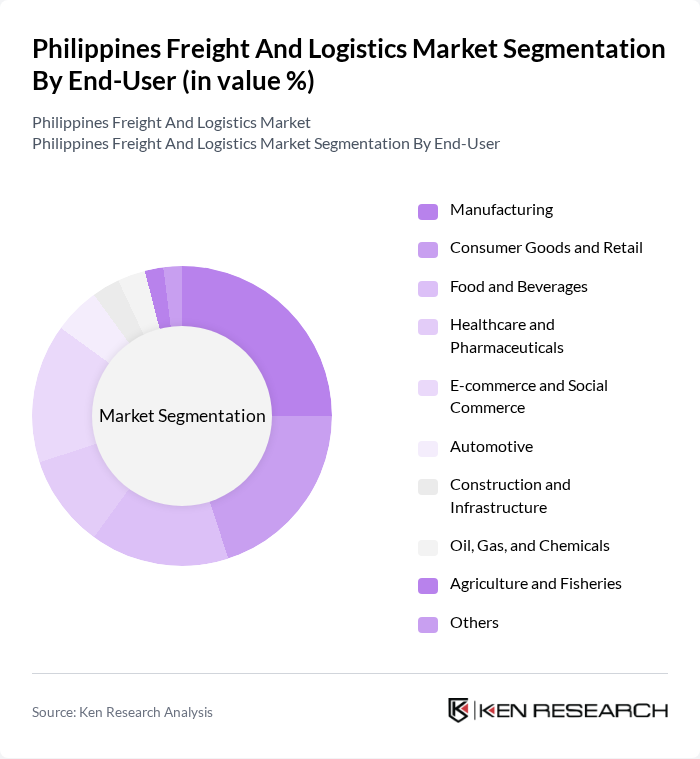

By End-User:The end-user segmentation of the freight and logistics market includes various sectors such as manufacturing, consumer goods and retail, food and beverages, healthcare and pharmaceuticals, e-commerce and social commerce, automotive, construction and infrastructure, oil, gas, and chemicals, agriculture and fisheries, and others. Each sector has unique logistics requirements that drive demand for specific services. Manufacturing, distributive trade/retail, and e-commerce are key demand centers; cold chain demand is rising in food and pharma; and construction and agriculture continue to rely on domestic inter-island networks for inputs and distribution .

The Philippines Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as 2GO Group, Inc., LBC Express Holdings, Inc., Airfreight 2100, Inc. (AIR21), Royal Cargo, Inc., Aboitiz Transport System/ATS Logistics, XDE Logistics, JRS Express, DHL Supply Chain Philippines (Deutsche Post DHL Group), FedEx Express Philippines, UPS Philippines, Kuehne+Nagel Philippines, CEVA Logistics Philippines, Agility Logistics (Agility Philippines), DB Schenker Philippines, Yusen Logistics Philippines contribute to innovation, geographic expansion, and service delivery in this space .

The Philippines freight and logistics market is poised for significant transformation, driven by technological advancements and increasing demand for efficient services. As e-commerce continues to expand, logistics providers are expected to enhance their capabilities through automation and AI integration. Additionally, government initiatives aimed at improving infrastructure will likely facilitate smoother operations. The focus on sustainability and green logistics practices will also shape the future landscape, encouraging companies to adopt eco-friendly solutions while meeting consumer demands for responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Air Freight Sea and Inland Water Freight Rail Freight (limited domestic rail freight) Warehousing and Storage Freight Forwarding Courier, Express, and Parcel (CEP) Value-Added Services (kitting, packaging, reverse logistics) |

| By End-User | Manufacturing Consumer Goods and Retail Food and Beverages Healthcare and Pharmaceuticals E-commerce and Social Commerce Automotive Construction and Infrastructure Oil, Gas, and Chemicals Agriculture and Fisheries Others |

| By Distribution Mode | Direct Distribution (in-house logistics) Indirect Distribution (distributors/agents) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL)/Integrated Logistics Cross-Border and Transshipment |

| By Service Type | Freight Transportation Freight Forwarding and Customs Brokerage Warehousing and Cold Chain Supply Chain Management Last-Mile and Same-Day Delivery Others |

| By Payload Capacity | Light Commercial Vehicles (up to 1 ton) Medium Trucks (1–5 tons) Heavy Trucks (5–10 tons) Very Heavy Trucks and Trailers (above 10 tons) Air and Containerized Payload Classes |

| By Pricing Model | Fixed/Contract Rates Variable/Spot Rates Subscription/Retainer-Based Logistics Pay-per-Use/Milestone-Based Others |

| By Customer Segment | Micro, Small, and Medium Enterprises (MSMEs) Large Enterprises Government Agencies and State-Owned Firms Non-Governmental Organizations Exporters and Importers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 120 | Logistics Managers, Freight Operations Directors |

| Warehousing Solutions | 90 | Warehouse Managers, Supply Chain Analysts |

| Last-Mile Delivery Services | 80 | Delivery Operations Managers, E-commerce Logistics Coordinators |

| Cold Chain Logistics | 70 | Quality Assurance Managers, Supply Chain Directors |

| Transportation Infrastructure Development | 60 | Transport Planners, Transportation Policy Makers |

The Philippines Freight and Logistics Market is valued at approximately USD 18 billion, reflecting a robust industry supported by e-commerce growth, trade, and infrastructure improvements aimed at enhancing connectivity and capacity.