Region:Europe

Author(s):Rebecca

Product Code:KRAD0211

Pages:86

Published On:August 2025

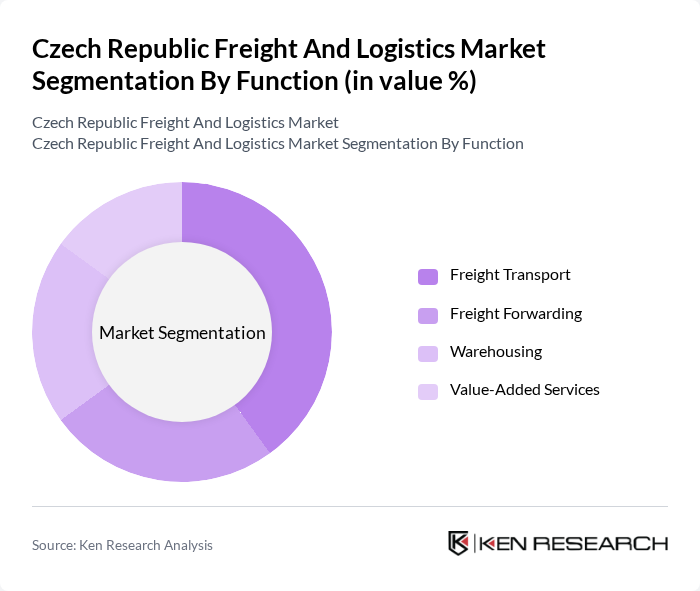

By Function:The market is segmented into four main functions: Freight Transport, Freight Forwarding, Warehousing, and Value-Added Services. Freight Transport remains the dominant segment, primarily due to the flexibility and accessibility of road freight, which accounts for the majority of domestic movements. Freight Forwarding supports international trade and cross-border logistics, while Warehousing is increasingly important for e-commerce fulfillment and inventory management. Value-Added Services, such as packaging, labeling, and reverse logistics, are gaining traction as companies seek to optimize supply chain efficiency .

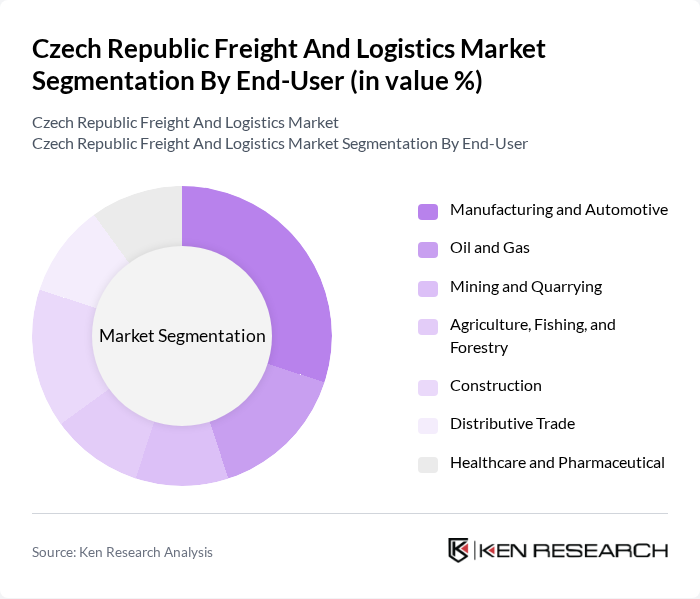

By End-User:The end-user segmentation includes Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, and Healthcare and Pharmaceutical. Manufacturing and Automotive is the largest segment, reflecting the Czech Republic's strong industrial base and its role as a major automotive exporter. Construction, Distributive Trade, and Healthcare and Pharmaceutical also represent significant shares, driven by ongoing infrastructure development, retail expansion, and the need for specialized logistics solutions in healthcare .

The Czech Republic Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, DB Schenker, Kuehne + Nagel, Geis Group, PPL CZ, DPDgroup, Raben Group, XPO Logistics, C.H. Robinson, DSV, FedEx Express, UPS, Cargo-Partner, PST CLC, Yusen Logistics, Gefco, MD Logistika, and HAVI Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The Czech Republic's freight and logistics market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital solutions, the integration of AI and big data analytics will enhance operational efficiency and decision-making. Additionally, the focus on sustainability will lead to the adoption of green logistics practices, positioning the sector for long-term growth and resilience in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport Freight Forwarding Warehousing Value-Added Services |

| By End-User | Manufacturing and Automotive Oil and Gas Mining and Quarrying Agriculture, Fishing, and Forestry Construction Distributive Trade Healthcare and Pharmaceutical |

| By Service Type | Domestic Transportation Management International Transportation Management Warehousing & Distribution Value-Added Services (Packaging, Assembly, Inventory Management) Others |

| By Distribution Mode | Road Freight Rail Freight Air Freight Sea Freight Third-Party Logistics (3PL) Others |

| By Goods Configuration | Solid Goods Fluid Goods Perishable Goods Hazardous Materials Others |

| By Customer Segment | B2B B2C Government Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Coordinators, Fleet Managers |

| Rail Freight Services | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 40 | Air Freight Managers, Customs Compliance Officers |

| Cold Chain Logistics | 50 | Supply Chain Managers, Quality Assurance Leads |

| Last-Mile Delivery Solutions | 70 | Delivery Operations Managers, E-commerce Logistics Heads |

The Czech Republic Freight and Logistics Market is valued at approximately USD 4.4 billion, reflecting significant growth driven by the country's strategic location in Central Europe, increasing e-commerce demand, and expansion in manufacturing sectors, particularly automotive.