Region:Asia

Author(s):Rebecca

Product Code:KRAD0165

Pages:86

Published On:August 2025

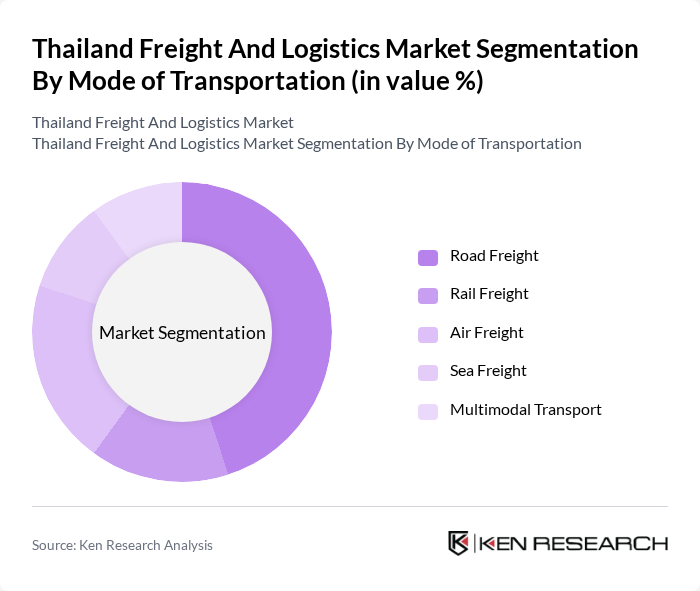

By Mode of Transportation:The transportation segment is critical in the logistics market, with various modes including road, rail, air, sea, and multimodal transport. Road freight dominates due to its flexibility and Thailand’s extensive highway network, supporting both domestic and cross-border trade. Air freight is preferred for high-value and time-sensitive goods, especially within the expanding e-commerce and electronics sectors. Rail and sea freight are essential for bulk and long-distance transportation, with ongoing investments in double-track railways and major seaport upgrades. Multimodal transport is gaining traction as businesses seek integrated solutions for efficiency and cost-effectiveness.

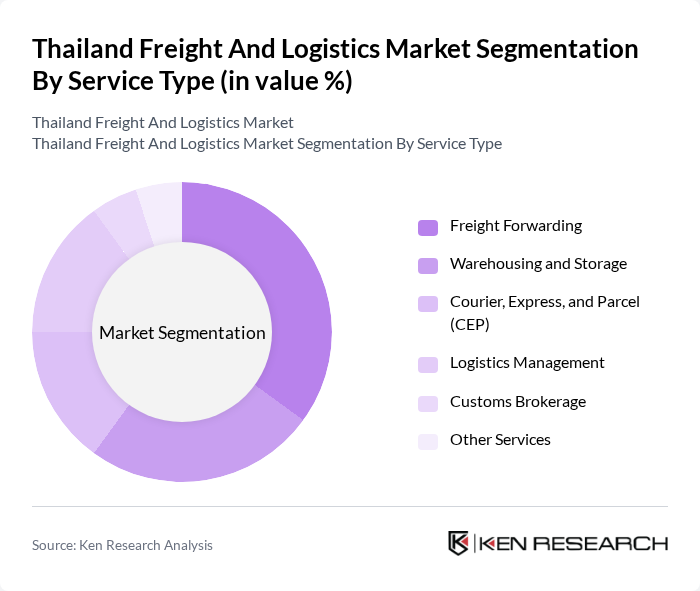

By Service Type:The service type segment encompasses various logistics services, including freight forwarding, warehousing, courier services, logistics management, customs brokerage, and other services. Freight forwarding is a leading service due to the increasing complexity of global trade and Thailand’s role as a regional distribution hub. Warehousing and storage are significant, driven by the rise of e-commerce and the need for efficient inventory management. Courier, express, and parcel (CEP) services are expanding rapidly, supported by surging online retail activity. Logistics management and customs brokerage remain essential for optimizing supply chains and ensuring regulatory compliance.

The Thailand Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Logistics Management Co., Ltd., Kerry Express (Thailand) Ltd., JWD Group, WHA Corporation PCL, BTS Group Holdings Public Company Limited, DHL Supply Chain (Thailand) Ltd., DB Schenker (Thailand) Ltd., Yusen Logistics (Thailand) Co., Ltd., Kuehne + Nagel (Thailand) Ltd., Nippon Express (Thailand) Co., Ltd., CEVA Logistics (Thailand) Ltd., Agility Logistics (Thailand) Ltd., FedEx Express (Thailand) Co., Ltd., United Parcel Service (UPS) Thailand, CJ Logistics (Thailand) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's freight and logistics market appears promising, driven by ongoing technological advancements and a focus on sustainability. The integration of AI and automation in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the government's commitment to improving infrastructure will likely facilitate smoother logistics operations. As e-commerce continues to grow, logistics providers will need to adapt to changing consumer demands, ensuring timely and efficient delivery services to maintain competitiveness in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Freight Rail Freight Air Freight Sea Freight Multimodal Transport |

| By Service Type | Freight Forwarding Warehousing and Storage Courier, Express, and Parcel (CEP) Logistics Management Customs Brokerage Other Services |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Healthcare Automotive E-commerce Government Others |

| By Destination Type | Domestic International |

| By Temperature Control (Warehousing) | Non-Temperature Controlled Temperature Controlled |

| By Technology Adoption | Traditional Logistics Digital Logistics Automated Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Coordinators, Fleet Managers |

| Air Cargo Operations | 60 | Air Freight Managers, Operations Managers |

| Maritime Logistics | 50 | Port Authorities, Shipping Line Executives |

| Warehousing and Distribution | 80 | Warehouse Managers, Supply Chain Analysts |

| Cold Chain Logistics | 40 | Quality Control Managers, Logistics Managers |

The Thailand Freight and Logistics Market is valued at approximately USD 53 billion, driven by increasing demand for efficient supply chain solutions, urbanization, and e-commerce growth. Investments in infrastructure and technology have further enhanced operational efficiencies in the sector.