Region:Europe

Author(s):Geetanshi

Product Code:KRAA1169

Pages:91

Published On:August 2025

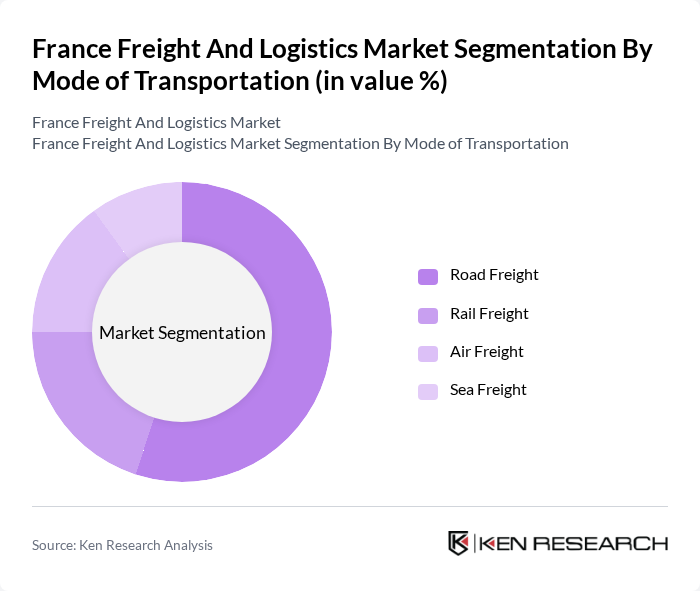

By Mode of Transportation:

The freight and logistics market is segmented by mode of transportation into Road Freight, Rail Freight, Air Freight, and Sea Freight. Road Freight remains the dominant mode, supported by France’s extensive and well-maintained road network, which enables fast, flexible, and reliable delivery for a wide range of goods. The rise of e-commerce and just-in-time delivery models has further increased demand for road freight services. Rail Freight is primarily utilized for bulk goods and long-distance shipments, offering cost-effective and sustainable solutions, especially for industrial cargo. Air Freight is critical for high-value and time-sensitive shipments, with major airports like Paris Charles de Gaulle serving as key international cargo hubs. Sea Freight is essential for international trade, particularly for large-volume shipments and bulk commodities, leveraging France’s major ports such as Marseille and Le Havre .

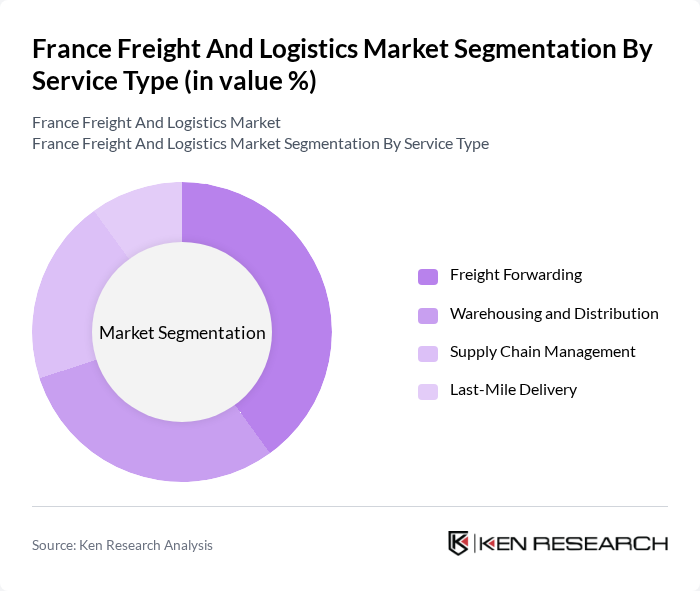

By Service Type:

The market is also segmented by service type, including Freight Forwarding, Warehousing and Distribution, Supply Chain Management, and Last-Mile Delivery. Freight Forwarding leads due to the increasing complexity of global trade and the need for integrated logistics solutions, including customs clearance and documentation. Warehousing and Distribution is a close second, as businesses strive to optimize inventory and reduce delivery times. Supply Chain Management is gaining importance as companies seek end-to-end visibility and efficiency across their logistics operations. Last-Mile Delivery has become a critical segment, driven by the surge in e-commerce and heightened consumer expectations for rapid, reliable delivery .

The France Freight And Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as GEODIS, XPO Logistics, DB Schenker, Kuehne + Nagel, DPDgroup (La Poste Group), Bolloré Logistics, CMA CGM Group, SNCF Logistics, DHL Supply Chain (Deutsche Post AG), Rhenus Logistics, Norbert Dentressangle (now part of XPO Logistics), TSE Express, Transports Roussel, ID Logistics, SEKO Logistics, Bansard International, DSV France, FedEx Express France, Nippon Express France, Kintetsu World Express France contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freight and logistics market in France appears promising, driven by ongoing digital transformation and a focus on sustainability. As companies increasingly adopt smart logistics solutions, operational efficiencies are expected to improve significantly. Furthermore, the integration of IoT technologies will enhance real-time tracking and inventory management, fostering greater supply chain resilience. The market is likely to see continued investment in automation, positioning logistics firms to better meet evolving consumer demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Freight Rail Freight Air Freight Sea Freight |

| By Service Type | Freight Forwarding Warehousing and Distribution Supply Chain Management Last-Mile Delivery |

| By End-User Industry | Manufacturing Retail Automotive Healthcare Food and Beverage Construction IT and Telecom Oil and Gas Chemicals Others |

| By Region | Northern France Southern France Central France Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Services | 60 | Rail Operations Managers, Supply Chain Analysts |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Compliance Officers |

| Maritime Shipping Logistics | 40 | Port Operations Managers, Shipping Coordinators |

| Last-Mile Delivery Solutions | 50 | Last-Mile Operations Managers, E-commerce Logistics Heads |

The France Freight and Logistics Market is valued at approximately USD 165 billion, driven by the growth of e-commerce, manufacturing, and retail activities, along with significant investments in logistics technology and infrastructure.