China Luxury Car Market Overview

- The China Luxury Car Market is valued at approximately USD 195 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, a rapidly expanding population of high-net-worth individuals, and increasing consumer preference for premium vehicles. The market has also seen a significant shift towards electric and hybrid luxury vehicles, reflecting changing consumer attitudes towards sustainability, digital innovation, and advanced automotive technology. Leading brands are introducing localized models and advanced features tailored to Chinese consumer preferences, further fueling demand .

- Key cities such as Beijing, Shanghai, and Guangzhou dominate the luxury car market due to their high concentration of wealth, advanced infrastructure, and urbanization. These cities are home to a large number of affluent consumers who prioritize luxury, status, and technological innovation, making them prime locations for luxury car sales. The presence of numerous luxury dealerships, service centers, and digital showrooms in these metropolitan areas further supports market growth .

- In 2023, the Chinese government implemented stricter emissions regulations aimed at reducing pollution from vehicles. These regulations require all new luxury cars sold to meet specific emissions standards, accelerating manufacturer investment in cleaner technologies and electric vehicles. This initiative is part of a broader strategy to promote sustainable transportation and reduce the environmental impact of the automotive sector, aligning with national carbon neutrality goals .

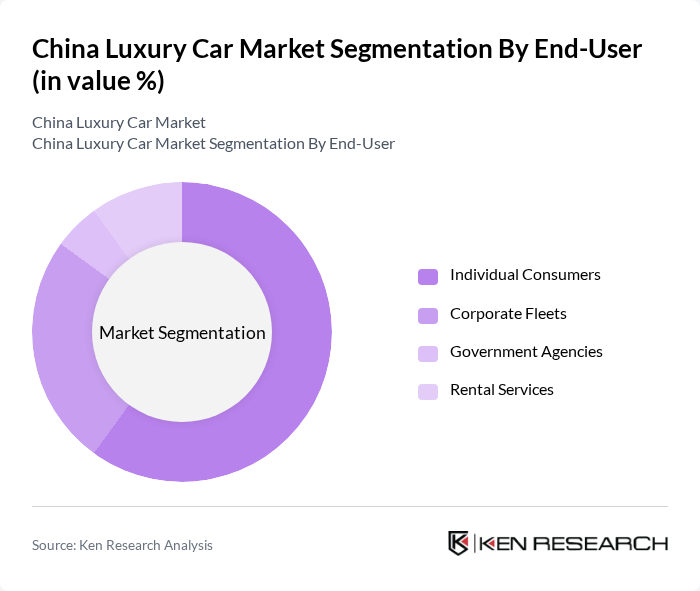

China Luxury Car Market Segmentation

By Type:The luxury car market is segmented into sedans, SUVs, coupes, convertibles, luxury electric vehicles, luxury hybrids, MPVs, hatchbacks, and others. Among these, SUVs have emerged as the dominant segment due to their versatility, spaciousness, and appeal to families and adventure-seekers. The growing trend of urbanization, rising preference for larger vehicles, and the introduction of luxury electric SUVs have further solidified the SUV's position in the market. Luxury electric vehicles and hybrids are also gaining traction, reflecting the market’s shift toward sustainability and advanced technology .

By End-User:The market is segmented by end-user into individual consumers, corporate fleets, government agencies, and rental services. Individual consumers represent the largest segment, driven by the increasing number of high-net-worth individuals and their desire for luxury, status, and advanced technology. Corporate fleets are also significant, as businesses invest in luxury vehicles for executive transport and branding purposes. The adoption of luxury vehicles by rental services is rising, particularly for premium mobility and chauffeur-driven experiences .

China Luxury Car Market Competitive Landscape

The China Luxury Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as BMW Group, Mercedes-Benz AG, Audi AG, Lexus (Toyota Motor Corporation), Porsche AG, Land Rover (Jaguar Land Rover), Volvo Cars, Tesla, Inc., Maserati S.p.A., Bentley Motors Limited, Rolls-Royce Motor Cars, Ferrari N.V., Aston Martin Lagonda Global Holdings plc, Genesis Motor (Hyundai Motor Group), McLaren Automotive, Hongqi (China FAW Group Corporation), Zeekr (Geely Automobile Holdings Limited), NIO Inc., Li Auto Inc., BYD Auto Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

China Luxury Car Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The average disposable income in urban areas of China reached approximately 43,000 CNY (about $6,000) in future, reflecting a moderate increase from the previous year. This rise in income enables consumers to allocate more funds towards luxury purchases, including high-end vehicles. As more individuals enter the middle and upper classes, the demand for luxury cars is expected to surge, with an estimated 1.5 million luxury vehicles sold in future, driven by affluent consumers seeking status and quality.

- Increasing Urbanization:By future, urbanization in China is projected to reach 65%, with over 900 million people living in cities. This trend is fostering a growing middle class that prioritizes luxury goods, including cars. Urban residents are increasingly drawn to luxury vehicles for their status and comfort. The expansion of urban infrastructure, including improved road networks, further supports this trend, making luxury cars more accessible and desirable for city dwellers seeking convenience and prestige.

- Growing Demand for Premium Features:In future, the demand for luxury cars equipped with advanced technology and premium features is expected to rise significantly. Features such as high-end infotainment systems, enhanced safety technologies, and superior comfort options are becoming standard expectations among consumers. With over 70% of luxury car buyers prioritizing these features, manufacturers are responding by integrating cutting-edge technology, which is anticipated to drive sales and enhance customer satisfaction in the luxury segment.

Market Challenges

- Intense Competition:The luxury car market in China is characterized by fierce competition, with over 30 brands vying for market share. In future, the top five luxury car manufacturers are expected to account for only 50% of total sales, indicating a fragmented market. This intense rivalry pressures companies to innovate continuously and offer competitive pricing, which can erode profit margins and complicate strategic positioning for both established and emerging brands.

- Regulatory Compliance Costs:Compliance with stringent government regulations, particularly regarding emissions and safety standards, poses a significant challenge for luxury car manufacturers. In future, the cost of meeting these regulations is projected to increase by 15%, impacting overall profitability. Companies must invest heavily in research and development to ensure their vehicles meet these evolving standards, which can divert resources from other critical areas such as marketing and customer engagement.

China Luxury Car Market Future Outlook

The future of the China luxury car market appears promising, driven by a combination of rising disposable incomes and increasing urbanization. As consumers become more environmentally conscious, the shift towards electric vehicles is expected to gain momentum, with sales projected to reach 500,000 units in future. Additionally, the integration of advanced technologies in luxury vehicles will likely enhance consumer appeal, fostering a competitive landscape that encourages innovation and sustainability in the industry.

Market Opportunities

- Electric Vehicle Adoption:The electric vehicle segment is poised for significant growth, with sales expected to double to 500,000 units in future. This shift presents an opportunity for luxury car manufacturers to capture a growing market of environmentally conscious consumers seeking premium electric options, thereby enhancing brand loyalty and market share.

- Expansion into Tier 2 and Tier 3 Cities:As urbanization continues, Tier 2 and Tier 3 cities are emerging as lucrative markets for luxury vehicles. With a combined population exceeding 300 million, these cities are witnessing a rise in disposable income and demand for luxury goods. Targeting these markets can provide manufacturers with substantial growth opportunities and increased sales potential.