GCC Luxury Car Market Overview

- The GCC Luxury Car Market is valued at USD 17 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, a growing affluent population, and an increasing demand for high-end vehicles that offer advanced technology and luxury features. The market has seen a significant uptick in sales, particularly in the luxury SUV and electric vehicle segments, as consumers seek both status and sustainability in their automotive choices. Recent trends highlight a strong preference for prestige brands, advanced in-car technology, and hybrid/electric models, with SUVs and crossovers outpacing traditional sedans in popularity. The region’s luxury car market benefits from limited public transport, rapid urbanization, and tourism-led spending, especially in Dubai, Riyadh, and Doha .

- The United Arab Emirates, particularly Dubai and Abu Dhabi, along with Saudi Arabia, are the dominant markets in the GCC Luxury Car sector. These regions benefit from a combination of high disposable incomes, a strong car culture, and a preference for luxury brands. The presence of numerous luxury car dealerships and a growing interest in high-performance vehicles further solidify their market leadership. The UAE accounts for nearly half of the GCC luxury market, with Saudi Arabia also contributing significantly due to its large population and high net worth individuals .

- In 2023, the UAE government implemented Cabinet Decision No. 37 of 2023, issued by the Ministry of Energy and Infrastructure, which promotes electric vehicles by offering incentives such as tax exemptions and rebates for EV buyers. This regulation forms part of the UAE’s National Electric Vehicles Policy, aiming to reduce carbon emissions and encourage sustainable transportation solutions. The policy mandates standards for EV charging infrastructure, sets compliance requirements for importers and dealers, and establishes eligibility for financial incentives, thereby enhancing the attractiveness of luxury electric vehicles in the market .

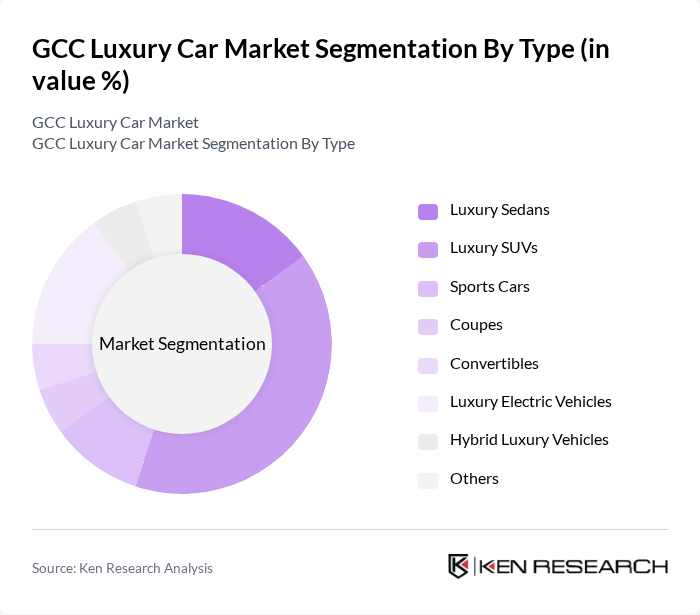

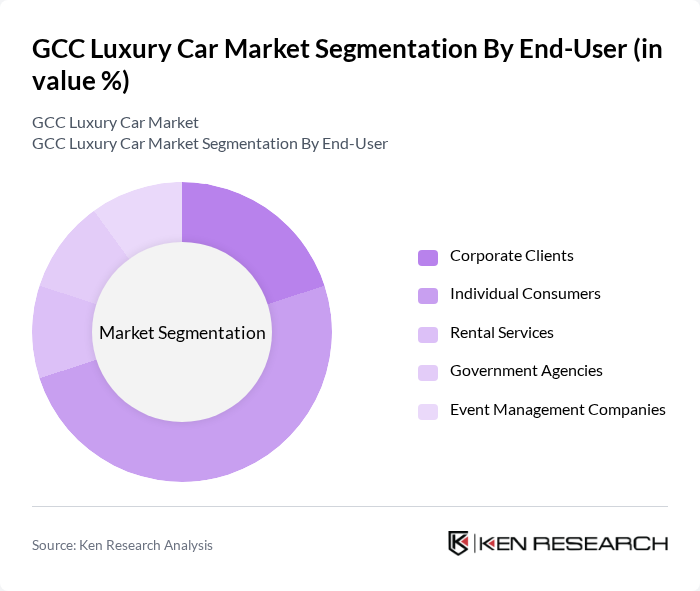

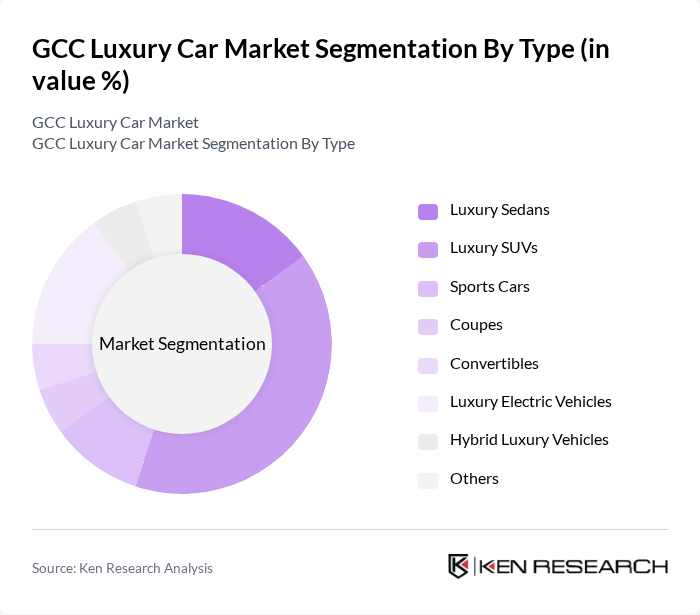

GCC Luxury Car Market Segmentation

By Type:The luxury car market is segmented into various types, including Luxury Sedans, Luxury SUVs, Sports Cars, Coupes, Convertibles, Luxury Electric Vehicles, Hybrid Luxury Vehicles, and Others. Among these, Luxury SUVs have emerged as the leading segment due to their versatility, spaciousness, and the growing preference for family-oriented luxury vehicles. The trend towards SUVs is driven by consumer demand for comfort, advanced features, and a desire for elevated driving experiences. Hybrid and electric luxury vehicles are gaining traction, supported by government incentives and stricter emission standards, while sports cars and convertibles remain popular among enthusiasts seeking performance and exclusivity .

By End-User:The market is segmented by end-user categories, including Corporate Clients, Individual Consumers, Rental Services, Government Agencies, and Event Management Companies. Individual Consumers dominate the market, driven by a growing trend of personal luxury vehicle ownership among affluent individuals. This segment is characterized by a strong desire for personalization, advanced technology, and exclusive features, leading to increased sales in high-end models. Corporate clients and rental services also contribute, particularly through executive fleets and luxury car leasing for events and tourism .

GCC Luxury Car Market Competitive Landscape

The GCC Luxury Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as BMW Group, Mercedes-Benz AG, Audi AG, Porsche AG, Lexus (Toyota Motor Corporation), Maserati S.p.A., Bentley Motors Limited, Rolls-Royce Motor Cars Limited, Aston Martin Lagonda Global Holdings plc, Ferrari N.V., Lamborghini (Automobili Lamborghini S.p.A.), Bugatti Automobiles S.A.S., McLaren Automotive Limited, Jaguar Land Rover Automotive PLC, Volvo Cars, Al-Futtaim Motors (UAE), Al Tayer Motors (UAE), Al Jaziri Motors (UAE), Al Nabooda Automobiles (UAE), Euro Motors (Bahrain), Al Mulla Group (Kuwait), Al Habtoor Motors (UAE), Emirates Motor Company (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

GCC Luxury Car Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The GCC region has witnessed a significant rise in disposable income, with average household income reaching approximatelyUSD 50,000in future. This increase is driven by economic diversification efforts and a growing expatriate population. As disposable income rises, consumers are more inclined to invest in luxury vehicles, leading to a projected increase in luxury car sales. The affluent demographic, particularly in the UAE and Saudi Arabia, is expected to drive demand for high-end automobiles.

- Rising Demand for Luxury Vehicles:The luxury vehicle segment in the GCC is experiencing robust growth, with sales expected to reach120,000 unitsin future. Factors contributing to this trend include a growing middle class and a cultural affinity for luxury brands. The demand for high-performance and premium vehicles is particularly strong in urban areas, where consumers prioritize status and quality. This trend is further supported by the increasing availability of luxury models from global manufacturers.

- Expansion of High-End Dealerships:The GCC is witnessing a surge in the establishment of high-end dealerships, with over40 new luxury car showroomsopening in future. This expansion is driven by the increasing demand for luxury vehicles and the need for enhanced customer service experiences. Dealerships are investing in state-of-the-art facilities and personalized services, which are crucial for attracting affluent customers. This trend is expected to enhance brand visibility and accessibility, further stimulating luxury car sales.

Market Challenges

- High Import Tariffs:The GCC luxury car market faces significant challenges due to high import tariffs, which can reach up to5%on luxury vehicles. These tariffs increase the overall cost of luxury cars, making them less accessible to potential buyers. As a result, many consumers may opt for less expensive alternatives, hindering market growth. The high tariffs also discourage foreign manufacturers from entering the market, limiting competition and innovation in the luxury segment.

- Limited Availability of Financing Options:Access to financing remains a challenge in the GCC luxury car market, with only40%of consumers able to secure loans for high-end vehicles. Stringent lending criteria and high-interest rates deter potential buyers from purchasing luxury cars. This limited access to financing options restricts market growth, as many consumers prefer financing over outright purchases. The lack of tailored financing solutions for luxury vehicles further exacerbates this issue, impacting overall sales.

GCC Luxury Car Market Future Outlook

The GCC luxury car market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The shift towards sustainable luxury vehicles is gaining momentum, with electric and hybrid models expected to dominate the market in future. Additionally, the rise of online luxury car sales platforms is reshaping the purchasing landscape, providing consumers with greater convenience. As the market adapts to these trends, opportunities for growth and innovation will emerge, particularly in the areas of customization and smart technology integration.

Market Opportunities

- Growth in Tourism Boosting Luxury Car Rentals:The GCC's tourism sector is projected to attract over25 million visitorsin future, significantly boosting the luxury car rental market. Tourists often seek high-end vehicles for their stay, creating a lucrative opportunity for rental companies. This trend is expected to drive demand for luxury car rentals, enhancing overall market growth and providing additional revenue streams for dealerships.

- Increasing Interest in Bespoke Luxury Vehicles:There is a growing trend towards bespoke luxury vehicles, with consumers willing to pay a premium for customization. In future, the bespoke luxury segment is expected to account for10%of total luxury car sales in the GCC. This trend reflects a shift in consumer preferences towards personalized experiences, presenting manufacturers with opportunities to cater to this demand through tailored offerings and exclusive features.