Region:North America

Author(s):Shubham

Product Code:KRAB0572

Pages:90

Published On:August 2025

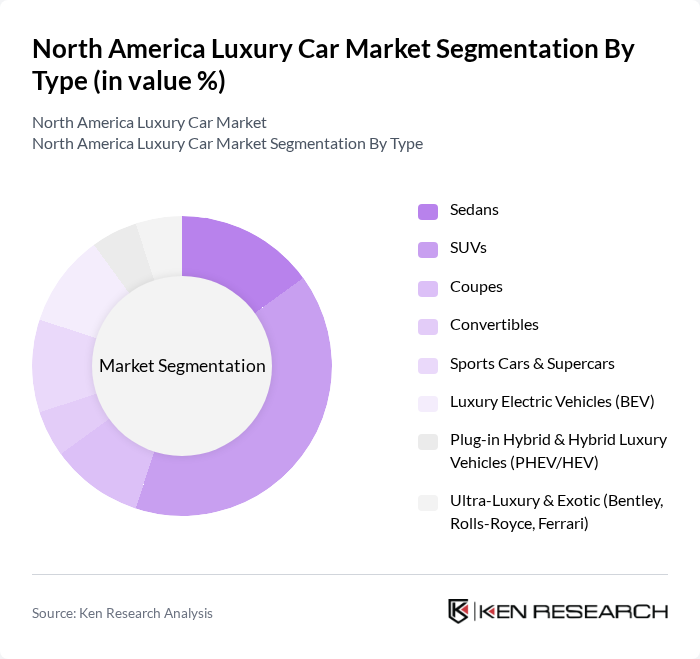

By Type:The luxury car market can be segmented into various types, including Sedans, SUVs, Coupes, Convertibles, Sports Cars & Supercars, Luxury Electric Vehicles (BEV), Plug-in Hybrid & Hybrid Luxury Vehicles (PHEV/HEV), and Ultra-Luxury & Exotic vehicles (e.g., Bentley, Rolls-Royce, Ferrari). Each of these segments caters to different consumer preferences and needs, with SUVs currently leading the market due to their versatility and luxury features; recent data identify SUVs as the largest revenue-generating vehicle type in North America.

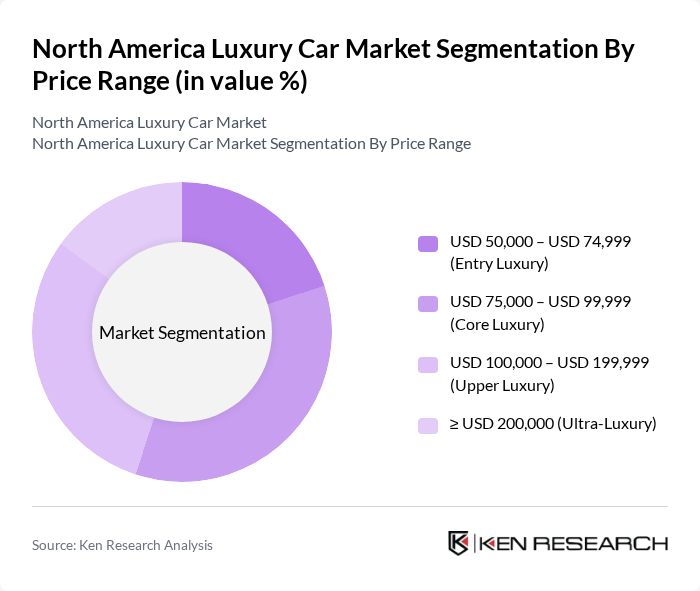

By Price Range:The luxury car market can also be segmented by price range, which includes Entry Luxury (USD 50,000 – USD 74,999), Core Luxury (USD 75,000 – USD 99,999), Upper Luxury (USD 100,000 – USD 199,999), and Ultra-Luxury (? USD 200,000). Each price segment attracts different consumer demographics, with the Core Luxury segment experiencing significant traction as buyers prioritize advanced safety, connectivity, and driver?assist features at accessible premium price points.

The North America Luxury Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercedes-Benz USA, LLC, BMW of North America, LLC, Audi of America, LLC, Lexus (Toyota Motor North America), Porsche Cars North America, Inc., Jaguar Land Rover North America, LLC, Tesla, Inc., Volvo Car USA, LLC, Genesis Motor North America, Cadillac (General Motors), Lincoln (Ford Motor Company), Acura (American Honda Motor Co., Inc.), Infiniti (Nissan North America, Inc.), Maserati North America, Inc., Bentley Motors, Inc., Rolls-Royce Motor Cars North America, Inc., Aston Martin Lagonda of North America, Inc., Ferrari North America, Inc., Lucid Motors USA, Inc., Rivian Automotive, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The North American luxury car market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As electric vehicles gain traction, manufacturers are expected to invest heavily in sustainable technologies and innovative features. Additionally, the rise of subscription services and personalized customer experiences will reshape how consumers engage with luxury brands. This dynamic environment will require companies to adapt quickly to maintain relevance and capitalize on emerging trends, ensuring a competitive edge in the marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Coupes Convertibles Sports Cars & Supercars Luxury Electric Vehicles (BEV) Plug-in Hybrid & Hybrid Luxury Vehicles (PHEV/HEV) Ultra-Luxury & Exotic (Bentley, Rolls-Royce, Ferrari) |

| By Price Range | $50,000 – $74,999 (Entry Luxury) $75,000 – $99,999 (Core Luxury) $100,000 – $199,999 (Upper Luxury) ? $200,000 (Ultra-Luxury) |

| By Propulsion/Engine Type | Gasoline (ICE) Diesel (limited, mostly legacy) Battery Electric (BEV) Plug-in Hybrid (PHEV) Hybrid Electric (HEV) |

| By Sales Channel | Franchised Dealerships Direct-to-Consumer (e.g., Tesla, Lucid) Online Configurator & E-Reservation Corporate & Fleet Sales Certified Pre-Owned (CPO) |

| By Customer Demographics | Age Cohorts (Millennials, Gen X, Baby Boomers) Gender Household Income Bands (>$150k, $100k–$149k, $75k–$99k) HNWI & UHNW Segments |

| By Geographic Distribution | United States Canada Mexico |

| By Usage Type | Personal Use Corporate & Executive Fleet Leasing & Subscription Rental & Chauffeur Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Car Dealerships | 120 | Sales Managers, General Managers |

| Luxury Vehicle Owners | 150 | Affluent Consumers, Brand Loyalists |

| Automotive Industry Experts | 60 | Market Analysts, Automotive Consultants |

| Luxury Car Rental Services | 80 | Operations Managers, Fleet Managers |

| Luxury Automotive Events Attendees | 90 | Event Organizers, Attendees, Influencers |

The North America Luxury Car Market is valued at approximately USD 52 billion, reflecting sustained demand for premium vehicles and model mix upgrades based on a five-year historical analysis.