Region:Asia

Author(s):Shubham

Product Code:KRAC0884

Pages:85

Published On:August 2025

By Product Category:The retail market in China is diverse, encompassing a wide range of product categories tailored to evolving consumer needs. The major segments include Food and Beverages, Apparel and Footwear, Consumer Electronics and Appliances, Home Improvement and Furniture, Beauty and Personal Care, Sports and Entertainment, and Others. Food and Beverages remain the largest segment, driven by the essential nature of these products and the rising trend of health-conscious consumption. Increasing demand for organic, locally sourced, and premium food products is fueling growth in this category. Apparel and Footwear, as well as Consumer Electronics and Appliances, are also experiencing strong momentum due to shifting fashion preferences and rapid adoption of smart devices.

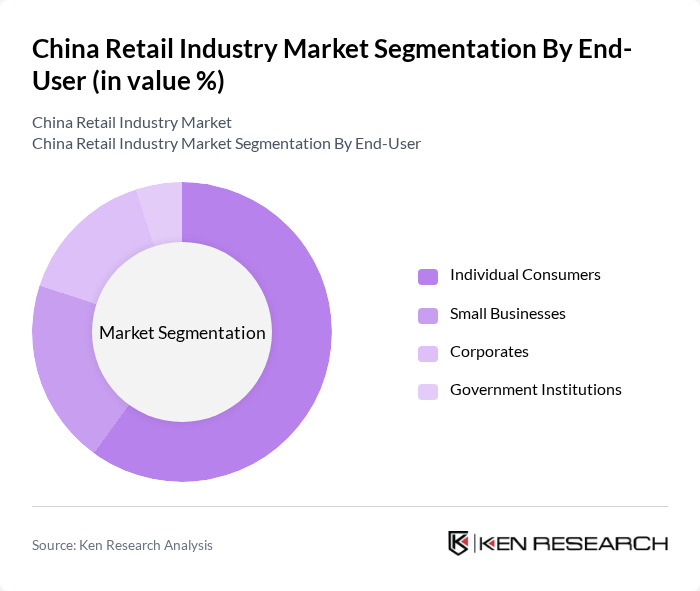

By End-User:The retail market serves a broad spectrum of end-users, including Individual Consumers, Small Businesses, Corporates, and Government Institutions. Individual Consumers represent the largest segment, supported by rising purchasing power, changing lifestyle preferences, and the convenience of digital shopping platforms. The growth of e-commerce and mobile payment adoption has made it easier for consumers to access a wide array of products. Small businesses and corporates are significant contributors, especially in niche markets and B2B transactions, while government institutions play a role in bulk procurement and specialized retail activities.

The China Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group Holding Limited, JD.com, Inc., Suning.com Co., Ltd., Pinduoduo Inc., Walmart China (?????), Tencent Holdings Ltd., Yonghui Superstores Co., Ltd. (????), Gome Retail Holdings Ltd. (????), China Resources Vanguard Co., Ltd. (????), Meituan (??), Costco Wholesale China (?????), Freshippo (????, Alibaba Group), 7-Eleven China (?-Eleven??), Lianhua Supermarket Holdings Co., Ltd. (????), Carrefour China (?????) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China retail industry appears promising, driven by technological innovations and evolving consumer preferences. As the middle class continues to expand, retail spending is expected to increase, particularly in e-commerce and personalized shopping experiences. Retailers are likely to invest in omnichannel strategies, integrating online and offline platforms to enhance customer engagement. Furthermore, sustainability will become a key focus, with brands adopting eco-friendly practices to meet consumer demand for responsible retailing.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Food and Beverages Apparel and Footwear Consumer Electronics and Appliances Home Improvement and Furniture Beauty and Personal Care Sports and Entertainment Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Institutions |

| By Sales Channel | Offline (Brick-and-Mortar Stores) Online (E-commerce Platforms) Mobile Commerce Direct Sales |

| By Distribution Mode | Direct Distribution Wholesalers Distributors Franchise Models |

| By Price Range | Budget Mid-Range Premium |

| By Consumer Demographics | Age Group Income Level Urban vs Rural |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Traditional Retail Outlets | 100 | Store Managers, Regional Directors |

| E-commerce Platforms | 80 | Digital Marketing Managers, Operations Managers |

| Consumer Electronics Retail | 60 | Product Managers, Sales Managers |

| Fashion Retail Chains | 50 | Merchandising Managers, Brand Managers |

| Food and Grocery Retail | 70 | Supply Chain Managers, Category Managers |

The China Retail Industry Market is valued at approximately USD 5.2 trillion, driven by factors such as rapid urbanization, rising disposable incomes, and the growth of e-commerce platforms. This valuation reflects a comprehensive analysis of consumer goods retail sales over the past five years.