Region:Asia

Author(s):Rebecca

Product Code:KRAB0248

Pages:94

Published On:August 2025

By Product Category:The Indonesian retail industry is segmented into Food & Beverages, Health, Beauty & Personal Care, Apparel, Footwear & Accessories, Electronics & Household Appliances, Furniture, Toys & Hobby, Home Improvement & Household Products, and Others. Food & Beverages remain the largest segment, reflecting the essential nature of these goods and consistent consumer demand. Health, Beauty & Personal Care is the fastest-growing category, driven by increased health awareness and rising disposable incomes. Apparel, Footwear & Accessories, and Electronics & Household Appliances also show robust growth, supported by lifestyle changes and digital adoption .

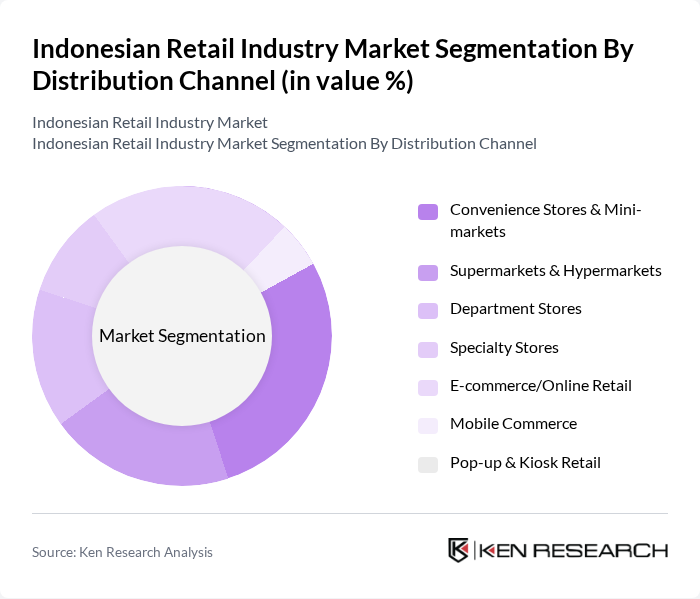

By Distribution Channel:The distribution channels in the Indonesian retail market include Convenience Stores & Mini-markets, Supermarkets & Hypermarkets, Department Stores, Specialty Stores, E-commerce/Online Retail, Mobile Commerce, and Pop-up & Kiosk Retail. Convenience Stores & Mini-markets hold the largest share among offline formats, reflecting consumer preference for accessibility and quick shopping experiences. E-commerce/Online Retail has rapidly gained traction, accounting for over 20% of the market, driven by increasing internet penetration, smartphone usage, and digital payment adoption. Mobile commerce and social commerce are emerging trends, particularly among younger, tech-savvy consumers .

The Indonesian retail industry market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Indomarco Prismatama (Indomaret), PT Sumber Alfaria Trijaya Tbk (Alfamart), PT Matahari Department Store Tbk (Matahari), PT Hero Supermarket Tbk (Hero Supermarket), PT Trans Retail Indonesia (Transmart Carrefour), PT Ramayana Lestari Sentosa Tbk (Ramayana), PT Mitra Adiperkasa Tbk (MAP Group), PT Lion Super Indo (Super Indo), PT Lotte Shopping Indonesia (Lotte Mart), PT Bhinneka Mentari Dimensi (Bhinneka), PT Bukalapak.com Tbk (Bukalapak), PT Tokopedia (Tokopedia), PT Global Digital Niaga Tbk (Blibli), PT JD.ID (JD.ID), PT Fashion Eservices Indonesia (Zalora Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesian retail industry is poised for significant transformation as it adapts to evolving consumer behaviors and technological advancements. With urbanization and a growing middle class driving demand, retailers are increasingly focusing on digital strategies and personalized shopping experiences. The integration of artificial intelligence and data analytics will enhance customer engagement, while sustainability practices will become essential. As the market evolves, retailers that embrace innovation and adapt to regulatory changes will be better positioned to thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Food & Beverages Health, Beauty & Personal Care Apparel, Footwear & Accessories Electronics & Household Appliances Furniture, Toys & Hobby Home Improvement & Household Products Others |

| By Distribution Channel | Convenience Stores & Mini-markets Supermarkets & Hypermarkets Department Stores Specialty Stores E-commerce/Online Retail Mobile Commerce Pop-up & Kiosk Retail |

| By Consumer Demographics | Age Groups Income Levels Urban vs Rural |

| By Price Range | Low-End Products Mid-Range Products Premium Products |

| By End-User | Individual Consumers Small Businesses Corporates Government Institutions |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Retail Market Insights | 100 | Retail Managers, Business Owners |

| Consumer Electronics Retail | 60 | Store Managers, Sales Supervisors |

| Fashion and Apparel Sector | 50 | Brand Managers, Merchandising Managers |

| Grocery and Supermarket Chains | 80 | Operations Managers, Supply Chain Coordinators |

| E-commerce Retail Trends | 40 | E-commerce Managers, Digital Marketing Specialists |

The Indonesian retail industry market is valued at approximately USD 175 billion, driven by rising disposable incomes, a growing middle class, urbanization, and the expansion of e-commerce platforms.