Region:Asia

Author(s):Rebecca

Product Code:KRAB0195

Pages:87

Published On:August 2025

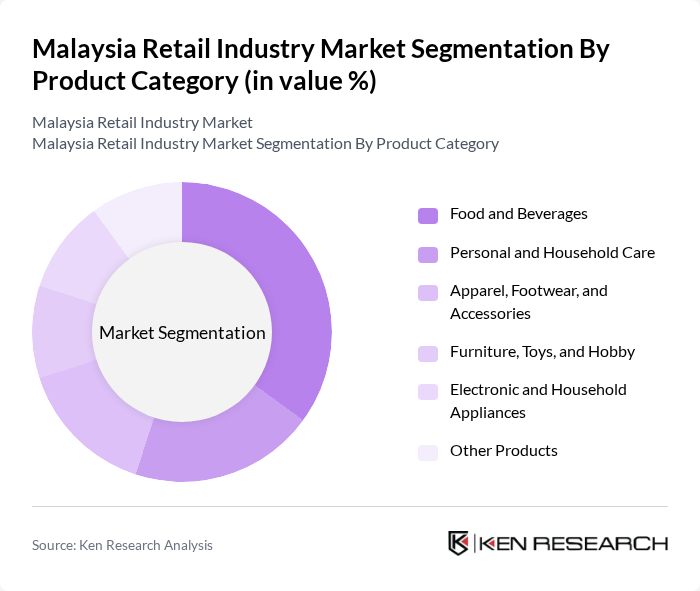

By Product Category:The product category segmentation includes Food and Beverages, Personal and Household Care, Apparel, Footwear, and Accessories, Furniture, Toys, and Hobby, Electronic and Household Appliances, and Other Products. Food and Beverages remain the largest segment, driven by the essential nature of these products, the growing trend of dining out, and the expansion of food delivery services. Increasing health consciousness among consumers has led to greater demand for organic and healthy food options. Personal and Household Care is also significant, reflecting consumer preferences for hygiene and wellness products. Apparel, Footwear, and Accessories continue to grow, supported by fashion trends and rising disposable incomes. Electronic and Household Appliances have seen increased demand due to digitalization and home improvement trends .

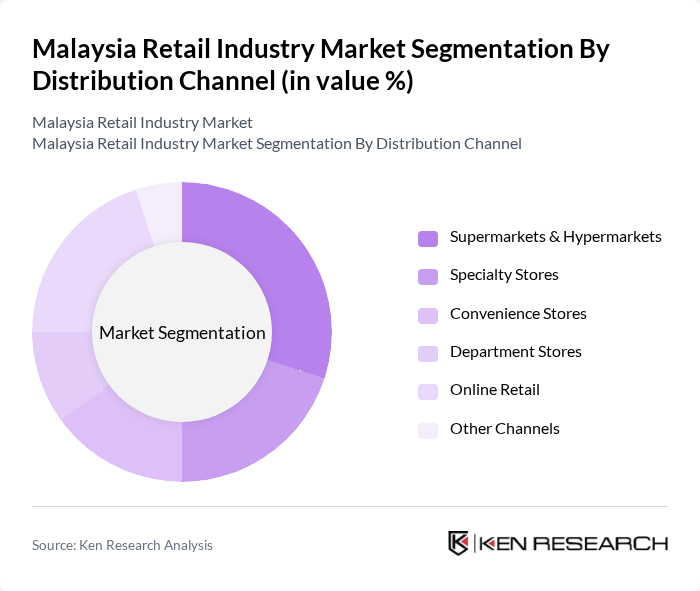

By Distribution Channel:The distribution channel segmentation includes Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Department Stores, Online Retail, and Other Channels. Online Retail is a rapidly expanding channel, driven by increased e-commerce penetration, changing consumer habits, and the convenience of digital platforms. Supermarkets & Hypermarkets maintain a strong presence due to their wide product range and accessibility. Specialty Stores and Convenience Stores are also significant, catering to specific consumer needs and offering localized services. Department Stores and Other Channels continue to serve niche markets .

The Malaysia Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lotus's Stores (Malaysia) Sdn Bhd, AEON Co. (M) Bhd, Giant Hypermarket (GCH Retail (Malaysia) Sdn Bhd), 7-Eleven Malaysia Holdings Bhd, Mydin Mohamed Holdings Bhd, Parkson Holdings Berhad, Watsons Malaysia (A.S. Watson Group), Guardian Health and Beauty Sdn Bhd, IKEA Malaysia (Ikano Handel Sdn Bhd), ZALORA Malaysia, Lazada Malaysia, Shopee Malaysia, Senheng Electric (KL) Sdn Bhd, The Store Corporation Berhad, 99 Speedmart Sdn Bhd, B.I.G. (Ben’s Independent Grocer) Store Sdn Bhd, MJ Department Stores Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysian retail industry appears promising, driven by technological advancements and evolving consumer behaviors. Retailers are increasingly adopting omnichannel strategies to enhance customer engagement, integrating online and offline experiences. Additionally, the focus on sustainability is expected to shape product offerings, as consumers become more environmentally conscious. As the market adapts to these trends, businesses that leverage technology and prioritize customer experience will likely thrive in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Food and Beverages Personal and Household Care Apparel, Footwear, and Accessories Furniture, Toys, and Hobby Electronic and Household Appliances Other Products |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores Convenience Stores Department Stores Online Retail Other Channels |

| By Price Range | Budget Mid-Range Premium |

| By Consumer Demographics | Age Group Gender Income Level |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Retail Market Insights | 120 | Retail Managers, Marketing Directors |

| Consumer Electronics Retail | 60 | Store Managers, Sales Associates |

| Fashion and Apparel Sector | 50 | Brand Managers, Merchandising Specialists |

| Grocery and Supermarket Chains | 80 | Operations Managers, Supply Chain Coordinators |

| Online Retail Platforms | 40 | E-commerce Managers, Digital Marketing Experts |

The Malaysia Retail Industry Market is valued at approximately USD 89 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and the rapid expansion of e-commerce platforms.