Region:Asia

Author(s):Dev

Product Code:KRAC0498

Pages:80

Published On:August 2025

By Type:The retail industry in the Philippines can be segmented into various types, including Food and Beverages, Personal and Household Care, Apparel, Footwear, and Accessories, Electronics and Household Appliances, Furniture, Home, and Living, Toys, Hobbies, Sports, and Leisure, and Others. Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics.

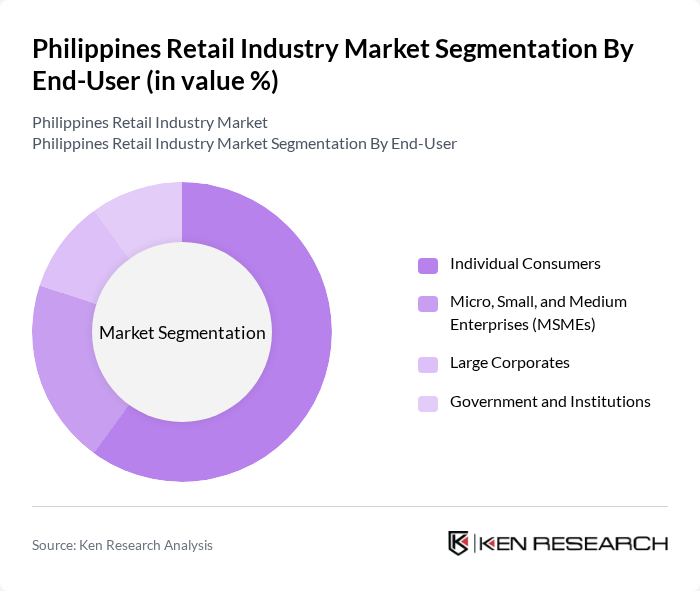

By End-User:The retail market serves various end-users, including Individual Consumers, Micro, Small, and Medium Enterprises (MSMEs), Large Corporates, and Government and Institutions. Each end-user segment has distinct purchasing behaviors and requirements, influencing the overall retail landscape.

The Philippines Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as SM Retail, Inc., Robinsons Retail Holdings, Inc., Puregold Price Club, Inc., Metro Retail Stores Group, Inc., AllDay Marts, Inc., Gaisano Capital Group, The Landmark Corporation (Landmark Department Store and Supermarket), Rustan Commercial Corporation (Rustan’s and Rustan Supercenters legacy), Philippine Seven Corporation (7?Eleven Philippines), Uncle John’s Convenience Store (formerly Ministop Philippines), Mercury Drug Corporation, Watsons Personal Care Stores (Philippines), Inc., The SM Store, SSI Group, Inc. (Specialty Fashion and Lifestyle Retail), Zalora Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines retail industry is poised for significant transformation, driven by technological advancements and changing consumer preferences. As e-commerce continues to expand, retailers will increasingly adopt omnichannel strategies to enhance customer experiences. Additionally, the focus on sustainability will shape product offerings, with consumers favoring eco-friendly brands. In future, the integration of artificial intelligence and data analytics will further optimize inventory management and personalized marketing, positioning retailers to better meet evolving consumer demands and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Food and Beverages Personal and Household Care Apparel, Footwear, and Accessories Electronics and Household Appliances Furniture, Home, and Living Toys, Hobbies, Sports, and Leisure Others |

| By End-User | Individual Consumers Micro, Small, and Medium Enterprises (MSMEs) Large Corporates Government and Institutions |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Department and Specialty Stores Online (E-commerce and Marketplaces) Other Offline Channels |

| By Distribution Mode | Modern Trade Traditional Trade (Sari-sari stores and Wet Markets) Omnichannel and Dark Stores |

| By Price Range | Mass / Value Premium Luxury |

| By Consumer Demographics | Age Group Income Level Gender |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Supermarket Retail Operations | 150 | Store Managers, Operations Directors |

| Online Retail Consumer Behavior | 120 | eCommerce Managers, Digital Marketing Specialists |

| Convenience Store Insights | 100 | Franchise Owners, Area Managers |

| Consumer Electronics Retail | 80 | Sales Representatives, Product Managers |

| Fashion Retail Trends | 90 | Merchandising Managers, Brand Strategists |

The Philippines retail industry market is valued at approximately USD 45 billion, driven by increasing consumer spending, urbanization, and the growth of e-commerce and digital payments, supported by high smartphone adoption and improved supply chains.