Region:Asia

Author(s):Shubham

Product Code:KRAA1846

Pages:97

Published On:August 2025

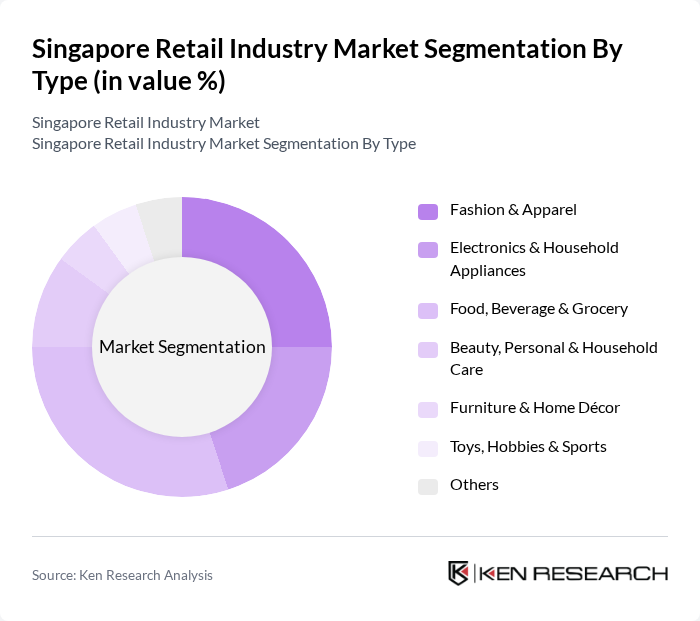

By Type:The retail industry in Singapore can be segmented into various types, including Fashion & Apparel, Electronics & Household Appliances, Food, Beverage & Grocery, Beauty, Personal & Household Care, Furniture & Home Décor, Toys, Hobbies & Sports, and Others. Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics. Key trends include stronger grocery and essentials demand, resilient beauty and personal care, and ongoing pressure in discretionary categories such as apparel amid shifting consumer sentiment and promotional intensity.

By End-User:The retail market serves various end-users, including Individual Consumers, Corporate & Institutional Buyers, and Government Agencies. Each of these end-user segments has distinct purchasing behaviors and requirements, influencing the overall retail landscape. Consumer-facing retail continues to dominate, with omnichannel behavior (online research, offline pickup/returns) entrenched across categories.

The Singapore Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTUC FairPrice Co-operative Limited (FairPrice, FairPrice Finest, FairPrice Xtra), DFI Retail Group (Giant, Cold Storage, Guardian, 7-Eleven Singapore), Sheng Siong Group Ltd., Decathlon Singapore, COURTS Singapore (Nojima Group), Best Denki (Singapore) Pte Ltd, Harvey Norman Singapore, Watsons Singapore (CK Hutchison Holdings), Guardian Singapore (DFI Retail Group), Sephora Singapore (LVMH), Uniqlo Singapore (Fast Retailing), H&M Hennes & Mauritz Pte. Ltd. (Singapore), Muji Singapore (Ryohin Keikaku), IKEA Singapore (Ikano Retail), Lazada Singapore, Shopee Singapore, Amazon Singapore (Amazon.sg, Amazon Fresh, Prime Now), Zalora Singapore, Mustafa Centre (Mustafa Singapore Pte Ltd), Don Don Donki Singapore (Pan Pacific International Holdings) contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore retail industry is poised for significant transformation as it adapts to evolving consumer behaviors and technological advancements. With a focus on enhancing customer experiences through personalized services and omnichannel strategies, retailers are expected to leverage data analytics and AI to drive engagement. Additionally, the growing emphasis on sustainability will shape product offerings, compelling retailers to innovate. As the market navigates these changes, businesses that embrace agility and responsiveness will likely thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Apparel Electronics & Household Appliances Food, Beverage & Grocery Beauty, Personal & Household Care Furniture & Home Décor Toys, Hobbies & Sports Others |

| By End-User | Individual Consumers Corporate & Institutional Buyers Government Agencies |

| By Sales Channel | Supermarkets & Hypermarkets Convenience Stores Specialty Stores Department Stores E-commerce (Web & App) Others |

| By Distribution Mode | Direct-to-Consumer Wholesale/B2B Distribution Franchise & Licensing Operations |

| By Price Range | Budget Mid-Range Premium & Luxury |

| By Consumer Demographics | Age Group Gender Income Level |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retail Sector | 120 | Store Managers, Brand Owners |

| Electronics Retail Sector | 100 | Sales Managers, Product Category Managers |

| Grocery Retail Sector | 120 | Operations Managers, Supply Chain Coordinators |

| Online Retail Sector | 80 | E-commerce Managers, Digital Marketing Specialists |

| Luxury Goods Retail Sector | 70 | Store Directors, Customer Experience Managers |

The Singapore retail industry market is valued at approximately USD 135140 billion, reflecting strong consumer spending, tourism recovery, and rapid e-commerce adoption. This valuation is based on a five-year historical analysis of retail sales trends.